- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Ivanhoe Mines (TSX:IVN): Assessing Valuation Following Copper Discovery at Merke Licence in Kazakhstan

Reviewed by Simply Wall St

If you are trying to figure out your next move with Ivanhoe Mines (TSX:IVN), this week’s news deserves your attention. The company just confirmed surface copper mineralization at its Merke licence in Kazakhstan’s Chu-Sarysu Basin, which is a big step in a region that has seen very little modern exploration. For Ivanhoe Mines, this milestone unlocks a fresh growth story, with a major diamond drill campaign now planned to follow up on the find. These kinds of early discoveries can sometimes be underappreciated until they deliver concrete results, but they also tend to attract attention from investors looking for exposure to new, high-potential resource basins.

Over the past year, Ivanhoe Mines’ stock has slipped 20%. Despite this, the company is coming off the back of several production records at its existing assets, including the Kipushi Mine, and notable operational progress elsewhere. While share price momentum has lagged, the company’s three-year return remains up more than 33%, indicating that longer-term investors have still come out ahead. Recent developments, including new offtake agreements and successful cost controls on large-scale projects, suggest the underlying business continues to generate value, even if investors have not fully bought in this year.

With the stock sitting well below last year’s highs and a potentially transformative exploration campaign just beginning, some may be asking whether Ivanhoe Mines is now trading at a discount or if the market is already accounting for all the upside in its price.

Most Popular Narrative: 18% Undervalued

The prevailing narrative sees Ivanhoe Mines trading significantly below its fair value, driven by ambitious growth plans and large-scale expansions.

Ongoing capacity expansions at Kamoa-Kakula (Phases 1, 2, and 3) and de-bottlenecking at Kipushi, alongside operational recovery from the recent seismic event, are projected to drive substantial increases in copper and zinc output. These factors are expected to support strong top-line revenue growth in the next 12 to 24 months as production returns to full scale.

Curious why analysts think Ivanhoe Mines could be worth so much more? They are betting on major growth catalysts and future profit assumptions that have surprised even some market veterans. The narrative is built on a bold view of future earnings, a margin story that defies current market trends, and a multiple normally reserved for high-flying sectors. What’s behind those calculations? You’ll have to see for yourself.

Result: Fair Value of $15.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, hurdles remain, including operational setbacks such as seismic events or escalating costs, either of which could challenge Ivanhoe Mines’ bullish valuation outlook.

Find out about the key risks to this Ivanhoe Mines narrative.Another View: How the Market’s Multiple Compares

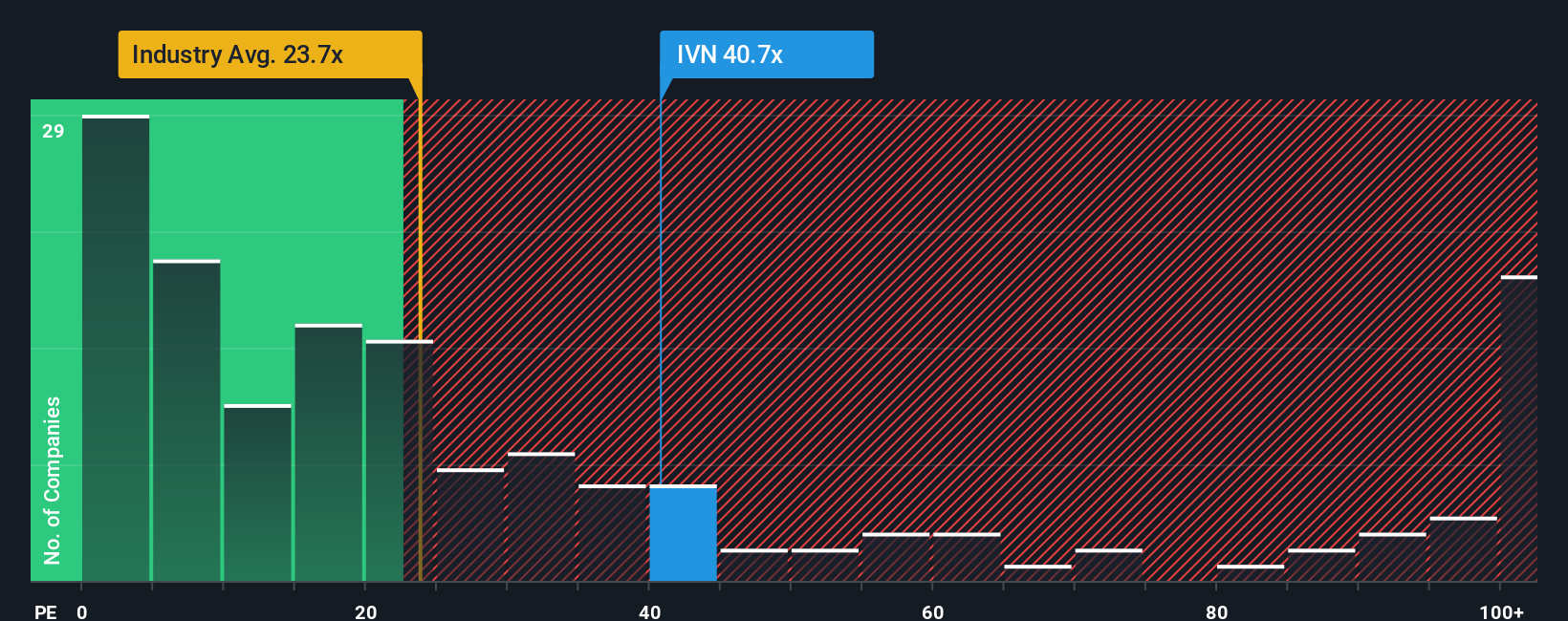

Taking a different approach, the market’s usual valuation method suggests Ivanhoe Mines is priced higher than others in its sector. Does this signal the market is already factoring in future highs, or is something being overlooked?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ivanhoe Mines Narrative

If the consensus view or the analysts’ models don’t quite fit your perspective, you can dive deeper, interpret the numbers your way, and shape your own conclusion. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ivanhoe Mines.

Looking for More Standout Investment Ideas?

Smart investing means staying ahead of the crowd. Don’t settle for the obvious plays when you can tap into expert-curated themes designed to put you on the front foot.

- Uncover stocks with exceptional income potential by tracking top companies offering dividend stocks with yields > 3%. These stocks have yields above 3% and reward shareholders generously.

- Boost your portfolio’s future focus by targeting pioneering businesses shaping society through healthcare AI stocks. These companies are leading the medical AI evolution.

- Spot hidden gems before the market by filtering for shares undervalued on cash flows using our intuitive screen for undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives