3 TSX Stocks Estimated To Be 44.3% To 47.7% Below Intrinsic Value

Reviewed by Simply Wall St

As the Canadian economy faces challenges with a contraction in GDP, the potential for monetary easing by the Bank of Canada offers a glimmer of hope for investors seeking opportunities in undervalued stocks. In this environment, identifying stocks trading below their intrinsic value can be particularly appealing, as these investments may benefit from broader market participation and supportive financial conditions.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vitalhub (TSX:VHI) | CA$12.60 | CA$20.78 | 39.4% |

| Versamet Royalties (TSXV:VMET) | CA$1.45 | CA$2.84 | 48.9% |

| TerraVest Industries (TSX:TVK) | CA$144.17 | CA$272.18 | 47% |

| Magellan Aerospace (TSX:MAL) | CA$15.94 | CA$28.60 | 44.3% |

| K92 Mining (TSX:KNT) | CA$15.49 | CA$27.81 | 44.3% |

| Ivanhoe Mines (TSX:IVN) | CA$12.14 | CA$19.74 | 38.5% |

| goeasy (TSX:GSY) | CA$213.04 | CA$380.84 | 44.1% |

| Exchange Income (TSX:EIF) | CA$71.78 | CA$111.87 | 35.8% |

| Discovery Silver (TSX:DSV) | CA$4.37 | CA$8.29 | 47.3% |

| BRP (TSX:DOO) | CA$86.43 | CA$165.11 | 47.7% |

Let's take a closer look at a couple of our picks from the screened companies.

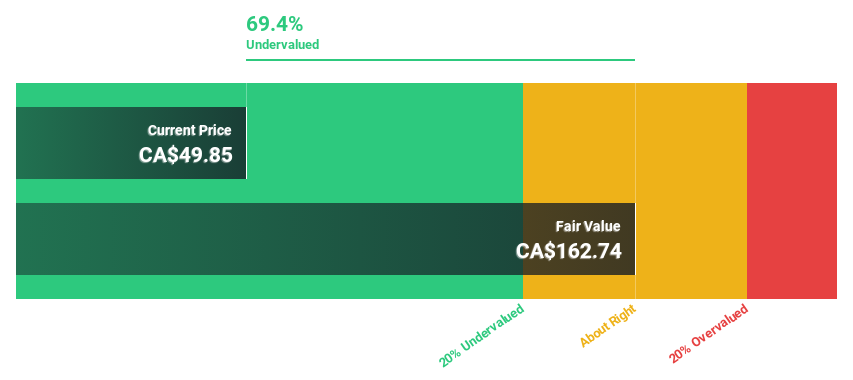

BRP (TSX:DOO)

Overview: BRP Inc. is a company that designs, develops, manufactures, and sells powersports vehicles and marine products across several countries including Mexico, Canada, Austria, the United States, Finland, Australia, and Germany with a market cap of CA$6.31 billion.

Operations: BRP Inc.'s revenue segments include the sale of powersports vehicles and marine products across regions such as Mexico, Canada, Austria, the United States, Finland, Australia, and Germany.

Estimated Discount To Fair Value: 47.7%

BRP Inc. appears undervalued based on cash flows, trading at CA$86.43, significantly below its estimated fair value of CA$165.11. Despite lower profit margins compared to last year, earnings are expected to grow significantly over the next three years, outpacing the Canadian market's growth rate. Recent financial results show improved net income and earnings per share for Q2 2025 compared to a year ago, supporting its potential as an undervalued stock in Canada.

- Our comprehensive growth report raises the possibility that BRP is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of BRP stock in this financial health report.

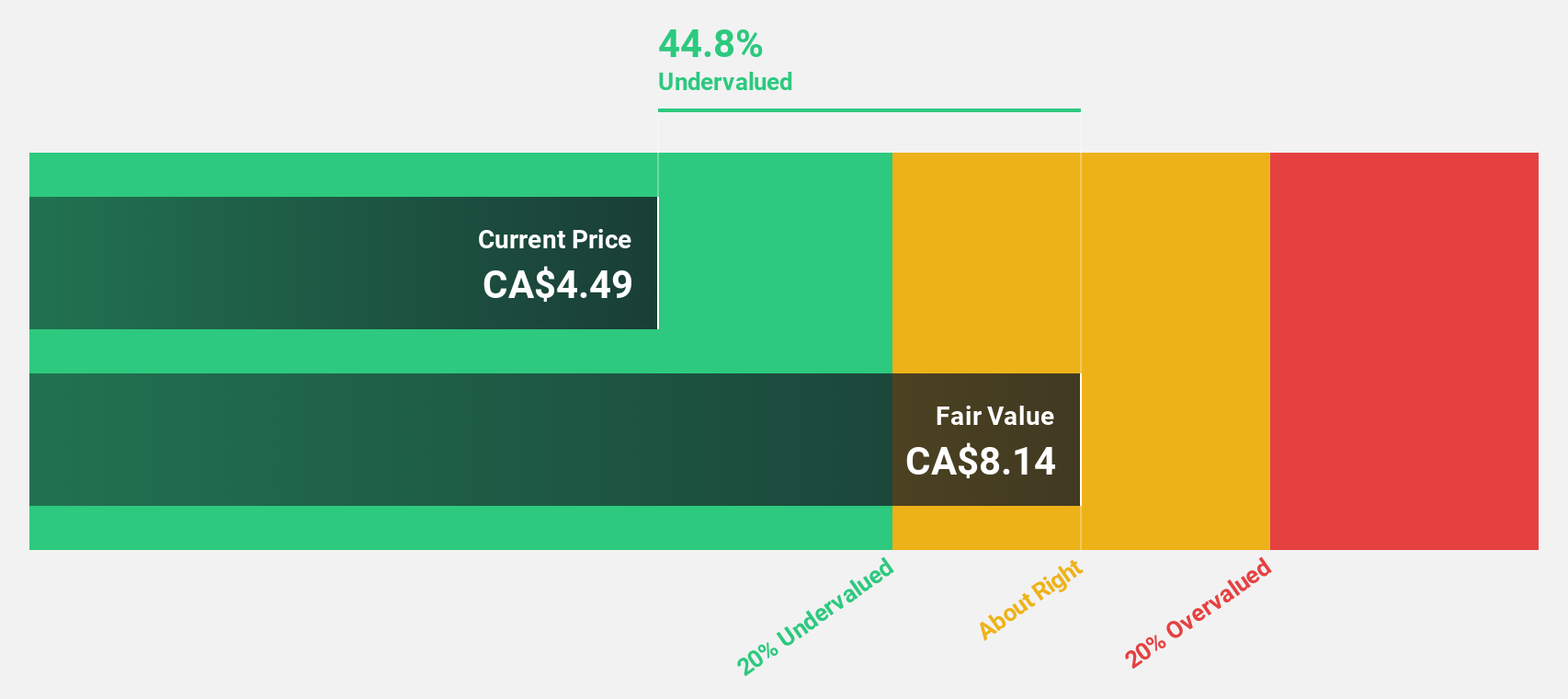

Discovery Silver (TSX:DSV)

Overview: Discovery Silver Corp. is a mineral exploration company focused on acquiring, exploring, and developing mineral properties in Canada, with a market cap of CA$3.51 billion.

Operations: Discovery Silver Corp. does not currently report any revenue segments, as it is primarily engaged in mineral exploration and development activities in Canada.

Estimated Discount To Fair Value: 47.3%

Discovery Silver, trading at CA$4.37, is significantly below its estimated fair value of CA$8.29, making it appear undervalued based on cash flows. The company reported a net income of US$5.53 million for Q2 2025, a positive shift from the previous year's loss. Revenue growth is forecast to outpace the Canadian market substantially at 34.2% per year, and profitability is expected within three years despite recent insider selling and shareholder dilution concerns.

- Our expertly prepared growth report on Discovery Silver implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Discovery Silver.

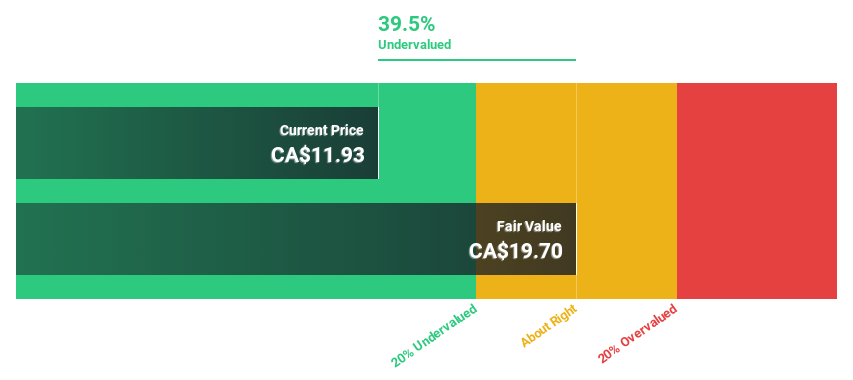

K92 Mining (TSX:KNT)

Overview: K92 Mining Inc. is involved in the exploration and development of mineral deposits in Papua New Guinea, with a market cap of CA$3.75 billion.

Operations: The company's revenue is primarily derived from the Kainantu Project, which generated $483.98 million.

Estimated Discount To Fair Value: 44.3%

K92 Mining, priced at CA$15.49, is trading 44.3% below its estimated fair value of CA$27.81, suggesting it is undervalued based on cash flows. Despite legal challenges in Papua New Guinea impacting exploration rights, the company reported strong earnings growth with net income reaching US$39.2 million in Q2 2025 compared to US$6.14 million a year ago. However, recent insider selling could be a concern for potential investors evaluating long-term stability.

- According our earnings growth report, there's an indication that K92 Mining might be ready to expand.

- Click here to discover the nuances of K92 Mining with our detailed financial health report.

Key Takeaways

- Investigate our full lineup of 24 Undervalued TSX Stocks Based On Cash Flows right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOO

BRP

Designs, develops, manufactures, and sells powersports vehicles and marine products in the Mexico, Canada, Austria, the United States, Finland, Australia, and Germany.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives