- Canada

- /

- Metals and Mining

- /

- TSX:IMG

IAMGOLD (TSX:IMG): Rethinking Valuation After a Strong Multi‑Year Share Price Run

Reviewed by Simply Wall St

IAMGOLD (TSX:IMG) has quietly turned into one of the stronger gold names in Canada, with shares up sharply this year as investors reward improving operations at its core Westwood, Côté and Essakane assets.

See our latest analysis for IAMGOLD.

The move has not been a blip either, with IAMGOLD’s share price delivering a powerful year to date run supported by a 30 day share price return above 20 percent and a three year total shareholder return above 500 percent, signaling clear positive momentum as investors reassess its growth profile and risk.

If IAMGOLD’s momentum has you rethinking your portfolio, it could be a smart moment to explore fast growing stocks with high insider ownership for other fast moving opportunities with aligned insiders.

Yet even after a near tripling in twelve months and rapid earnings growth, IAMGOLD still trades at a sizable discount to some analyst estimates. This leaves investors to debate whether there is still a buying opportunity here or whether the market is already pricing in future growth.

Most Popular Narrative Narrative: 6.2% Undervalued

With IAMGOLD closing at CA$23.16 against a narrative fair value of about CA$24.69, the story leans toward modest upside driven by operations and growth.

The successful ramp up and ahead of schedule capacity achievement at the Côté Gold mine, coupled with consistent production and ongoing cost optimization, set the stage for a material near term increase in gold output, which should significantly boost future revenues and cash flow as temporary ramp up costs subside.

Want to see the math behind that optimism? Revenue expansion, margin shifts and a future earnings multiple all collide in one valuation blueprint. Curious?

Result: Fair Value of $24.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent cost pressures and heavy reliance on Côté and Essakane mean that any operational stumble could quickly undermine those upbeat valuation assumptions.

Find out about the key risks to this IAMGOLD narrative.

Another Take on Valuation

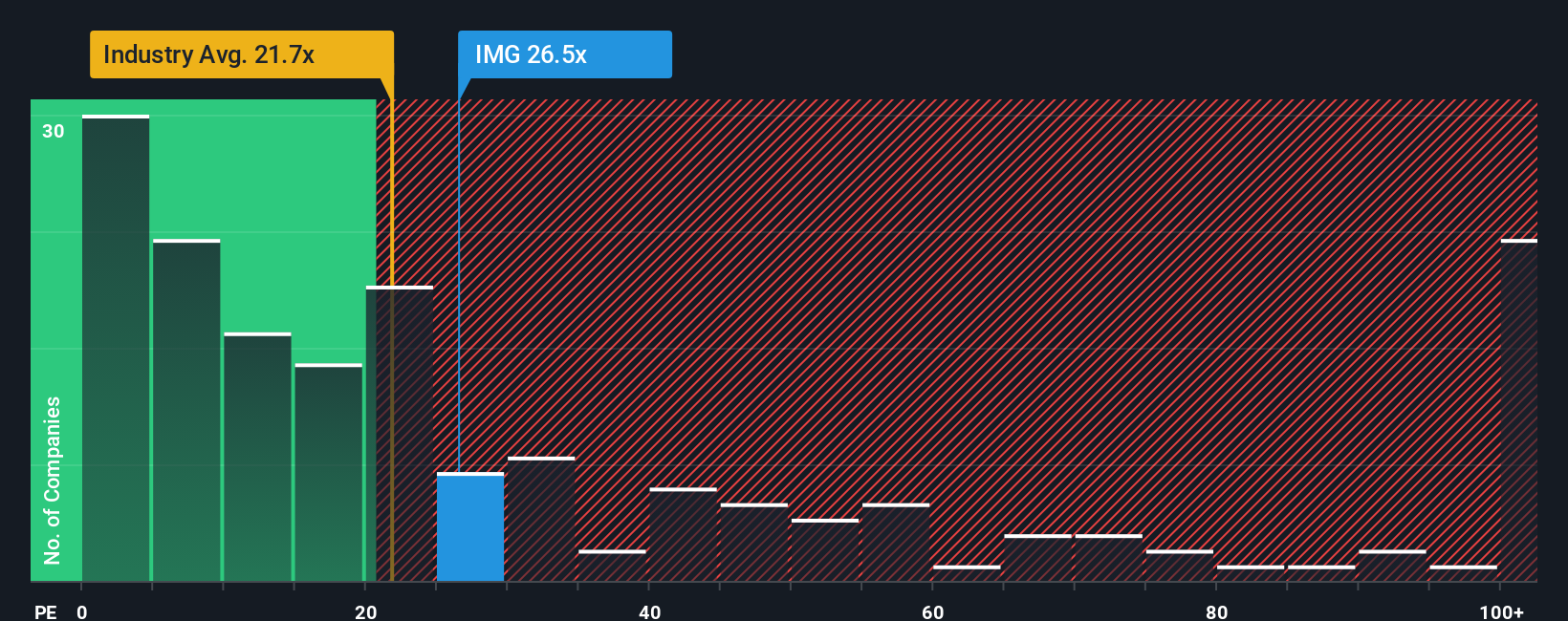

Our fair ratio work paints a more complicated picture. IAMGOLD trades on a 28.1x earnings multiple, richer than the Canadian metals and mining average of 21.2x, yet well below a 38.6x fair ratio suggested by peers. Is this a margin of safety or a warning signal?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IAMGOLD Narrative

If you see the numbers differently, or simply want to dig into the details yourself, you can build a custom version in minutes, Do it your way.

A great starting point for your IAMGOLD research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you stop at IAMGOLD, you could miss out on other powerful opportunities, so use the Simply Wall St Screener to uncover your next standout winner today.

- Capture potential mispricings early by scanning these 912 undervalued stocks based on cash flows that the market may be overlooking right now.

- Ride powerful structural trends by focusing on these 29 healthcare AI stocks reshaping medicine, diagnosis, and patient care.

- Position yourself ahead of the next payments revolution by assessing these 79 cryptocurrency and blockchain stocks building real businesses around blockchain and digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IMG

IAMGOLD

Through its subsidiaries, operates as a gold producer and developer in Canada and Burkina Faso.

Exceptional growth potential and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion