- Canada

- /

- Electrical

- /

- TSX:HPS.A

Discovering Canada's Hidden Stock Gems August 2024

Reviewed by Simply Wall St

As the Canadian market responds to easing inflation and better-than-expected economic data, investors are closely watching central banks' next moves. With the S&P 500 and TSX rebounding significantly from recent lows, there is renewed interest in finding promising opportunities within the small-cap sector. In this article, we explore three undiscovered gems in Canada that stand out due to their potential for growth and resilience amid evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Amerigo Resources | 12.87% | 7.49% | 12.97% | ★★★★★☆ |

| Reconnaissance Energy Africa | NA | 31.73% | -6.92% | ★★★★★☆ |

| Firan Technology Group | 17.91% | 3.75% | 23.32% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Firm Capital Mortgage Investment | 57.73% | 9.38% | 5.91% | ★★★★☆☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Hammond Power Solutions Inc., along with its subsidiaries, specializes in designing, manufacturing, and selling various transformers across Canada, the United States, Mexico, and India with a market cap of CA$1.40 billion.

Operations: Hammond Power Solutions generates CA$754.37 million from the manufacture and sale of transformers across Canada, the United States, Mexico, and India. The company's market cap stands at CA$1.40 billion.

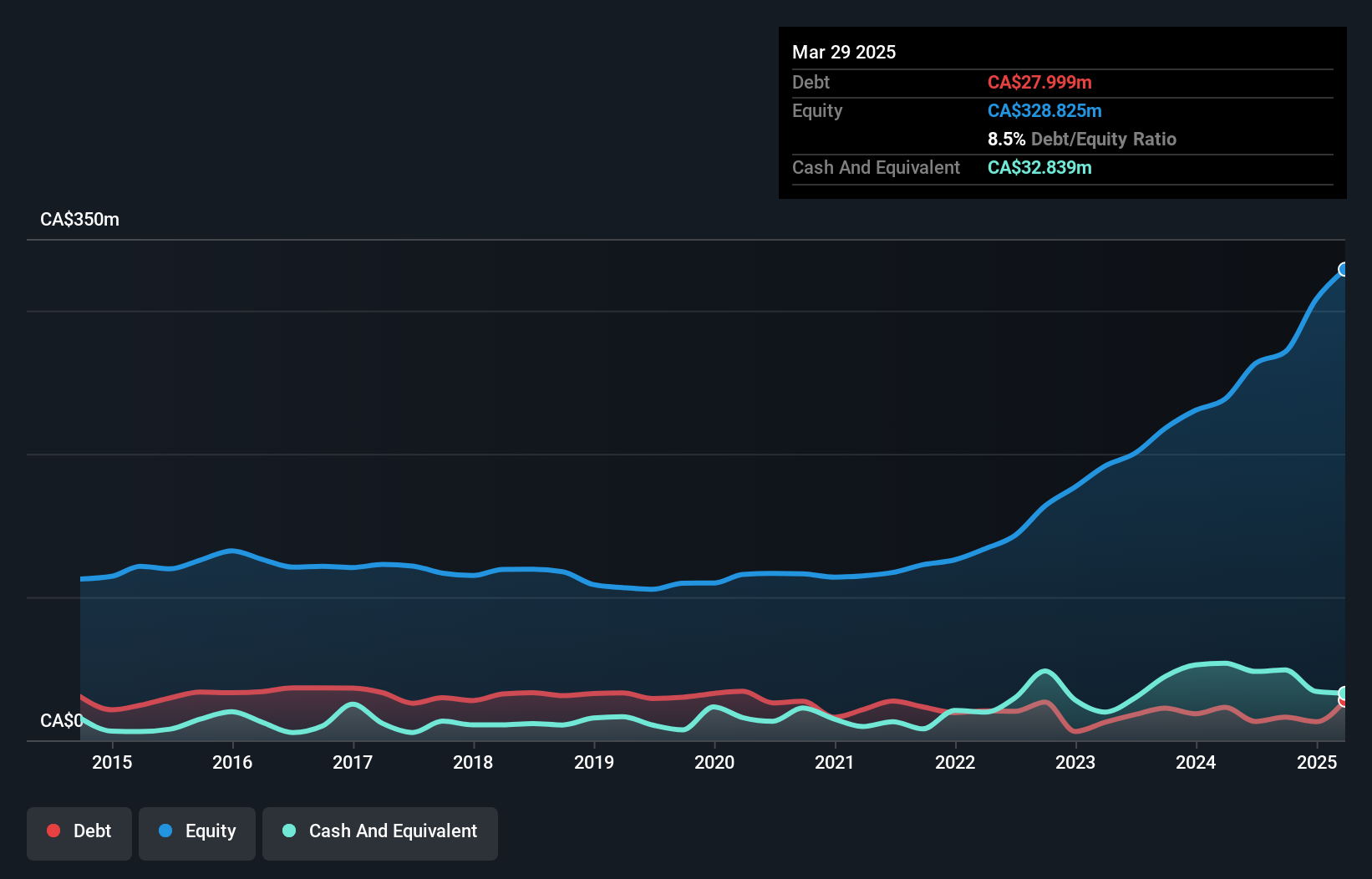

Hammond Power Solutions has shown impressive financial performance, with earnings growing by 12.3% over the past year, outpacing the electrical industry’s 6.5%. The company reported second-quarter sales of CAD 197.21 million and net income of CAD 23.59 million, reflecting a substantial increase from last year's CAD 172.45 million in sales and CAD 13.33 million in net income. Additionally, HPS.A's debt-to-equity ratio improved significantly from 27.7% to just 5% over five years, indicating strong financial health and prudent management practices.

Silvercorp Metals (TSX:SVM)

Simply Wall St Value Rating: ★★★★★★

Overview: Silvercorp Metals Inc., with a market cap of CA$1.07 billion, is involved in the acquisition, exploration, development, and mining of mineral properties through its subsidiaries.

Operations: Silvercorp Metals generates revenue from its mining operations in Guangdong ($27.35 million) and Henan Luoning ($200 million). The company's market cap is CA$1.07 billion.

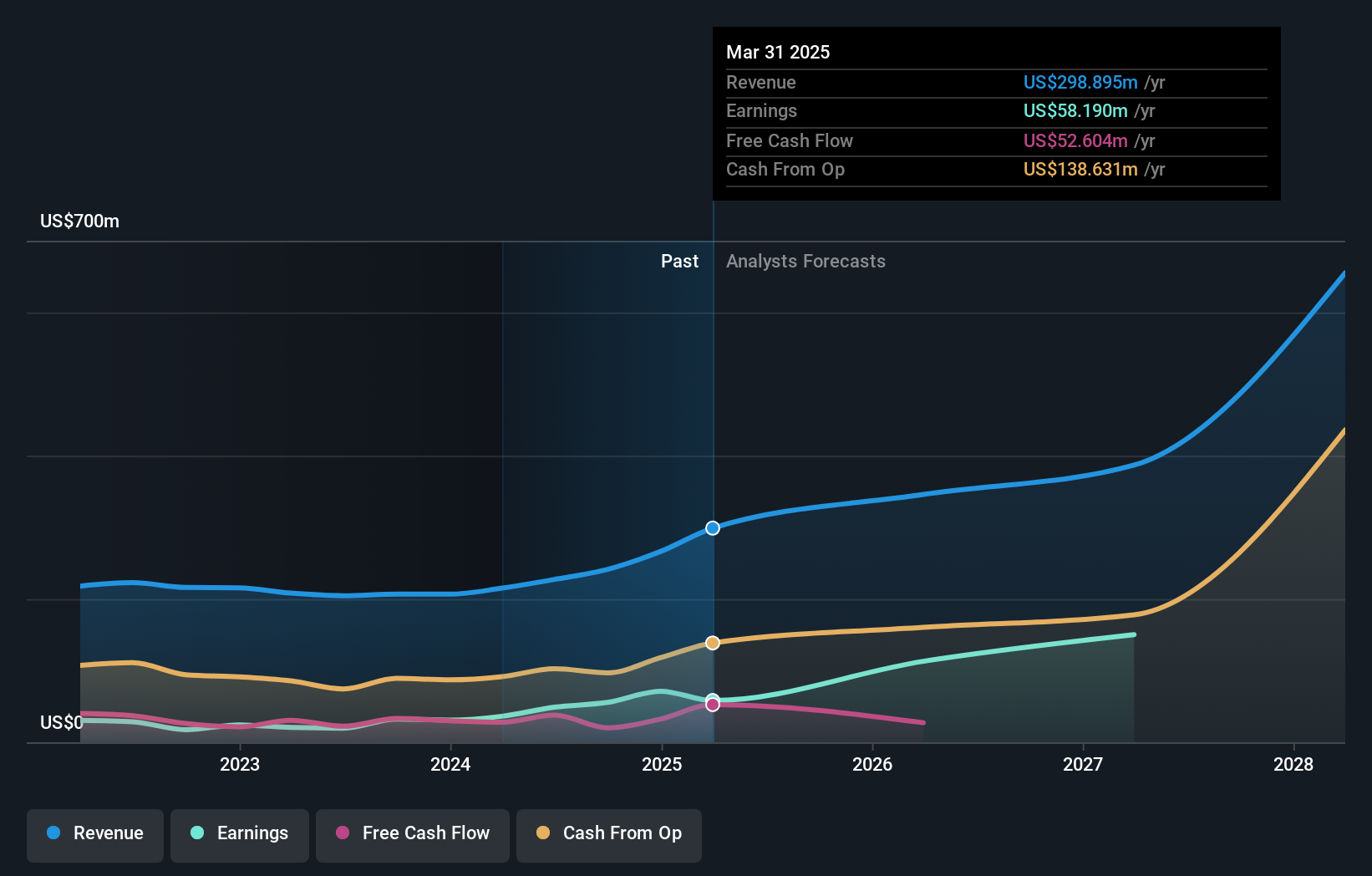

Silvercorp Metals, a notable player in the mining sector, has shown impressive earnings growth of 149.4% over the past year, surpassing industry growth rates. Recently reported Q1 sales reached US$72.17 million compared to US$60.01 million last year, with net income rising to US$21.94 million from US$9.22 million previously. The company remains debt-free and has repurchased 191,770 shares this year for $0.61 million while advancing its El Domo-Curipamba Project in Ecuador to the exploitation phase.

- Delve into the full analysis health report here for a deeper understanding of Silvercorp Metals.

Evaluate Silvercorp Metals' historical performance by accessing our past performance report.

TerraVest Industries (TSX:TVK)

Simply Wall St Value Rating: ★★★★★☆

Overview: TerraVest Industries Inc. manufactures and sells goods and services to energy, agriculture, mining, transportation, and other markets in Canada and the United States with a market cap of CA$1.84 billion.

Operations: Revenue streams for TerraVest Industries Inc. include Service (CA$201.78 million), Processing Equipment (CA$117.58 million), Compressed Gas Equipment (CA$243.77 million), and HVAC and Containment Equipment (CA$292.90 million). The Corporate segment shows a negative revenue of CA$-0.93 million.

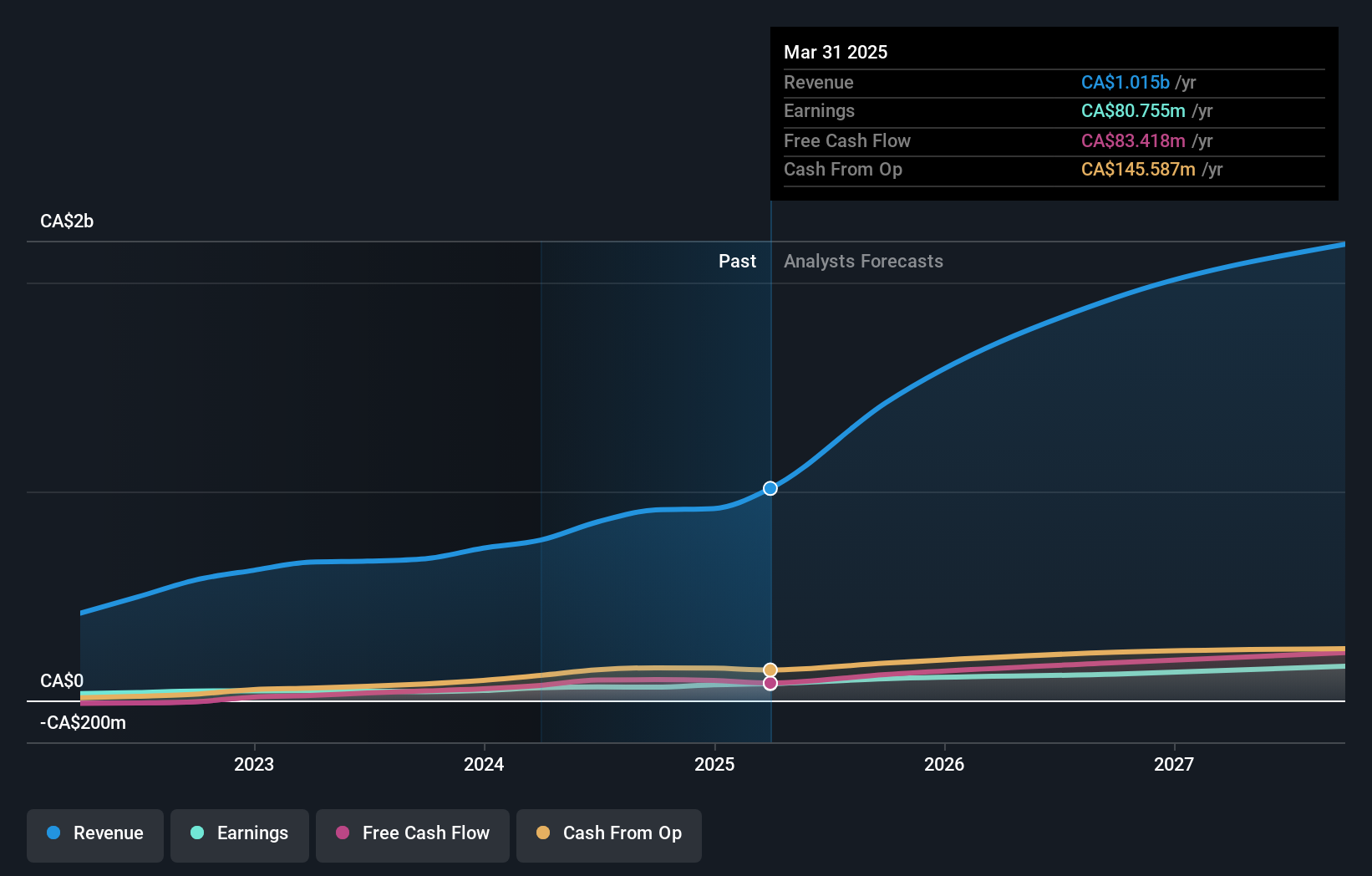

TerraVest Industries reported robust earnings for the third quarter of 2024, with revenue climbing to CAD 238.13 million from CAD 150.36 million a year ago. Net income also rose to CAD 11.92 million compared to last year's CAD 7.97 million, reflecting strong operational performance. Over the past five years, TerraVest's debt-to-equity ratio improved significantly from 117.9% to 49.4%. The company is trading at a notable discount of approximately 27% below its estimated fair value and has high-quality earnings as well as free cash flow positivity

- Get an in-depth perspective on TerraVest Industries' performance by reading our health report here.

Assess TerraVest Industries' past performance with our detailed historical performance reports.

Key Takeaways

- Access the full spectrum of 44 TSX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammond Power Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HPS.A

Hammond Power Solutions

Engages in the design, manufacture, and sale of various transformers in Canada, the United States, Mexico, and India.

Flawless balance sheet with proven track record.