- Canada

- /

- Metals and Mining

- /

- TSX:JAG

Jaguar Mining (TSX:JAG): Assessing Valuation After Private Placement and Industry Conference Moves

Reviewed by Kshitija Bhandaru

Jaguar Mining (TSX:JAG) has just unveiled a significant private placement deal to raise over CA$25 million. In addition, the company is preparing to present at a leading metals conference. Both moves are drawing attention from investors seeking signals about the company’s next steps.

See our latest analysis for Jaguar Mining.

Jaguar Mining’s recent bought deal and conference appearance have coincided with a surge in momentum, as shown by a remarkable 17.5% 1-month share price return and a 162.9% gain year-to-date. While the stock’s 1-year total shareholder return is a more modest 22%, strong near-term moves suggest that investor optimism is building, even though the company faces a challenging long-term track record.

If Jaguar's renewed momentum has you thinking broader, consider seeing what’s next among fast growing stocks with high insider ownership.

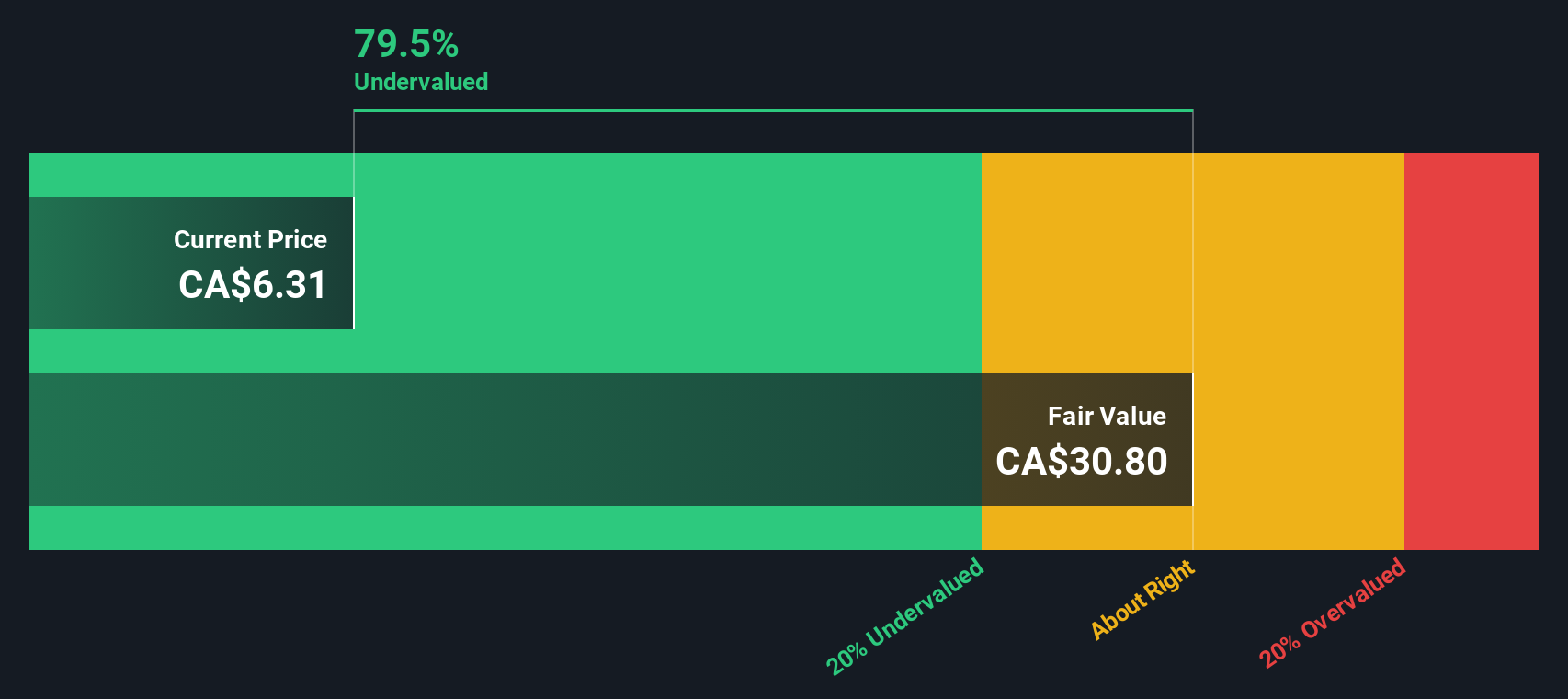

But after such a strong rally, is Jaguar Mining still undervalued based on its fundamentals? Or has the market already factored future growth into the current share price? Is there a buying opportunity, or is everything priced in?

Price-to-Sales of 2.5x: Is it justified?

Jaguar Mining is trading at a price-to-sales ratio of 2.5x, well below both the Canadian Metals and Mining industry average of 5.9x and the peer average of 26.4x. At its last close of CA$6.31, the stock looks attractively valued relative to sector norms.

The price-to-sales ratio compares a company’s market value to its annual sales. This measure is especially relevant for mining firms like Jaguar where earnings can be volatile or negative. The lower ratio suggests the market is currently undervaluing each dollar of Jaguar’s sales compared to industry peers.

Jaguar’s price-to-sales ratio is significantly more attractive than the typical company in its industry, and it also trades below an estimated fair price-to-sales ratio of 7.1x. This signals potential upside if the share price moves higher toward its fair ratio based on fundamentals.

Explore the SWS fair ratio for Jaguar Mining

Result: Price-to-Sales of 2.5x (UNDERVALUED)

However, ongoing net losses and Jaguar's challenging long-term track record could limit near-term upside if recent sales growth does not translate into profitability.

Find out about the key risks to this Jaguar Mining narrative.

Another View: What Does the SWS DCF Model Say?

Looking at Jaguar Mining through the lens of our DCF model, the picture shifts. The SWS DCF model estimates a fair value of CA$30.59 per share, which is far above its current trading price. This suggests the stock may be deeply undervalued on a cash flow basis. However, are future expectations too optimistic for an unprofitable miner, or is the market missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Jaguar Mining for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Jaguar Mining Narrative

If you want to challenge these views or dig into the numbers your own way, you can build your own analysis in just a few minutes. Do it your way.

A great starting point for your Jaguar Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Why settle for familiar options when there are exceptional companies just waiting to be uncovered? The Simply Wall Street Screener makes it easy to spot unique opportunities that could help your portfolio reach new heights.

- Capture growth you might be missing by checking out these 898 undervalued stocks based on cash flows trading far below their intrinsic value and positioned for a potential market catch-up.

- Strengthen your holdings with reliable income by targeting these 19 dividend stocks with yields > 3% that offer robust yields above 3% and a history of consistent payments.

- Capitalize on breakthrough tech by focusing on these 26 quantum computing stocks, where innovative businesses are advancing computation and transforming industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:JAG

Jaguar Mining

A junior gold mining company, engages in the acquisition, exploration, development, and operation of gold mineral properties in Brazil.

Undervalued with high growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.