- Canada

- /

- Metals and Mining

- /

- TSX:K

Is Kinross Gold (TSX:K) Still Undervalued After a Strong Year of Shareholder Returns?

Reviewed by Simply Wall St

Kinross Gold (TSX:K) has been attracting some attention from investors lately, especially after delivering modest annual revenue growth and a slight dip in net income. With shares moving gently over the past month, some are reevaluating its valuation in a shifting gold market.

See our latest analysis for Kinross Gold.

Kinross Gold’s share price has soared over the past year, returning 126.25% year-to-date and an impressive 123.21% in total shareholder return for the past year. That sharp momentum, especially after a strong 45.4% three-month share price rally, suggests investors are seeing renewed growth potential despite earlier earnings softness. Over the longer term, shareholders have enjoyed substantial multi-year gains even as the company navigated a changing gold market and shifting investor sentiment.

If you’re interested in what else is gaining traction beyond gold miners, consider broadening your search and discover fast growing stocks with high insider ownership

But with this remarkable run-up, is Kinross Gold now undervalued compared to its future prospects, or has the market already priced in all the expected growth? This could leave little room for new investors to benefit.

Most Popular Narrative: 6.9% Undervalued

The narrative consensus has pegged Kinross Gold’s fair value at $34.65, above its last closing price of CA$32.24. This suggests untapped upside based on forward-looking financial assumptions.

The company is poised to benefit from persistent global inflation and ongoing geopolitical uncertainty. These trends are expected to support robust gold prices and investor demand, which underpins Kinross's strong realized sales prices and record operating margins. The consensus maintains a positive outlook for sustained revenue and net earnings growth.

Want to know what drives this calculation? Earnings and revenue forecasts are just the start. There is a bold margin call at work here, as well as a future valuation multiple that could surprise you. Find out which assumptions are anchoring this optimism and what the consensus thinks is next for Kinross’s financial trajectory.

Result: Fair Value of $34.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising costs and delays at key projects could threaten Kinross Gold’s earnings outlook and challenge the case for continued outperformance.

Find out about the key risks to this Kinross Gold narrative.

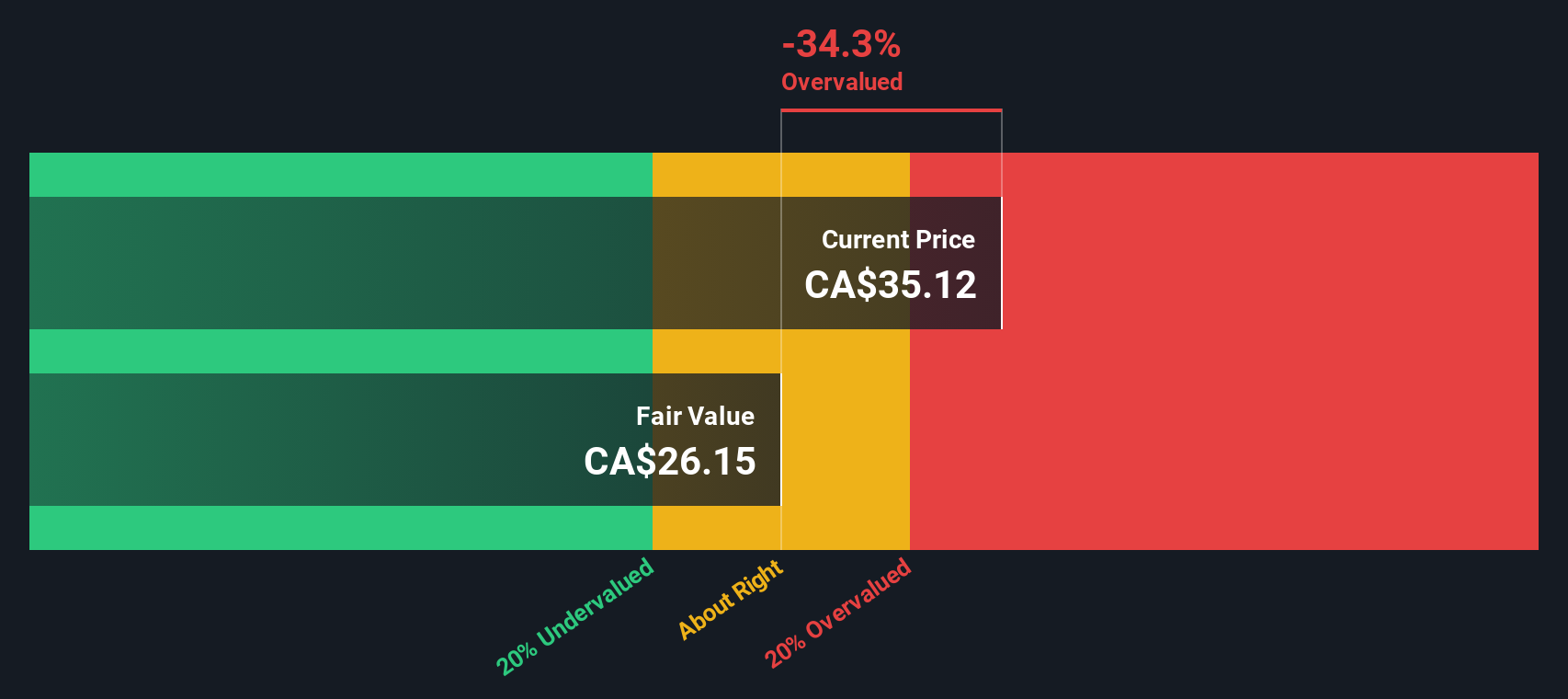

Another View: SWS DCF Model Says Overvalued

While consensus puts Kinross Gold’s fair value above the current price, our DCF model presents a different view. According to this method, the stock is trading above its estimated fair value of CA$25.09, which suggests it could be overvalued. Is this a sign the market is being too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Kinross Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Kinross Gold Narrative

If you want to dig deeper into the figures or shape your own perspective, you can craft a custom narrative in just a few minutes. Do it your way

A great starting point for your Kinross Gold research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let standout opportunities pass you by. Use the Simply Wall Street Screener to unlock stocks that fit your goals. Others are already acting on these hidden gems.

- Catch the next wave of AI innovators and leap into growth with these 26 AI penny stocks. These companies are redefining entire industries through intelligent automation.

- Maximize your income with these 21 dividend stocks with yields > 3% which offers reliable yields above 3 percent, providing a strong foundation even when markets turn volatile.

- Get ahead of the crypto curve by tapping into these 81 cryptocurrency and blockchain stocks. These companies are powering advancements in blockchain, secure payments, and digital finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinross Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:K

Kinross Gold

Engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives