- Canada

- /

- Metals and Mining

- /

- TSX:IVN

3 TSX Stocks Trading At Up To 47.4% Below Intrinsic Value

Reviewed by Simply Wall St

As the Canadian market rebounds from recent sell-offs, with the TSX up over 5%, investors are eyeing opportunities amid easing inflation and favorable economic data. In this environment of potential rate cuts by central banks, identifying undervalued stocks becomes crucial for capturing value in a diversified portfolio.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$186.67 | CA$358.15 | 47.9% |

| Alvopetro Energy (TSXV:ALV) | CA$5.06 | CA$9.06 | 44.2% |

| Kinaxis (TSX:KXS) | CA$152.02 | CA$282.28 | 46.1% |

| Obsidian Energy (TSX:OBE) | CA$9.21 | CA$18.14 | 49.2% |

| Africa Oil (TSX:AOI) | CA$2.05 | CA$3.70 | 44.6% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Calibre Mining (TSX:CXB) | CA$2.39 | CA$4.54 | 47.4% |

| Kraken Robotics (TSXV:PNG) | CA$1.43 | CA$2.53 | 43.5% |

| NFI Group (TSX:NFI) | CA$19.16 | CA$37.58 | 49% |

| NanoXplore (TSX:GRA) | CA$2.27 | CA$4.20 | 46% |

Here we highlight a subset of our preferred stocks from the screener.

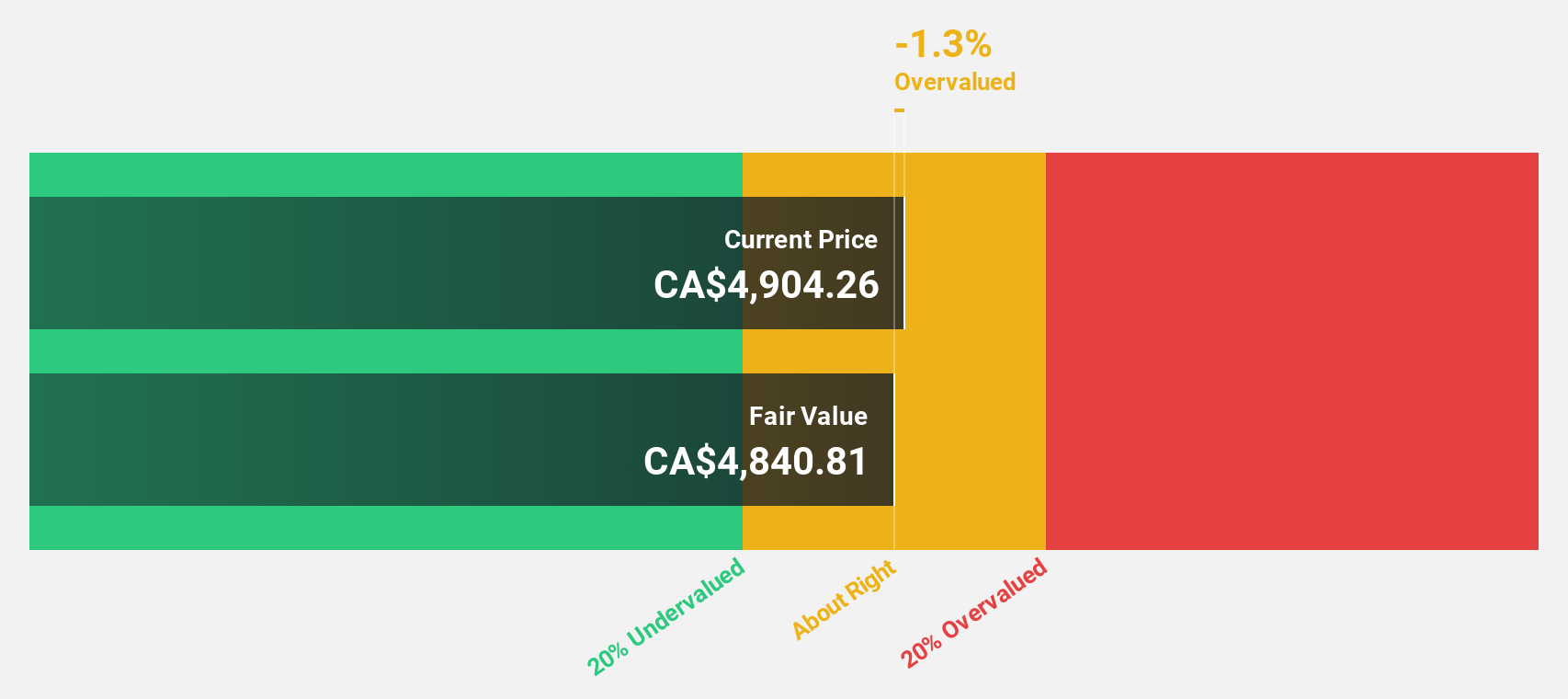

Constellation Software (TSX:CSU)

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses in Canada, the United States, Europe, and internationally with a market cap of CA$89.54 billion.

Operations: Revenue from Software & Programming amounts to $9.27 billion.

Estimated Discount To Fair Value: 32.7%

Constellation Software (CA$4300.03) is trading significantly below its estimated fair value of CA$6385.92, indicating it may be undervalued based on cash flows. Recent earnings show strong growth with Q2 revenue at US$2.47 billion and net income at US$177 million, up from US$103 million a year ago. The company’s earnings are forecast to grow 23.55% annually over the next three years, outpacing the Canadian market's expected growth rate of 15.2%.

- Our growth report here indicates Constellation Software may be poised for an improving outlook.

- Get an in-depth perspective on Constellation Software's balance sheet by reading our health report here.

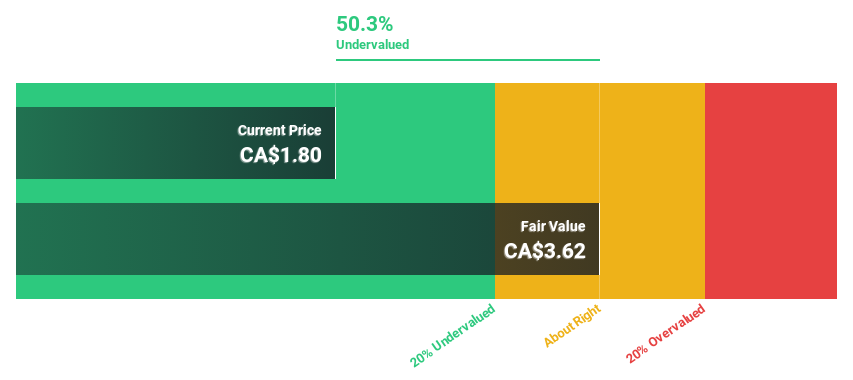

Calibre Mining (TSX:CXB)

Overview: Calibre Mining Corp., with a market cap of CA$1.75 billion, is involved in the exploration, development, and mining of gold properties across Nicaragua, the United States, and Canada.

Operations: Calibre Mining generates its revenue primarily from refined gold, amounting to $564.69 million.

Estimated Discount To Fair Value: 47.4%

Calibre Mining (CA$2.39) is trading well below its estimated fair value of CA$4.54, highlighting its potential as an undervalued stock based on cash flows. Despite a decline in net income to US$20.76 million for Q2 2024 from US$33.2 million a year ago, earnings are forecast to grow significantly at 22.7% annually over the next three years, surpassing the Canadian market's growth rate of 15.2%. Recent drill results and production guidance further support future revenue growth prospects.

- Upon reviewing our latest growth report, Calibre Mining's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Calibre Mining stock in this financial health report.

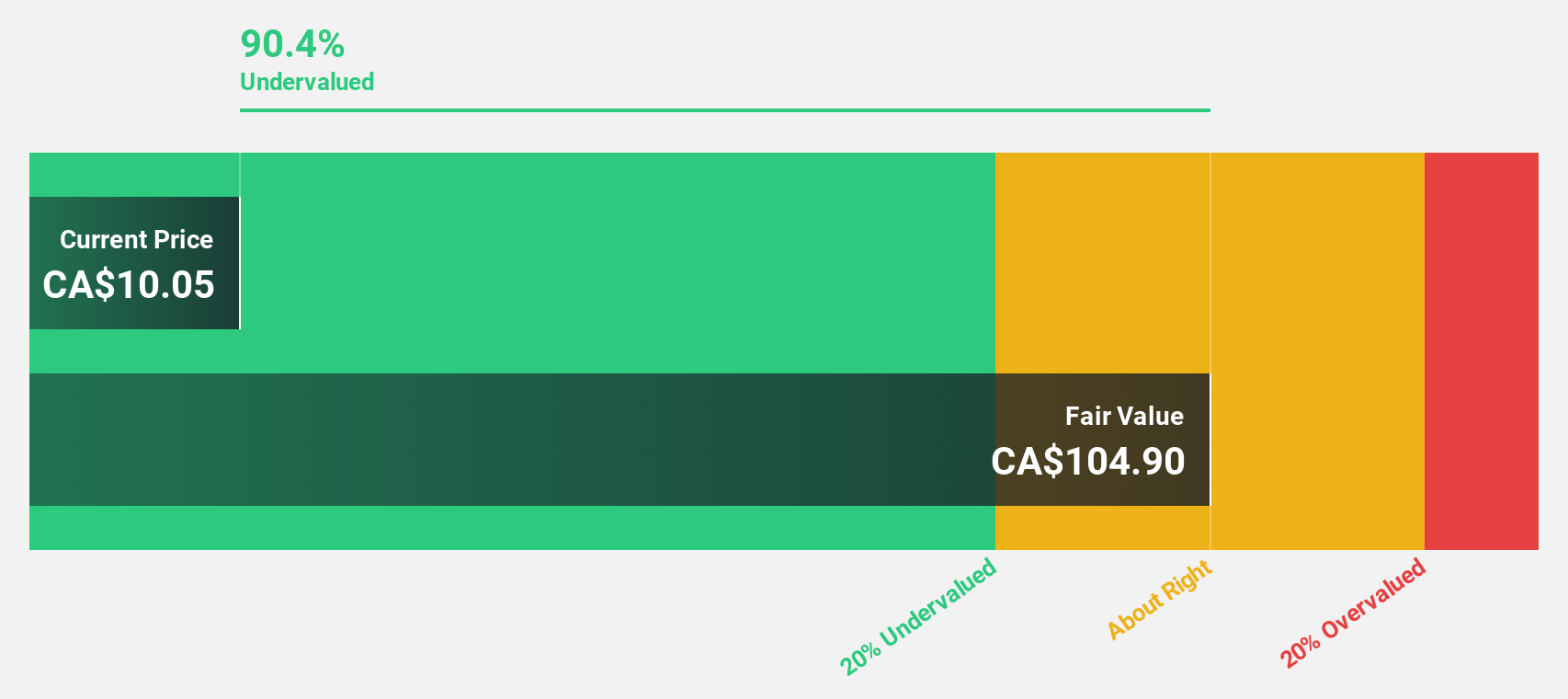

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. engages in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$23.99 billion.

Operations: Ivanhoe Mines generates revenue through the mining, development, and exploration of minerals and precious metals primarily in Africa.

Estimated Discount To Fair Value: 20.5%

Ivanhoe Mines (CA$18.26) is trading 20.5% below its estimated fair value of CA$22.96, suggesting it may be undervalued based on cash flows. Despite significant insider selling and shareholder dilution over the past year, its earnings are forecast to grow at a robust 72.4% annually, outpacing the Canadian market's 15.2%. Recent completion of Phase 3 at Kamoa-Kakula ahead of schedule is expected to boost production capacity significantly, enhancing future revenue streams and cash flow stability.

- In light of our recent growth report, it seems possible that Ivanhoe Mines' financial performance will exceed current levels.

- Take a closer look at Ivanhoe Mines' balance sheet health here in our report.

Turning Ideas Into Actions

- Unlock our comprehensive list of 32 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals primarily in Africa.

High growth potential and fair value.