- Canada

- /

- Metals and Mining

- /

- TSX:K

Is Kinross Gold’s Surge Justified After 150% Rally in 2025?

Reviewed by Bailey Pemberton

- Wondering if Kinross Gold might be undervalued right now? You are not alone, as recent buzz has put the stock firmly back on many investors’ radars.

- Shares of Kinross Gold have surged 4.6% in the past week and are up a remarkable 150.5% since the start of the year, hinting at rapidly shifting investor sentiment and fresh optimism about the company’s growth story.

- Much of this enthusiasm can be traced to recent developments, including Kinross Gold’s expansion into new mining jurisdictions and growing speculation about further gold price rallies. Headlines about increasing production targets and industry consolidation have helped drive both excitement and a re-evaluation of risk surrounding the stock.

- But how does the current market price stack up against intrinsic value? According to our valuation checks, Kinross Gold scores a 3 out of 6, and is notably undervalued in half of the areas considered. In the sections to follow, we will break down what this actually means using several key methods, and we will wrap up by revealing a smarter way to size up what really drives Kinross Gold’s value in today’s market.

Approach 1: Kinross Gold Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them to today’s value. This approach aims to answer, “What is Kinross Gold worth now, based on the money it’s expected to generate in the future?”

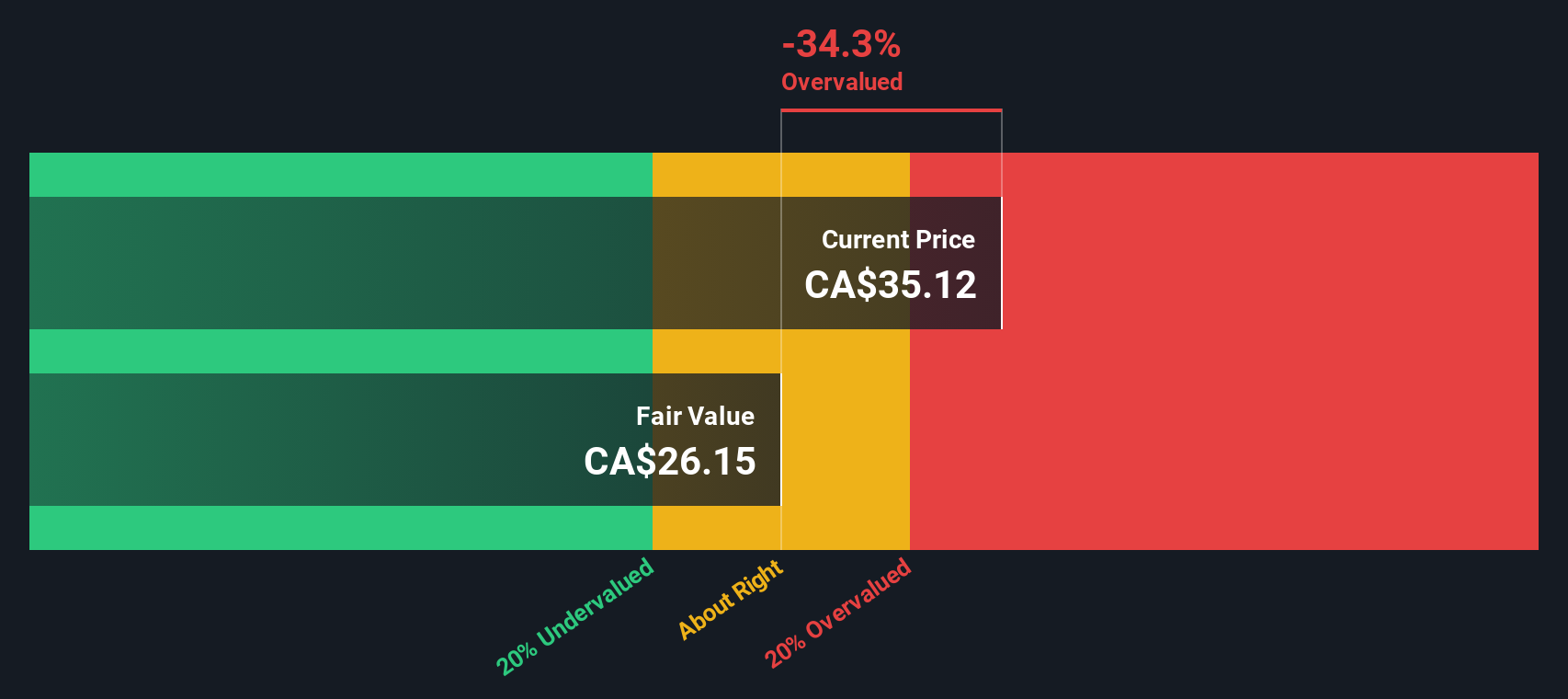

For Kinross Gold, the current Free Cash Flow (FCF) stands at $1.87 Billion. Over the next decade, analysts anticipate gradual declines, with FCF expected to be about $1.22 Billion by the end of 2029. Up to five years of these forecasts are sourced directly from analysts, while further estimates come from extrapolation. The DCF model used here is the 2 Stage Free Cash Flow to Equity method, which is widely accepted in equity valuation for projecting business worth based on future performance.

Using these projections, the DCF model estimates Kinross Gold’s intrinsic value at $23.81 per share. Compared to the current share price, this suggests the stock is about 50.0% overvalued according to this method. In other words, the market is pricing Kinross Gold significantly above what the company’s long-term cash-generating potential would seem to justify at this time.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Kinross Gold may be overvalued by 50.0%. Discover 886 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Kinross Gold Price vs Earnings (PE Ratio)

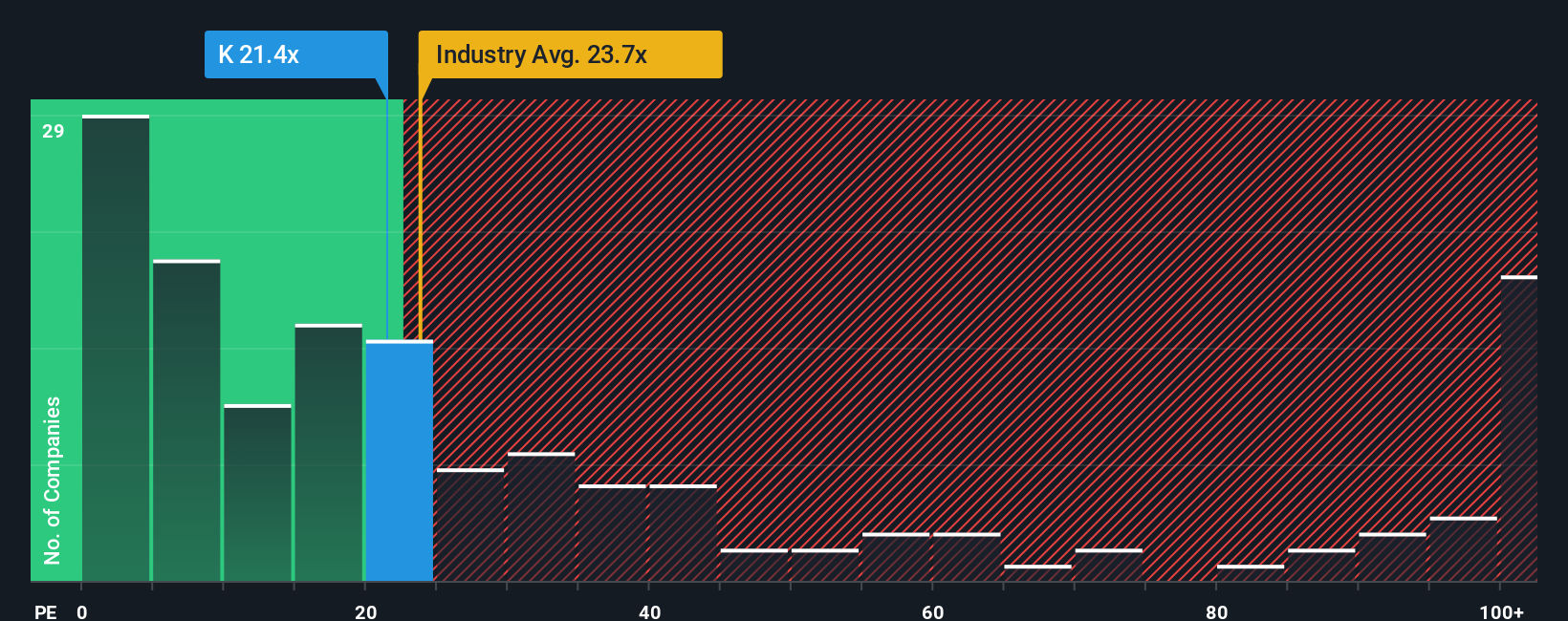

For profitable companies like Kinross Gold, the Price-to-Earnings (PE) ratio is a simple and popular way to weigh a stock’s market price against its earnings power. Investors commonly use this multiple because it tells you how much the market is willing to pay today for a dollar of earnings, making it a straightforward yardstick for comparing value, especially among consistently profitable mining companies.

Of course, what counts as a “fair” PE ratio is not static. If a company is growing fast and faces fewer risks, a higher PE may be warranted. Conversely, slower-growing or higher-risk firms typically trade at lower PEs.

Currently, Kinross Gold trades at 17.5x earnings. This sits slightly below both its peer group (35.7x) and the broader Metals and Mining industry average (19.6x), suggesting the market is not pricing in outsized future growth or minimal risk. But to determine what is truly “fair,” Simply Wall St introduces its Fair Ratio. This custom metric weighs not just industry, profits, and growth, but also considers factors like the company’s margins, overall market cap, and risks. Because of this, it gives a tailored benchmark that is arguably more relevant than just using peer or sector averages alone.

For Kinross Gold, the Fair Ratio is 18.2x. With the stock’s current PE at 17.5x, this is only a small difference, indicating the market’s current valuation is pretty much in line with its specific profile and prospects.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Kinross Gold Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story or perspective on a company, bringing to life your assumptions and beliefs about its business future, such as fair value, expected revenue growth, and earnings margins, rather than just relying on average analyst estimates or market multiples.

By connecting the company’s unique story to a financial forecast, Narratives let you see how confidence in factors like new mining projects, gold prices, or cost optimizations could support different views of intrinsic value for Kinross Gold. On Simply Wall St’s Community page, millions of investors are already using Narratives as an easy tool for tracking their own insights and updating forecasts as news and earnings come in.

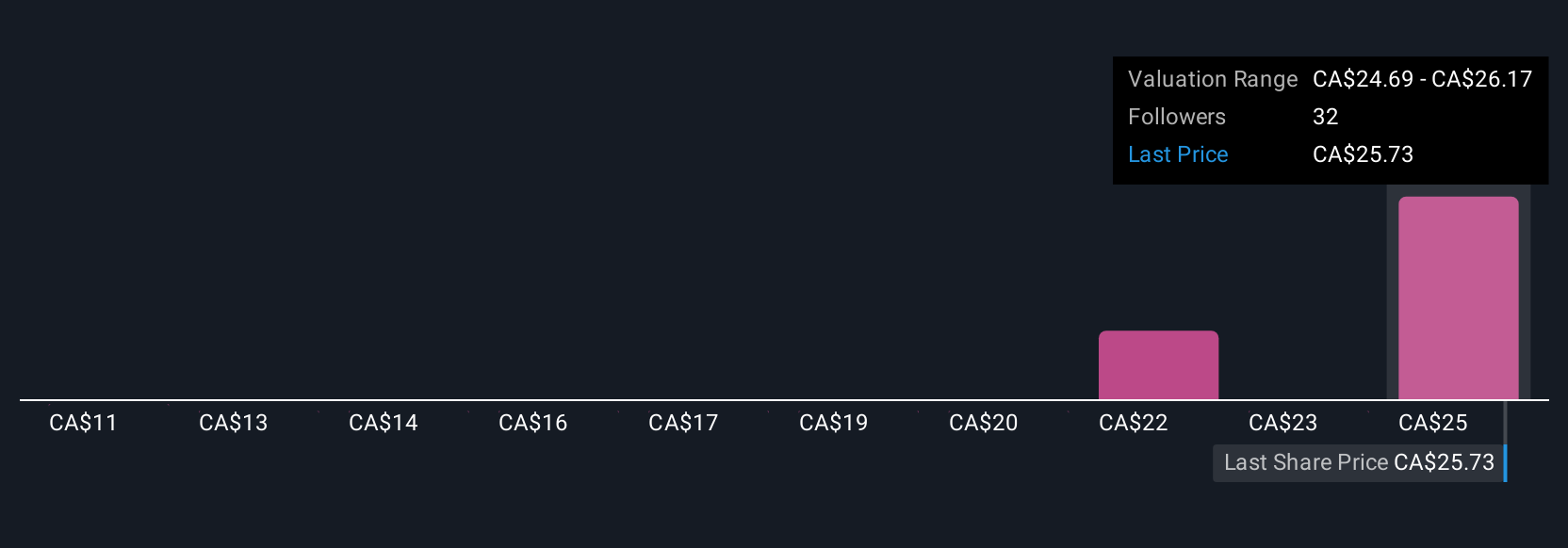

This approach helps you decide whether to buy, sell, or hold by continually comparing a dynamically calculated Fair Value to the live share price, reflecting new information much more quickly than consensus estimates. For example, some investors believe robust gold prices and operational improvements will drive Kinross to a fair value as high as CA$29.93, while others see risks from rising costs or regulatory hurdles and value it closer to CA$9.98. Narratives help you define your own view, adjust as the story evolves, and make more confident investment choices based on what matters most to you.

Do you think there's more to the story for Kinross Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinross Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:K

Kinross Gold

Engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives