David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that Kinross Gold Corporation (TSE:K) does use debt in its business. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Kinross Gold

How Much Debt Does Kinross Gold Carry?

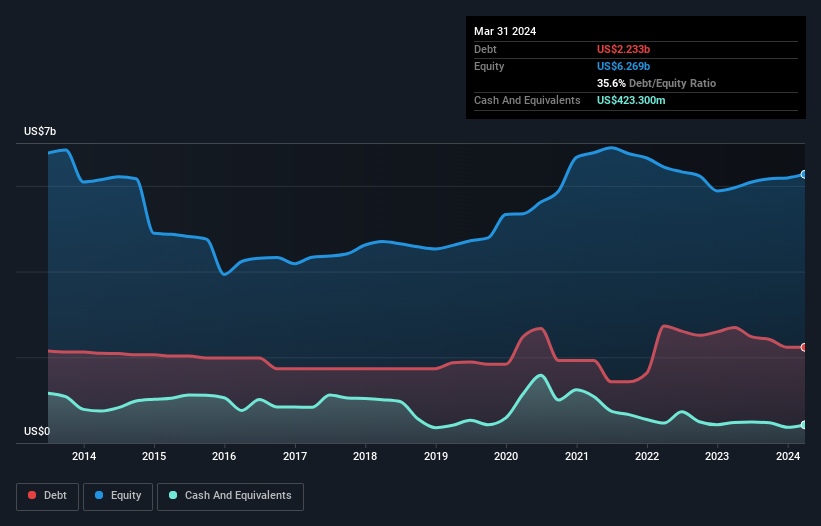

The image below, which you can click on for greater detail, shows that Kinross Gold had debt of US$2.23b at the end of March 2024, a reduction from US$2.69b over a year. However, it also had US$423.3m in cash, and so its net debt is US$1.81b.

How Healthy Is Kinross Gold's Balance Sheet?

The latest balance sheet data shows that Kinross Gold had liabilities of US$1.59b due within a year, and liabilities of US$2.69b falling due after that. Offsetting this, it had US$423.3m in cash and US$150.9m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$3.71b.

While this might seem like a lot, it is not so bad since Kinross Gold has a market capitalization of US$9.82b, and so it could probably strengthen its balance sheet by raising capital if it needed to. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Kinross Gold has a low net debt to EBITDA ratio of only 0.96. And its EBIT covers its interest expense a whopping 30.2 times over. So we're pretty relaxed about its super-conservative use of debt. Better yet, Kinross Gold grew its EBIT by 111% last year, which is an impressive improvement. That boost will make it even easier to pay down debt going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Kinross Gold's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Kinross Gold produced sturdy free cash flow equating to 72% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Kinross Gold's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. And that's just the beginning of the good news since its EBIT growth rate is also very heartening. Zooming out, Kinross Gold seems to use debt quite reasonably; and that gets the nod from us. While debt does bring risk, when used wisely it can also bring a higher return on equity. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. We've identified 2 warning signs with Kinross Gold (at least 1 which is a bit unpleasant) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

Valuation is complex, but we're here to simplify it.

Discover if Kinross Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:K

Kinross Gold

Engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives