- Canada

- /

- Metals and Mining

- /

- TSX:JAG

Jaguar Mining (TSX:JAG): Valuation in Focus After C$25 Million Raise for Turmalina Restart and Exploration

Reviewed by Kshitija Bhandaru

Jaguar Mining (TSX:JAG) just shook up its outlook with a C$25 million bought deal private placement. This move aims to fund the Turmalina Mine restart and ramp up exploration, directly addressing liquidity and growth needs.

See our latest analysis for Jaguar Mining.

The share price has inched up slightly year-to-date, as the company’s C$25 million fundraising has put a spotlight on its growth ambitions and efforts to stabilize operations. While recent moves have captured investor interest, the one-year total shareholder return remains only marginally positive. Momentum is tentative, and any upside will depend on successful execution at Turmalina as well as broader operational improvements.

If you’re looking for opportunities beyond gold miners positioning for a rebound, it could be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

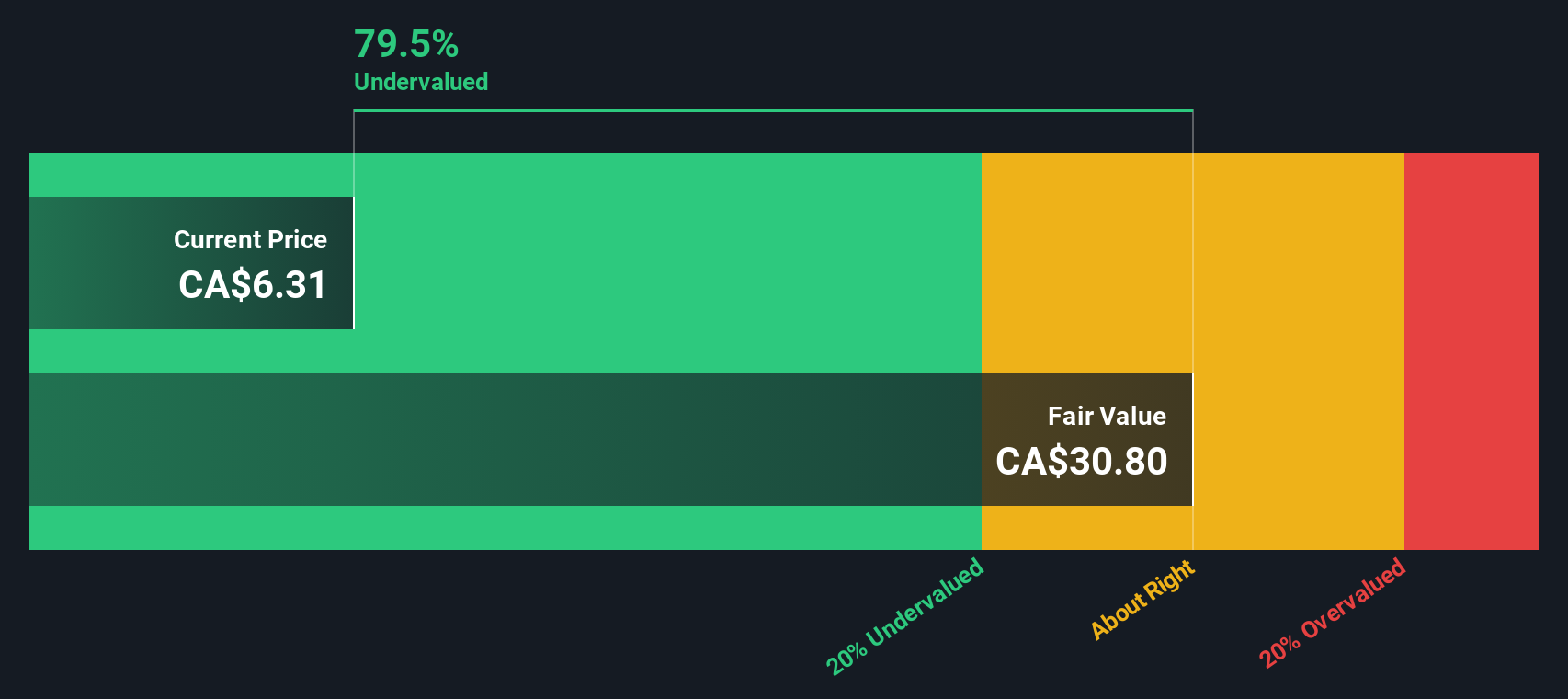

With the stock trading well below analyst targets and the company’s turnaround fully in focus, investors may wonder whether Jaguar Mining is currently underestimated by the market or if future growth is already reflected in the price.

Price-to-Sales of 2.4x: Is it justified?

Jaguar Mining trades at a price-to-sales (P/S) ratio of 2.4x, a clear signal that the stock is being valued well below both its direct peers and the wider industry at its last close of CA$6.05.

The price-to-sales multiple measures what investors are willing to pay for each dollar of revenue the company generates. In capital-intensive sectors like mining, this ratio can spotlight market expectations for top-line growth and profitability, especially when earnings are negative.

This P/S ratio is not only lower than the Canadian Metals and Mining industry average of 5.6x but also significantly beneath the peer group average of 18x. Based on the fair price-to-sales ratio of 7x, the market could be underestimating Jaguar Mining’s ability to expand revenues or achieve an operational turnaround. If sentiment shifts and performance improves, there is considerable room for this multiple to move closer to sector norms.

Explore the SWS fair ratio for Jaguar Mining

Result: Price-to-Sales of 2.4x (UNDERVALUED)

However, sustained negative net income and the company’s reliance on operational turnaround remain key risks. These factors could quickly shift investor sentiment.

Find out about the key risks to this Jaguar Mining narrative.

Another View: SWS DCF Model Suggests Further Upside

Switching gears, the SWS DCF model values Jaguar Mining at CA$30.98 per share, which is dramatically above the current price of CA$6.05. This method points to the stock being deeply undervalued, which could indicate an even greater opportunity or might reflect risk the market is pricing in. Is the DCF model capturing more potential than the market sees right now?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jaguar Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jaguar Mining Narrative

If you see the story differently or want to dive into the numbers yourself, you can build your own perspective in just a few minutes. Why not Do it your way?

A great starting point for your Jaguar Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Act quickly, as opportunities in the market can move fast and you don't want to miss out on stocks making headlines for all the right reasons.

- Boost your portfolio with reliable income streams by checking out these 19 dividend stocks with yields > 3% featuring companies offering yields above 3%.

- Jump ahead of market trends with these 26 quantum computing stocks uncovering innovators driving progress in quantum computing and tech disruption.

- Catch early-stage growth stories through these 3561 penny stocks with strong financials that combine solid financials and massive potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:JAG

Jaguar Mining

A junior gold mining company, engages in the acquisition, exploration, development, and operation of gold mineral properties in Brazil.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives