- Canada

- /

- Capital Markets

- /

- TSX:SEC

Discovering Canada's Undiscovered Gems in February 2025

Reviewed by Simply Wall St

As we enter February 2025, the Canadian market is navigating a landscape of mixed signals, with inflation showing signs of stability and economic growth facing potential headwinds. Amid these crosscurrents, identifying promising small-cap stocks requires a keen eye for companies with solid fundamentals and resilience in the face of broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Reconnaissance Energy Africa | NA | 9.16% | 15.11% | ★★★★★★ |

| Sol Strategies | NA | 13.70% | 4.95% | ★★★★★★ |

| Maxim Power | 25.01% | 12.79% | 17.14% | ★★★★★☆ |

| Mako Mining | 10.21% | 38.44% | 58.78% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 19.37% | 188.55% | ★★★★★☆ |

| Corby Spirit and Wine | 59.18% | 8.79% | -5.67% | ★★★★☆☆ |

| Petrus Resources | 19.44% | 17.20% | 46.03% | ★★★★☆☆ |

| Genesis Land Development | 47.40% | 28.61% | 52.30% | ★★★★☆☆ |

| Queen's Road Capital Investment | 8.87% | 13.76% | 16.18% | ★★★★☆☆ |

| Dundee | 3.76% | -37.57% | 44.64% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Mandalay Resources (TSX:MND)

Simply Wall St Value Rating: ★★★★★★

Overview: Mandalay Resources Corporation is involved in the acquisition, exploration, extraction, processing, and reclamation of mineral properties across Canada, Australia, Sweden, and Chile with a market cap of CA$438.56 million.

Operations: Mandalay Resources generates revenue primarily from its Metals & Mining segment, focusing on gold and other precious metals, with a reported income of $224.44 million.

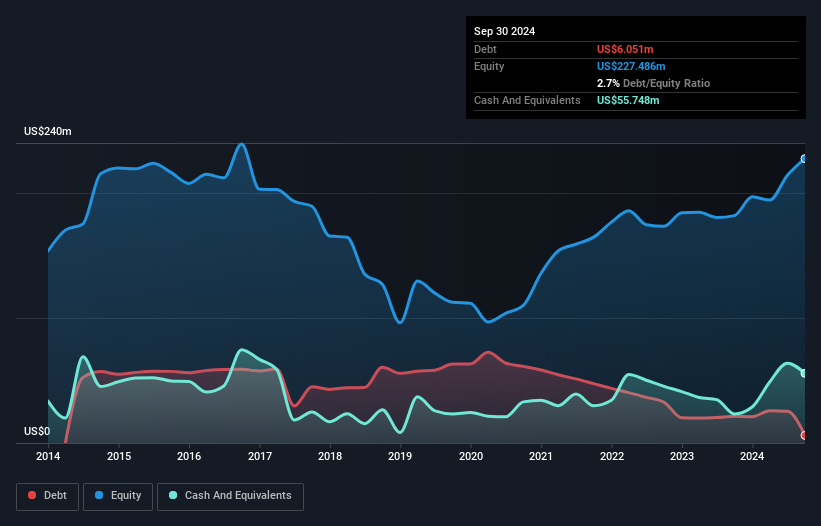

Mandalay Resources, a small Canadian mining company, has shown impressive growth with earnings surging 381.7% over the past year, far outpacing the industry's 35.8%. Its debt-to-equity ratio improved significantly from 56.1% to just 2.7% over five years, highlighting prudent financial management. The company trades at a substantial discount of 67.6% below its estimated fair value, suggesting potential undervaluation in the market. Recent exploration success at its True Blue prospect in Australia revealed high-grade gold and antimony deposits, indicating promising future production potential and further enhancing Mandalay's growth prospects in the metals sector.

- Get an in-depth perspective on Mandalay Resources' performance by reading our health report here.

Assess Mandalay Resources' past performance with our detailed historical performance reports.

Senvest Capital (TSX:SEC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Senvest Capital Inc. is a privately owned hedge fund sponsor with a market capitalization of CA$977.37 million.

Operations: Senvest Capital generates revenue primarily from managing its own investments and those of the funds, amounting to CA$810.05 million.

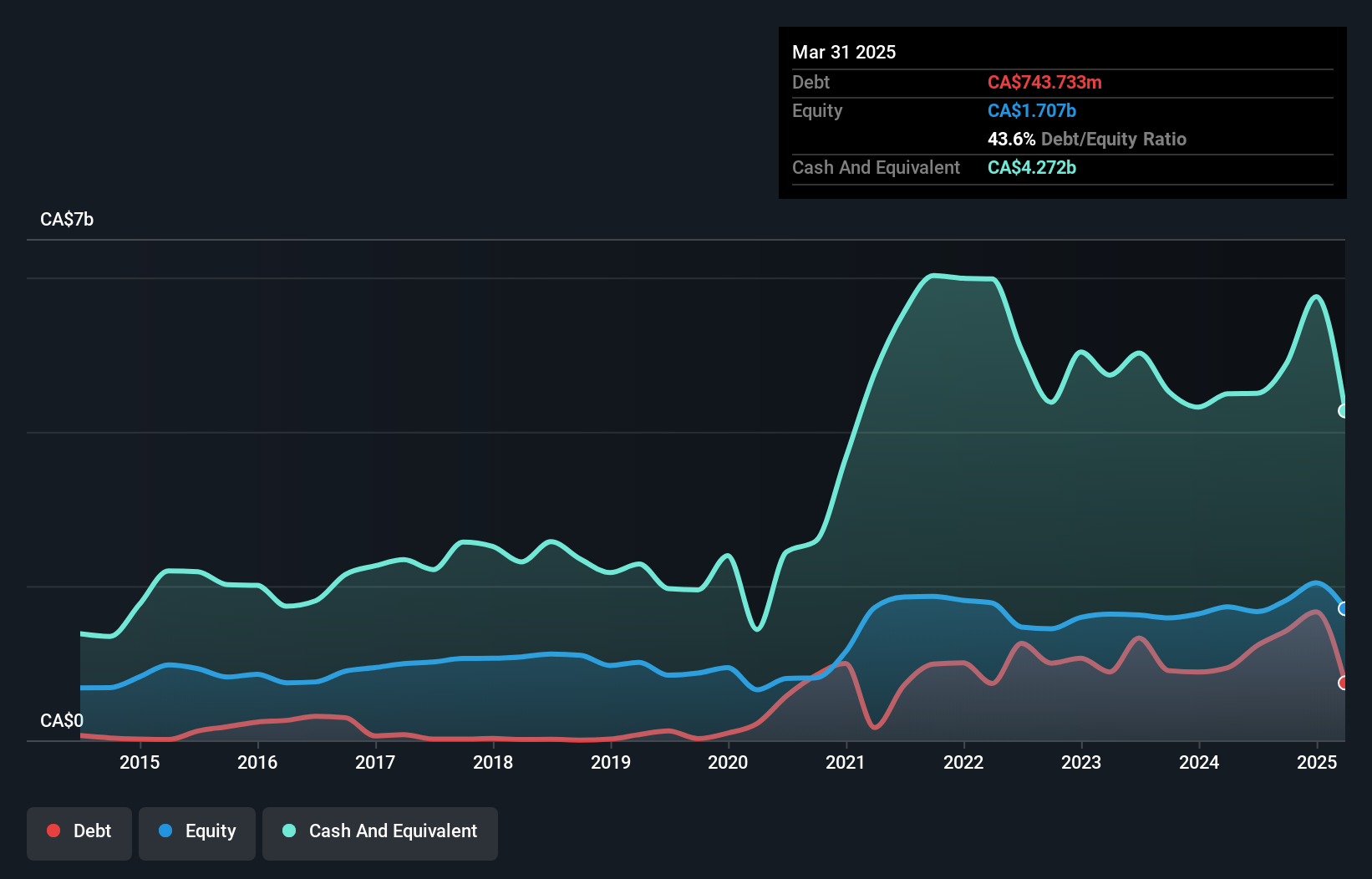

Senvest Capital, a small Canadian player, has shown impressive earnings growth of 56% over the past year, outpacing the Capital Markets industry average of 11.3%. Its price-to-earnings ratio stands at an attractive 4.1x compared to the broader Canadian market's 15x, suggesting potential undervaluation. Despite significant insider selling recently, Senvest remains free cash flow positive and boasts high-quality earnings. The company's debt levels appear manageable with more cash than total debt and interest payments covered well by EBIT at 8.2 times coverage. However, its debt-to-equity ratio has surged from 2.5% to 78.3% over five years, indicating increased leverage risk.

- Unlock comprehensive insights into our analysis of Senvest Capital stock in this health report.

Review our historical performance report to gain insights into Senvest Capital's's past performance.

Westshore Terminals Investment (TSX:WTE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Westshore Terminals Investment Corporation operates a coal storage and unloading/loading terminal at Roberts Bank, British Columbia, with a market capitalization of approximately CA$1.50 billion.

Operations: The primary revenue stream for Westshore Terminals comes from its transportation infrastructure segment, generating CA$382.57 million. The company's financial performance is highlighted by a net profit margin of 27%.

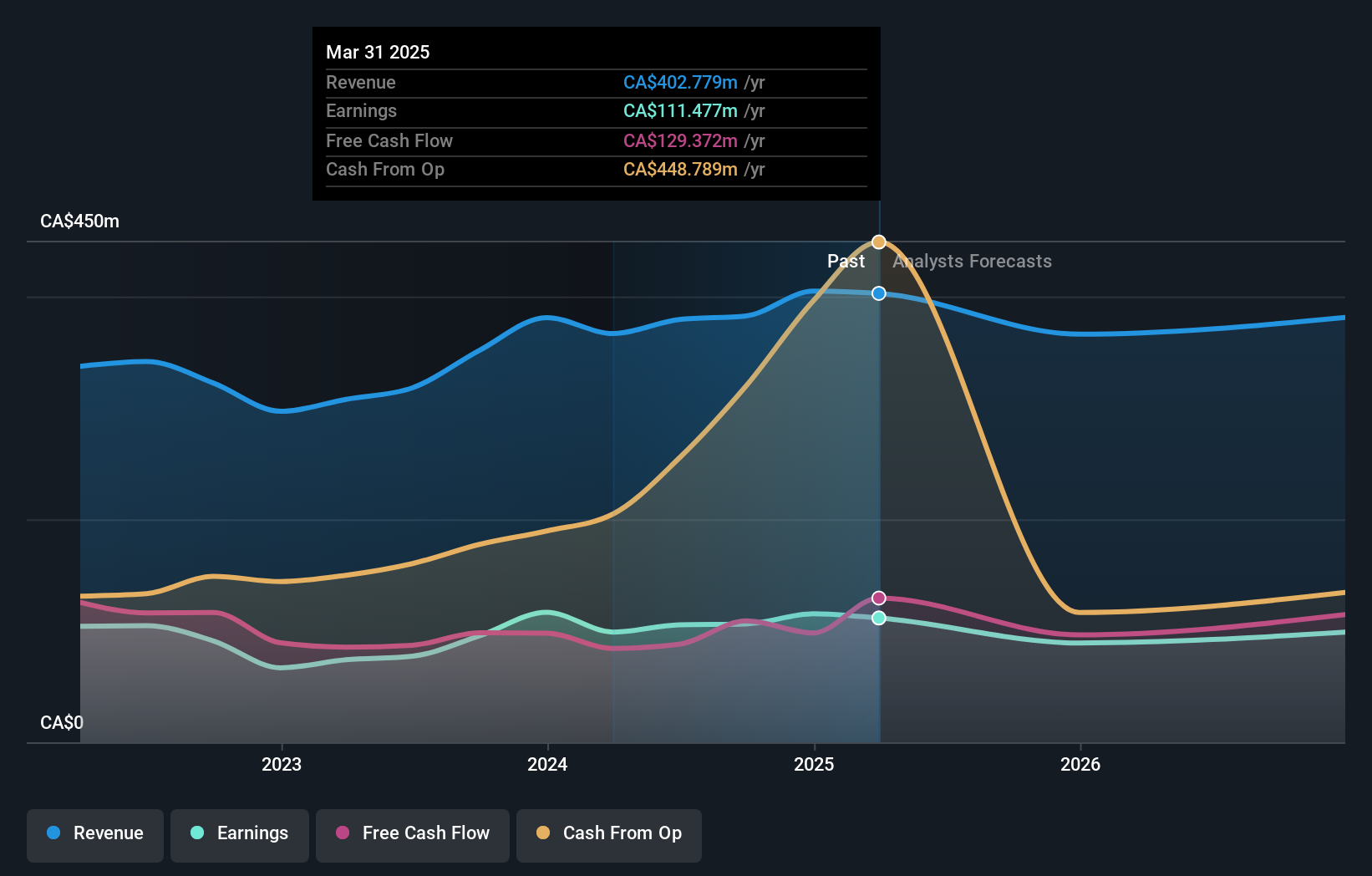

Westshore Terminals, a Canadian infrastructure player, is making waves with its impressive financial health. Earnings surged by 11% last year, outpacing the industry’s 9.5% growth. The company stands debt-free, eliminating concerns over interest coverage and showcasing its robust financial position. Its price-to-earnings ratio of 14x undercuts the broader Canadian market's 15x benchmark, hinting at potential value for investors. High-quality earnings further bolster confidence in Westshore's operations. With consistent free cash flow positivity and no debt burden over the past five years, this company seems well-positioned within its sector for continued stability and growth potential.

Taking Advantage

- Dive into all 47 of the TSX Undiscovered Gems With Strong Fundamentals we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SEC

Adequate balance sheet low.

Market Insights

Community Narratives