Why You Might Be Interested In Intertape Polymer Group Inc. (TSE:ITP) For Its Upcoming Dividend

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Intertape Polymer Group Inc. (TSE:ITP) is about to trade ex-dividend in the next four days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Thus, you can purchase Intertape Polymer Group's shares before the 15th of June in order to receive the dividend, which the company will pay on the 30th of June.

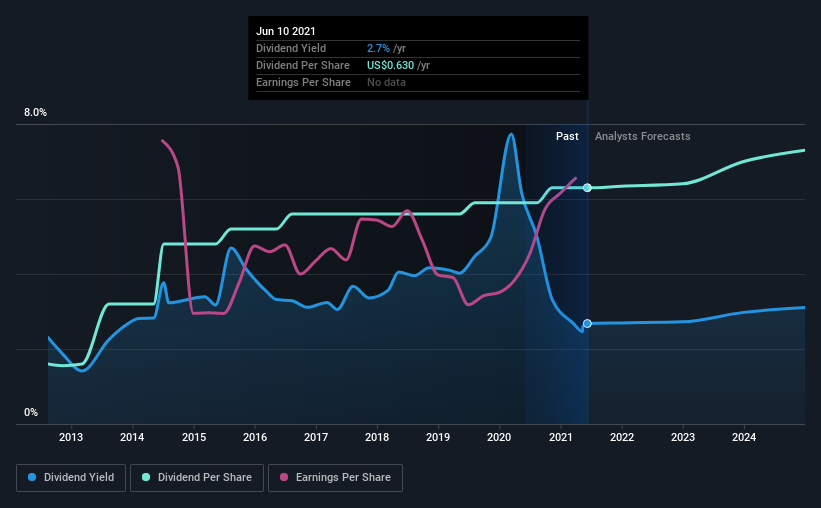

The company's upcoming dividend is US$0.16 a share, following on from the last 12 months, when the company distributed a total of US$0.63 per share to shareholders. Calculating the last year's worth of payments shows that Intertape Polymer Group has a trailing yield of 2.7% on the current share price of CA$28.46. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

View our latest analysis for Intertape Polymer Group

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Fortunately Intertape Polymer Group's payout ratio is modest, at just 47% of profit. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Thankfully its dividend payments took up just 31% of the free cash flow it generated, which is a comfortable payout ratio.

It's positive to see that Intertape Polymer Group's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. This is why it's a relief to see Intertape Polymer Group earnings per share are up 6.7% per annum over the last five years. Management have been reinvested more than half of the company's earnings within the business, and the company has been able to grow earnings with this retained capital. Organisations that reinvest heavily in themselves typically get stronger over time, which can bring attractive benefits such as stronger earnings and dividends.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Intertape Polymer Group has delivered 16% dividend growth per year on average over the past nine years. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Should investors buy Intertape Polymer Group for the upcoming dividend? Earnings per share have been growing moderately, and Intertape Polymer Group is paying out less than half its earnings and cash flow as dividends, which is an attractive combination as it suggests the company is investing in growth. We would prefer to see earnings growing faster, but the best dividend stocks over the long term typically combine significant earnings per share growth with a low payout ratio, and Intertape Polymer Group is halfway there. There's a lot to like about Intertape Polymer Group, and we would prioritise taking a closer look at it.

On that note, you'll want to research what risks Intertape Polymer Group is facing. In terms of investment risks, we've identified 3 warning signs with Intertape Polymer Group and understanding them should be part of your investment process.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you're looking for stocks to buy, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ITP

Intertape Polymer Group

Intertape Polymer Group Inc. provides packaging and protective solutions for the industrial markets in North America, Europe, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion