- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Ivanhoe Mines (TSX:IVN) Valuation in Focus After Kipushi Upgrades and Operational Records

Reviewed by Simply Wall St

If you have been watching Ivanhoe Mines (TSX:IVN), this might be the moment you were waiting for: the company just revealed that its ambitious debottlenecking program at the Kipushi Zinc Mine wrapped up ahead of schedule and under budget. Not only did Ivanhoe hit its targets early, but it also unlocked fresh production records as a result. With improved equipment uptime and a surge in recoveries, Kipushi is now operating at a level that places it among the world’s top zinc mines. The news continued as Ivanhoe landed a new offtake agreement and financing with Mercuria, adding more security to its sales channels.

It’s no surprise that developments like these have drawn new attention to Ivanhoe Mines. Still, it’s been a complicated year for the stock, with shares dropping about 32% over the past twelve months despite steady revenue and net income growth. Momentum is starting to rebound, however. In the past month alone, shares climbed nearly 14%, outpacing the earlier decline and prompting debate on whether the worst is behind. Operational wins at both Kipushi and Kamoa-Kakula, combined with strategic partnerships, have started to shift the narrative for Ivanhoe after a difficult stretch.

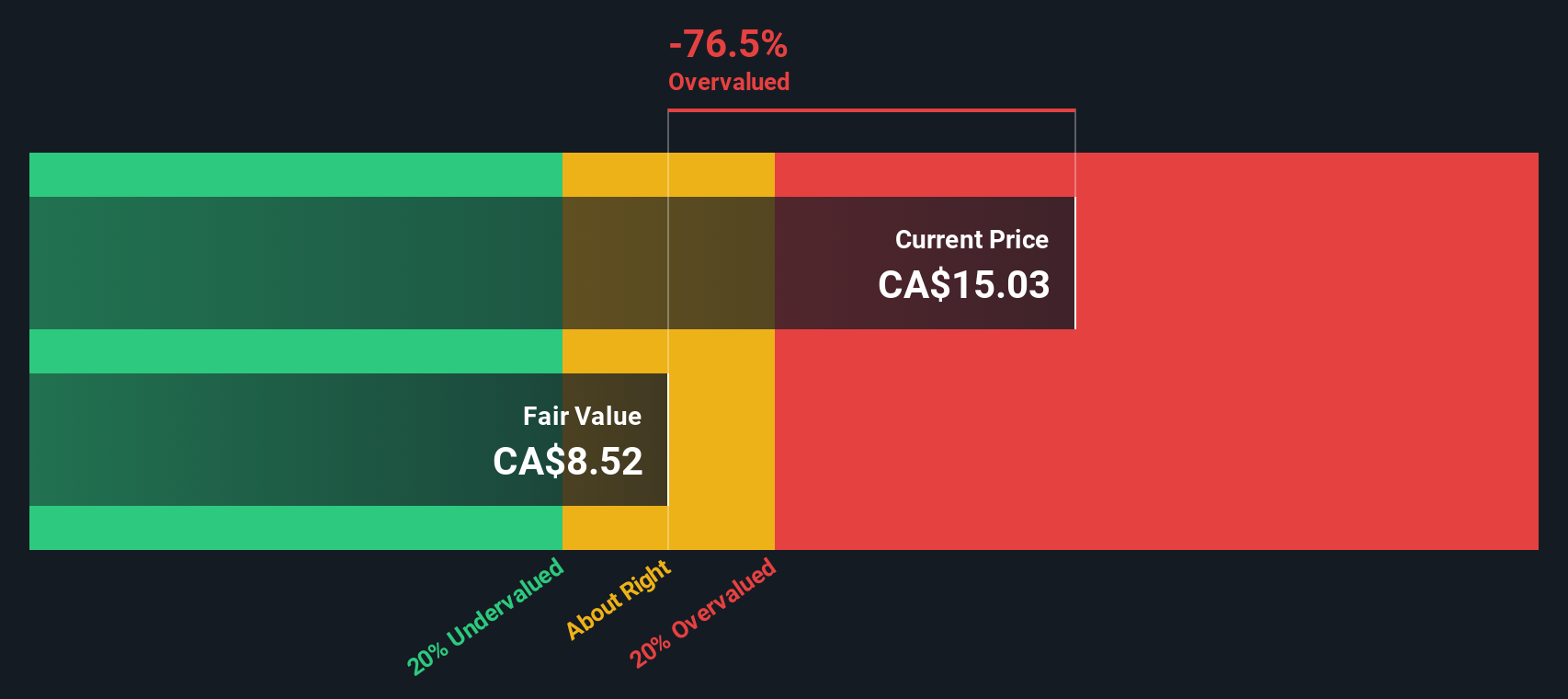

As the market absorbs these turnaround signals, the big question is whether Ivanhoe Mines is now undervalued or if today’s share price already reflects all of its anticipated future growth.

Most Popular Narrative: 21.4% Undervalued

According to the community narrative, Ivanhoe Mines is seen as significantly undervalued, with a current share price offering a notable discount to its estimated fair value. The bullish outlook is anchored in expectations of strong earnings, revenue growth, and operational improvements fueled by expansion projects.

Ongoing capacity expansions at Kamoa-Kakula (Phases 1-3) and de-bottlenecking at Kipushi, alongside operational recovery from the recent seismic event, are projected to drive substantial increases in copper and zinc output. This is expected to support strong top-line revenue growth over the next 12 to 24 months as production returns to full scale.

Want to know what propels this sky-high valuation? There is a bold blueprint behind the numbers: rapid revenue scaling, margin recalibration, and a profit trajectory that is not often seen in mining. The narrative’s fair value calculation is built on aggressive forecasts and a multiple that signals major growth expectations. Wondering just how optimistic the projections get? The details may surprise you.

Result: Fair Value of $15.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, serious setbacks such as further seismic disruptions at Kamoa-Kakula or unexpected cost overruns could quickly challenge even the most optimistic assumptions in this narrative.

Find out about the key risks to this Ivanhoe Mines narrative.Another View: Looking Through a Different Lens

On the other hand, our SWS DCF model also points to Ivanhoe Mines trading well below its estimated fair value. This supports the undervalued story presented by multiples. However, it is worth considering whether this alignment is too good to be true or if it represents a rare opportunity.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ivanhoe Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ivanhoe Mines Narrative

If you're not fully convinced by these narratives or want to dig into the numbers on your own, you can craft your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ivanhoe Mines.

Looking for More Smart Investment Moves?

Don’t limit your strategy to just one company when a world of promising stocks is at your fingertips. The Simply Wall Street Screener quickly connects you with unique opportunities so you can act fast and stay ahead. Unlock your next stock idea and make every decision count.

- Tap into steady income streams by checking out companies that consistently pay with attractive yields using dividend stocks with yields > 3%.

- Spot tomorrow’s disruptors today by scouting standout opportunities among AI penny stocks in artificial intelligence and automation.

- Supercharge your portfolio by targeting undervalued gems that may be trading below their true worth through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives