We Think Some Shareholders May Hesitate To Increase Intertape Polymer Group Inc.'s (TSE:ITP) CEO Compensation

Under the guidance of CEO Greg Yull, Intertape Polymer Group Inc. (TSE:ITP) has performed reasonably well recently. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 12 May 2021. However, some shareholders may still want to keep CEO compensation within reason.

Check out our latest analysis for Intertape Polymer Group

Comparing Intertape Polymer Group Inc.'s CEO Compensation With the industry

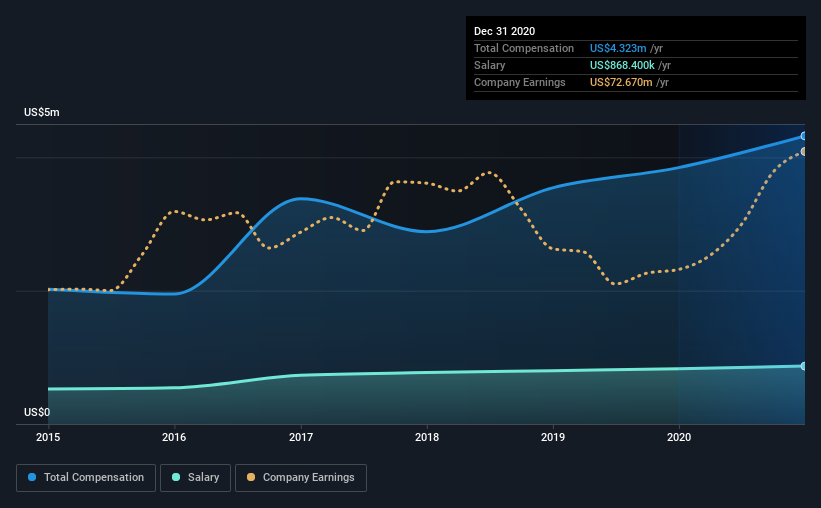

According to our data, Intertape Polymer Group Inc. has a market capitalization of CA$1.8b, and paid its CEO total annual compensation worth US$4.3m over the year to December 2020. Notably, that's an increase of 12% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$868k.

On comparing similar companies from the same industry with market caps ranging from CA$1.2b to CA$3.9b, we found that the median CEO total compensation was US$1.5m. This suggests that Greg Yull is paid more than the median for the industry. Furthermore, Greg Yull directly owns CA$23m worth of shares in the company, implying that they are deeply invested in the company's success.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | US$868k | US$828k | 20% |

| Other | US$3.5m | US$3.0m | 80% |

| Total Compensation | US$4.3m | US$3.8m | 100% |

On an industry level, roughly 24% of total compensation represents salary and 76% is other remuneration. Intertape Polymer Group pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

A Look at Intertape Polymer Group Inc.'s Growth Numbers

Intertape Polymer Group Inc. has seen its earnings per share (EPS) increase by 4.2% a year over the past three years. In the last year, its revenue is up 4.7%.

We'd prefer higher revenue growth, but the modest improvement in EPS is good. It's clear the performance has been quite decent, but it it falls short of outstanding,based on this information. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Intertape Polymer Group Inc. Been A Good Investment?

We think that the total shareholder return of 83%, over three years, would leave most Intertape Polymer Group Inc. shareholders smiling. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, if the board proposes to increase the compensation, some shareholders might have questions given that the CEO is already being paid higher than the industry.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 4 warning signs for Intertape Polymer Group that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:ITP

Intertape Polymer Group

Intertape Polymer Group Inc. provides packaging and protective solutions for the industrial markets in North America, Europe, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026