- Canada

- /

- Metals and Mining

- /

- TSX:K

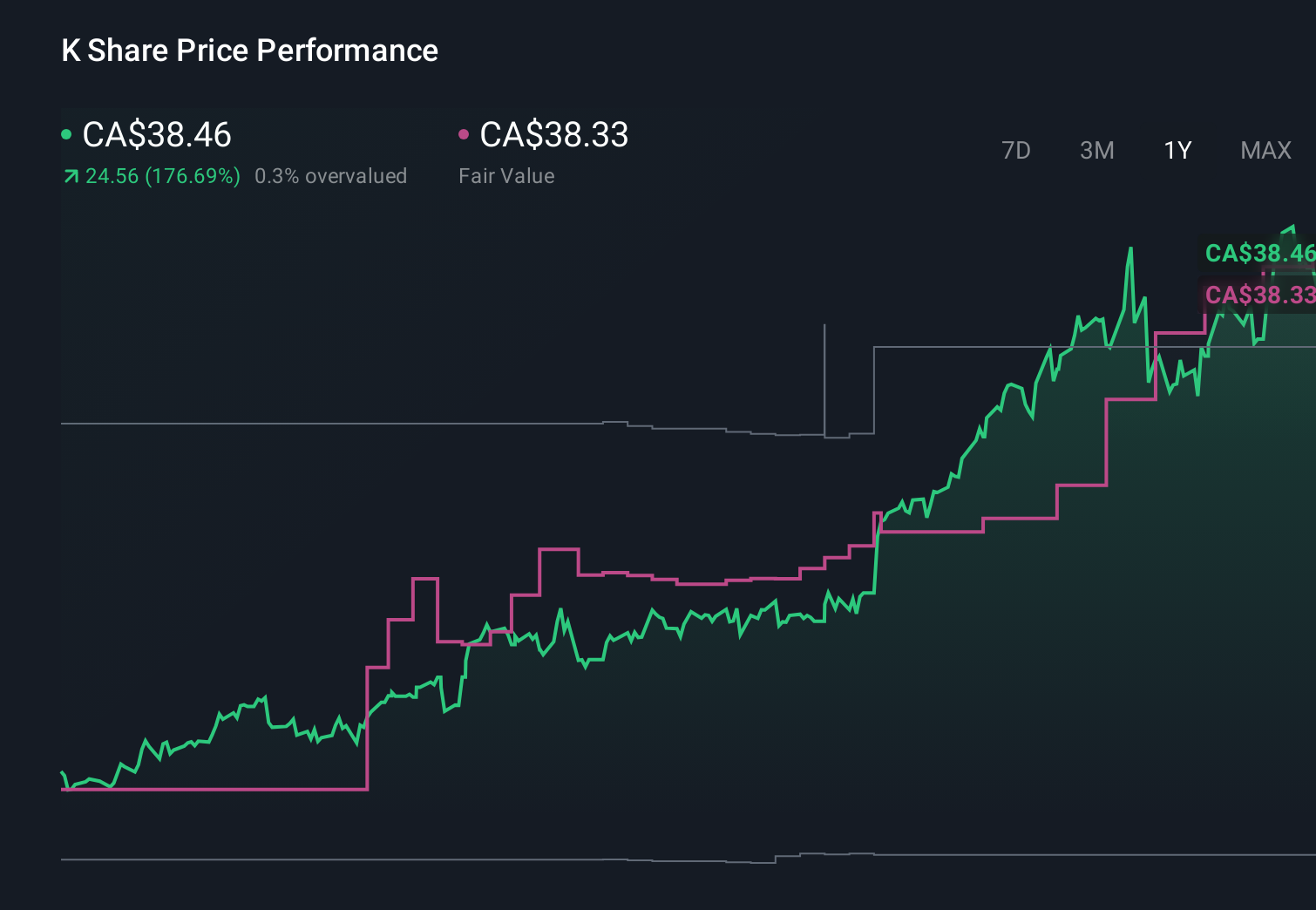

How Kinross’s Accelerated Debt Repayment And Credit Upgrade At Kinross Gold (TSX:K) Has Changed Its Investment Story

Reviewed by Sasha Jovanovic

- On December 4, 2025, Kinross Gold Corporation fully repaid its US$500 million 4.50% Senior Notes ahead of their July 15, 2027 maturity, bringing total debt repayments to US$1.5 billion across fiscal 2024 and 2025 and leaving US$750 million of Senior Notes outstanding, with the next maturity in 2033.

- This accelerated deleveraging, combined with an upgraded investment-grade credit rating and a stronger earnings outlook, underlines how Kinross is reinforcing its balance sheet while aiming to support long-term cash flow resilience.

- Next, we’ll examine how Kinross’s early debt repayment and stronger credit profile may influence its existing investment narrative and risk profile.

We've found 12 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Kinross Gold Investment Narrative Recap

To own Kinross Gold, you need to believe it can convert a large, diversified production base into durable free cash flow while managing cost inflation and political risk in key jurisdictions. The early repayment of US$500 million in Senior Notes tightens its balance sheet, but does not materially change the near term earnings catalyst, which still hinges on margins holding up against rising operating and capital costs.

The most closely linked recent development is Moody’s upgrade of Kinross’s senior unsecured rating to Baa2, which directly reflects and reinforces the impact of its accelerated deleveraging. A stronger credit profile can modestly improve financing flexibility, but investors still need to watch how higher royalties, mine sequencing and power costs affect cash generation at sites like Tasiast, Paracatu and Fort Knox over the next few years.

Yet while the balance sheet looks stronger, investors should also be aware of rising operating and capital cost pressures that...

Read the full narrative on Kinross Gold (it's free!)

Kinross Gold’s narrative projects $6.4 billion in revenue and $1.5 billion in earnings by 2028.

Uncover how Kinross Gold's forecasts yield a CA$38.33 fair value, in line with its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community currently see Kinross’s fair value between CA$12.50 and CA$38.33, showing a wide spread of views. When you weigh those opinions against rising cost risks that could pressure margins and cash flow, it becomes even more important to explore several different viewpoints before deciding how Kinross fits in your portfolio.

Explore 5 other fair value estimates on Kinross Gold - why the stock might be worth as much as CA$38.33!

Build Your Own Kinross Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinross Gold research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Kinross Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinross Gold's overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kinross Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:K

Kinross Gold

Engages in the acquisition, exploration, and development of gold properties principally in the United States, Brazil, Chile, Canada, and Mauritania.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion