- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Ivanhoe Mines (TSX:IVN) Earnings Growth Forecast at 51%, Reinforcing Bullish Investor Narratives

Reviewed by Simply Wall St

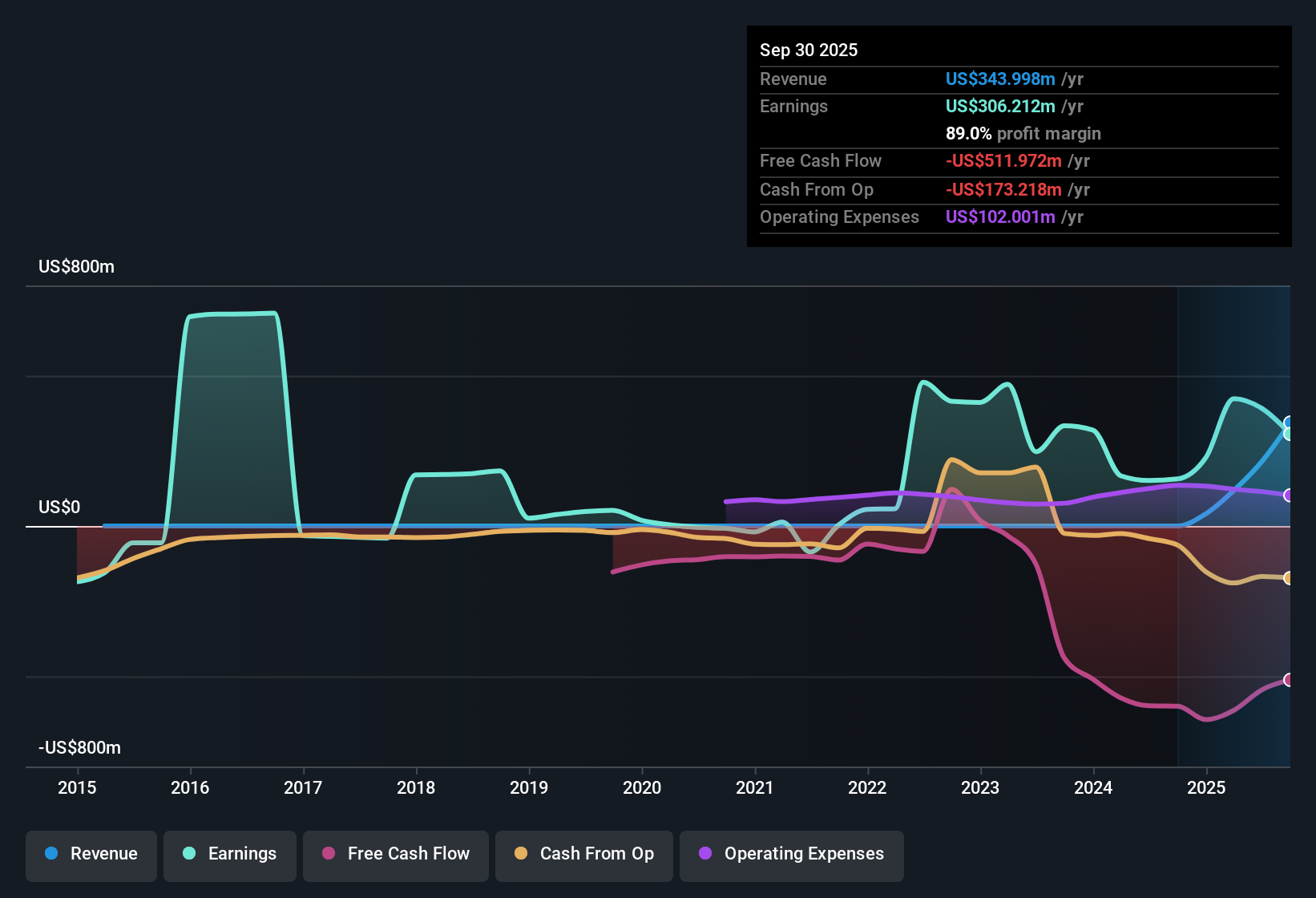

Ivanhoe Mines (TSX:IVN) has posted standout growth rates, with revenue projected to climb 30.8% per year and earnings expected to soar 51.1% annually. Both figures handily beat the Canadian market's 5% and 11.8% growth rates, respectively. Over the past year, earnings surged 95.6% compared to a five-year average of 30.7% per year, affirming the company's rapid expansion. The combination of strong profitability, ongoing revenue momentum, and the stock trading below analyst price targets is likely to shape bullish investor sentiment heading into this earnings season.

See our full analysis for Ivanhoe Mines.The next section will put these headline results head-to-head with the most widely discussed narratives, highlighting what’s in line with expectations and where surprises may emerge.

See what the community is saying about Ivanhoe Mines

Margins Set to Decline as Production Scales Up

- Analysts expect Ivanhoe Mines' profit margins to shrink from 182.2% today to 71.5% over the next three years, even as revenue is projected to rise sharply.

- According to the consensus narrative, new project ramp-ups like the Kamoa-Kakula smelter and de-bottlenecking at Kipushi are expected to boost output and reduce costs, supporting higher revenue streams.

- However, concerns linger that heavy capex and operational risks, such as the potential for future seismic events, could keep margins under pressure despite cost-saving initiatives.

- This tension highlights that even with exciting expansion, margin compression could impact long-term earnings stability.

- Consensus narrative points to both upside from scale and cost efficiency, but flags higher costs and operational surprises as key watch areas as the company grows.

- Bringing the latest earnings into focus, see how analysts balance optimism and caution in the full Ivanhoe Mines Consensus Narrative. 📊 Read the full Ivanhoe Mines Consensus Narrative.

Resource Growth Drives Diversification Story

- The company is nearly doubling resources at Western Forelands over 18 months and expanding exploration into new regions including Angola and Kazakhstan.

- The consensus narrative highlights these ongoing expansions are central to Ivanhoe Mines' multi-year organic growth, providing a buffer against commodity price swings and supporting long-term valuation.

- Analysts argue that successful project developments in these areas could further improve production resilience, especially as new phases at Platreef and Kamoa-Kakula add to output.

- The expansion effort shows Ivanhoe is aiming to balance risk by not depending solely on copper, as new precious metals streams from Platreef are expected to diversify earnings.

Trading Below Analyst Target, Yet Premium to Sector

- Ivanhoe’s share price stands at CA$14.41, which is 21.8% below the consensus analyst price target of CA$18.41, but its price-to-earnings ratio of 31.3x still exceeds the Canadian metals and mining industry average of 18.0x.

- The consensus narrative suggests that while the current market valuation offers an apparent discount to targets, some investors may hesitate due to Ivanhoe’s premium to industry peers, especially if margins fall faster than forecast.

- Supporters argue the growth profile, diversification, and copper market tailwinds justify paying more than the industry average for Ivanhoe’s future earnings power.

- On the flip side, critics worry that expectations for a swift ramp-up and rapid earnings growth are already priced in, so any execution stumble could put pressure on the stock.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Ivanhoe Mines on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Do the figures tell you another story? Make your voice heard and build your own take on Ivanhoe in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ivanhoe Mines.

Explore Alternatives

Ivanhoe Mines faces pressure as profit margins are set to fall, operational risks remain, and its valuation premium could become a liability if growth stumbles.

If you are concerned about stretched valuations and want more upside potential, shift your attention to these 833 undervalued stocks based on cash flows for stocks analysts believe are trading below their fair value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion