- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Discover 3 TSX Stocks That May Be Trading Below Fair Value Estimates

Reviewed by Simply Wall St

With the Canadian market showing signs of recovery and positive sentiment amid easing inflation and better-than-expected economic data, investors are keenly watching how central banks will navigate interest rate cuts. As the TSX rebounds alongside global indices, identifying stocks that may be trading below their fair value estimates becomes crucial for those looking to capitalize on potential opportunities. In this article, we will explore three TSX stocks that could be undervalued based on current market conditions and economic trends.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$186.02 | CA$358.58 | 48.1% |

| Alvopetro Energy (TSXV:ALV) | CA$5.00 | CA$9.12 | 45.1% |

| Computer Modelling Group (TSX:CMG) | CA$12.73 | CA$22.27 | 42.8% |

| Kinaxis (TSX:KXS) | CA$153.90 | CA$284.03 | 45.8% |

| Obsidian Energy (TSX:OBE) | CA$9.56 | CA$18.17 | 47.4% |

| Africa Oil (TSX:AOI) | CA$2.11 | CA$3.71 | 43.2% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Kraken Robotics (TSXV:PNG) | CA$1.43 | CA$2.53 | 43.5% |

| Green Thumb Industries (CNSX:GTII) | CA$15.32 | CA$30.10 | 49.1% |

| NanoXplore (TSX:GRA) | CA$2.28 | CA$4.20 | 45.8% |

Let's explore several standout options from the results in the screener.

Green Thumb Industries (CNSX:GTII)

Overview: Green Thumb Industries Inc. manufactures, distributes, markets, and sells cannabis products for medical and adult use in the United States with a market cap of CA$3.61 billion.

Operations: Green Thumb Industries Inc. generates revenue from two primary segments: Retail at $822.99 million and Consumer Packaged Goods at $604.04 million.

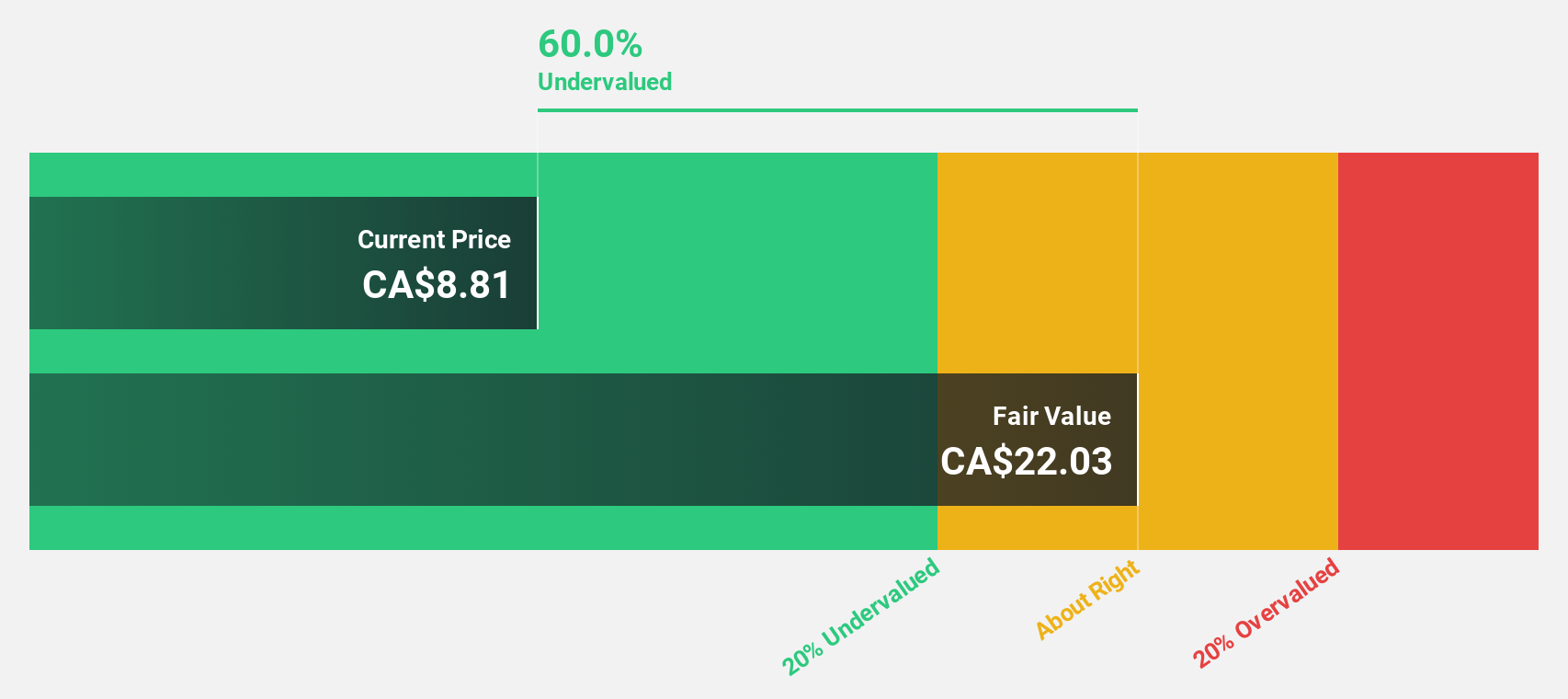

Estimated Discount To Fair Value: 49.1%

Green Thumb Industries (CA$15.32) is trading at 49.1% below its estimated fair value of CA$30.10, indicating significant undervaluation based on discounted cash flows. The company reported Q2 2024 earnings with net income rising to US$20.71 million from US$13.4 million a year ago, reflecting strong financial performance and profitability growth this year. Despite slower revenue growth forecasts (12.3% per year), its earnings are expected to grow significantly at 27.7% annually, outpacing the Canadian market's average growth rate of 14.9%.

- In light of our recent growth report, it seems possible that Green Thumb Industries' financial performance will exceed current levels.

- Navigate through the intricacies of Green Thumb Industries with our comprehensive financial health report here.

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc., with a market cap of CA$8.96 billion, acquires, builds, and manages vertical market software businesses in Canada, the United States, Europe, and internationally.

Operations: Constellation Software generates revenue primarily from its Software & Programming segment, which totaled $9.27 billion.

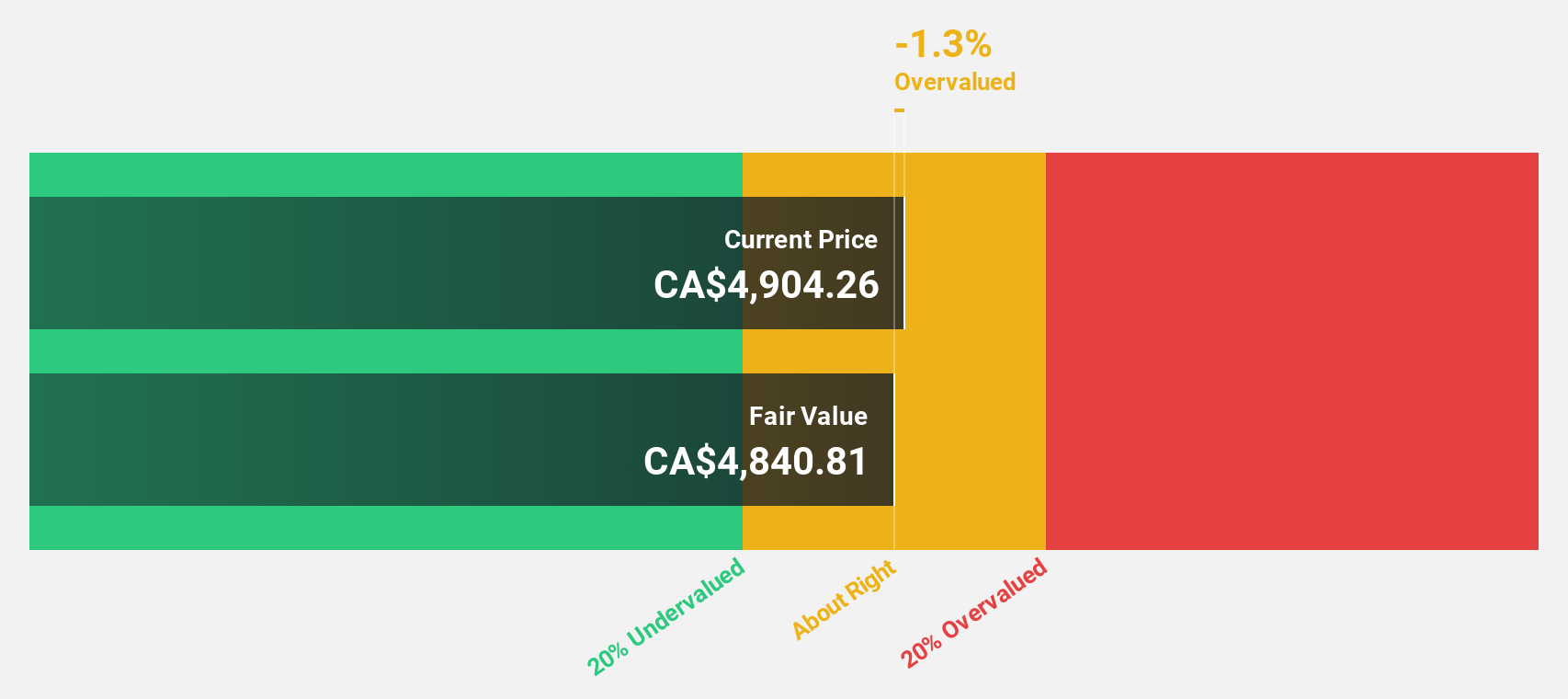

Estimated Discount To Fair Value: 34.2%

Constellation Software (CA$4,228.74) trades at 34.2% below its estimated fair value of CA$6,423.75, highlighting significant undervaluation based on discounted cash flows. Recent Q2 earnings showed substantial growth with revenue reaching US$2.47 billion and net income rising to US$177 million from US$103 million a year ago. Despite high debt levels and insider selling, the company’s earnings are forecasted to grow significantly at 23.55% annually, surpassing the Canadian market's average growth rate of 14.9%.

- Upon reviewing our latest growth report, Constellation Software's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Constellation Software.

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. engages in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$23.26 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through the mining, development, and exploration of minerals and precious metals predominantly in Africa.

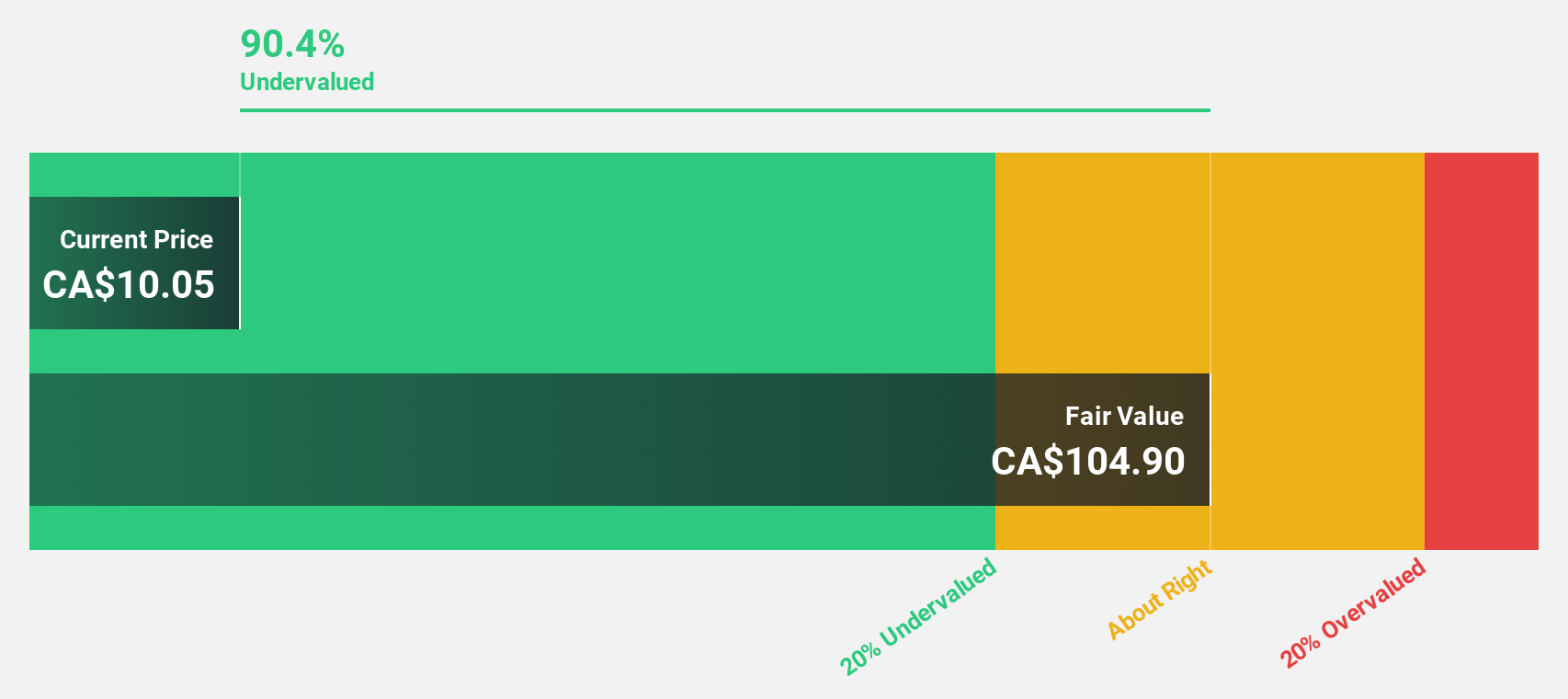

Estimated Discount To Fair Value: 25.4%

Ivanhoe Mines (CA$17.24) trades at 25.4% below its estimated fair value of CA$23.1, indicating significant undervaluation based on discounted cash flows. Despite recent insider selling and shareholder dilution, the company's revenue is forecast to grow at 47.5% annually, outpacing the Canadian market's 6.6%. Earnings are also expected to grow significantly at 40.9% per year, driven by the Phase 3 concentrator expansion at Kamoa-Kakula Copper Complex, which will boost production capacity and cash flow generation capabilities.

- Our growth report here indicates Ivanhoe Mines may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Ivanhoe Mines stock in this financial health report.

Taking Advantage

- Reveal the 33 hidden gems among our Undervalued TSX Stocks Based On Cash Flows screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals primarily in Africa.

High growth potential and fair value.