- Canada

- /

- Metals and Mining

- /

- TSX:LUN

Lundin Mining (TSX:LUN) Valuation in Focus After Q2 Results, Dividend, and Strategic Updates

Reviewed by Simply Wall St

Lundin Mining (TSX:LUN) just wrapped up a busy quarter, announcing updates on its share capital and confirming the continuation of its share buyback program. The company also reported its second quarter earnings and declared a dividend, all while doubling down on exploration and expansion projects across its operations. With disciplined acquisition plans still in focus, these moves are giving investors fresh insight into Lundin’s evolving strategy and long-term goals.

This string of announcements follows a period where momentum has been clearly on the rise. Over the past year, Lundin Mining’s total return climbed 46%, with a 32% gain year-to-date and a surge of 16% in the past 3 months. While management continues to highlight the upside potential of new projects and growth initiatives, the stock’s performance suggests that expectations for future gains may already be reflected in the market.

After such a strong run and a flurry of updates, does the current stock price still offer value for buyers, or is the market already pricing in most of Lundin’s future growth story?

Most Popular Narrative: 3.7% Undervalued

According to the most widely followed narrative, Lundin Mining is currently trading at a slight discount to its fair value, indicating modest upside potential if analyst forecasts materialize. The consensus view reflects ongoing optimism about the company’s future earnings power and capital allocation strategy.

"Lundin Mining is advancing multiple organic growth initiatives, such as the Vicuña project and brownfield expansions at existing operations, that are expected to significantly increase copper and gold production volumes over the coming years, positioning the company to benefit from rising global demand for electrification metals; these developments are set to drive higher future revenue and EBITDA."

Curious about the numbers supporting this bullish outlook? Uncover the quantitative drivers that make this valuation stand out. It is all about how much profit expansion, operational leverage, and efficiency gains could reshape the company’s trajectory. Want to see what is really behind the projected lift in value?

Result: Fair Value of $17.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, sustained weakness in copper prices or setbacks at major South American projects could quickly undermine the bullish consensus regarding Lundin’s growth prospects.

Find out about the key risks to this Lundin Mining narrative.Another View: Market-Based Valuation

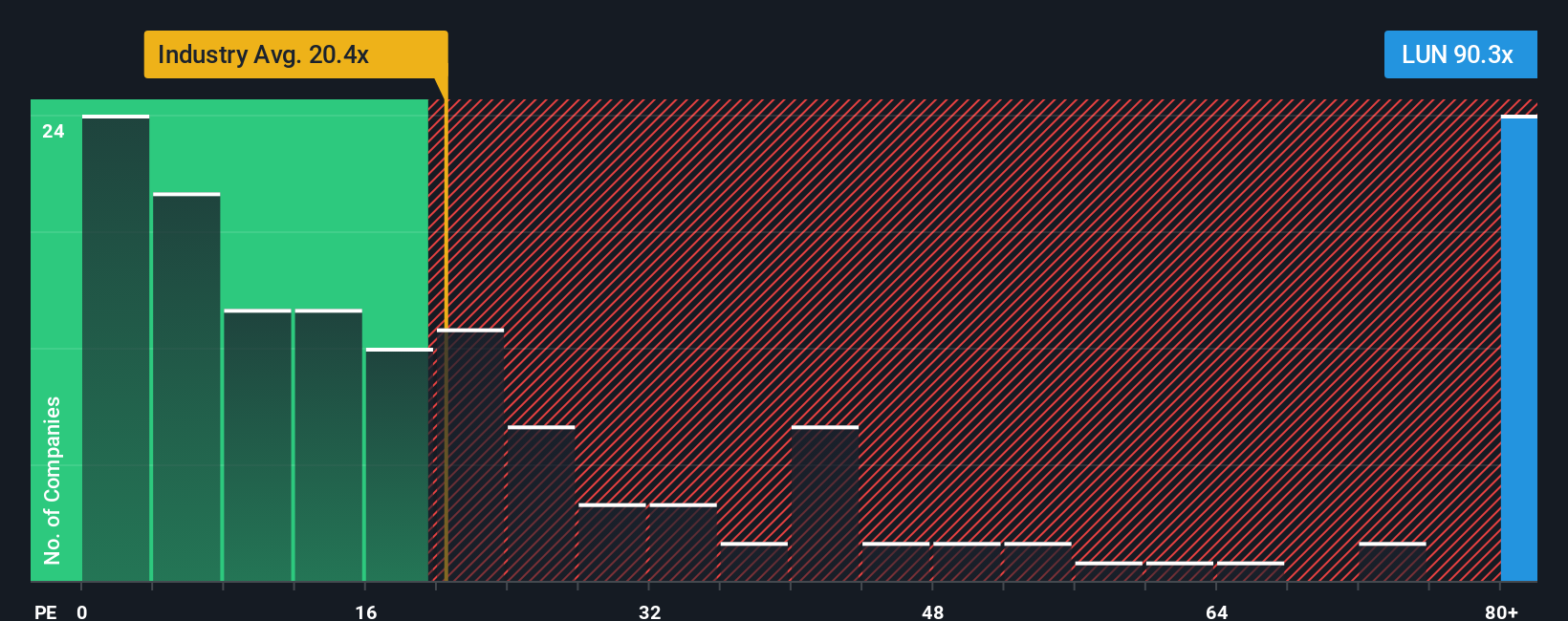

While the primary narrative points to undervaluation, a closer look at Lundin Mining’s current market pricing ratio compared to the industry average raises doubts. Is the stock really as cheap as it first appears, or is the market already pricing in much of the upside?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Lundin Mining to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Lundin Mining Narrative

If you see things differently or want a deeper dive into the numbers yourself, you can easily craft your own view in just a few minutes. Do it your way.

A great starting point for your Lundin Mining research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Do not limit your portfolio to just one story. The Simply Wall Street Screener makes it easy to identify stocks that match your unique interests and goals. Act now to discover where fresh opportunities may be hiding.

- Uncover hidden gems with strong fundamentals by checking out penny stocks with strong financials before the crowd catches on.

- Capitalize on the growth of artificial intelligence by focusing on leaders who are reshaping industries through AI penny stocks.

- Maximize your returns by targeting undervalued companies that are positioned for upward movement using undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:LUN

Lundin Mining

A diversified base metals mining company, engages in the exploration, development, and mining of mineral properties in Chile, Brazil, the United States, Portugal, Sweden, and Argentina.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives