- Canada

- /

- Metals and Mining

- /

- TSX:IMG

IAMGOLD (TSX:IMG) Margin Surge Reinforces Bull Narratives, But Earnings Quality Faces Scrutiny

Reviewed by Simply Wall St

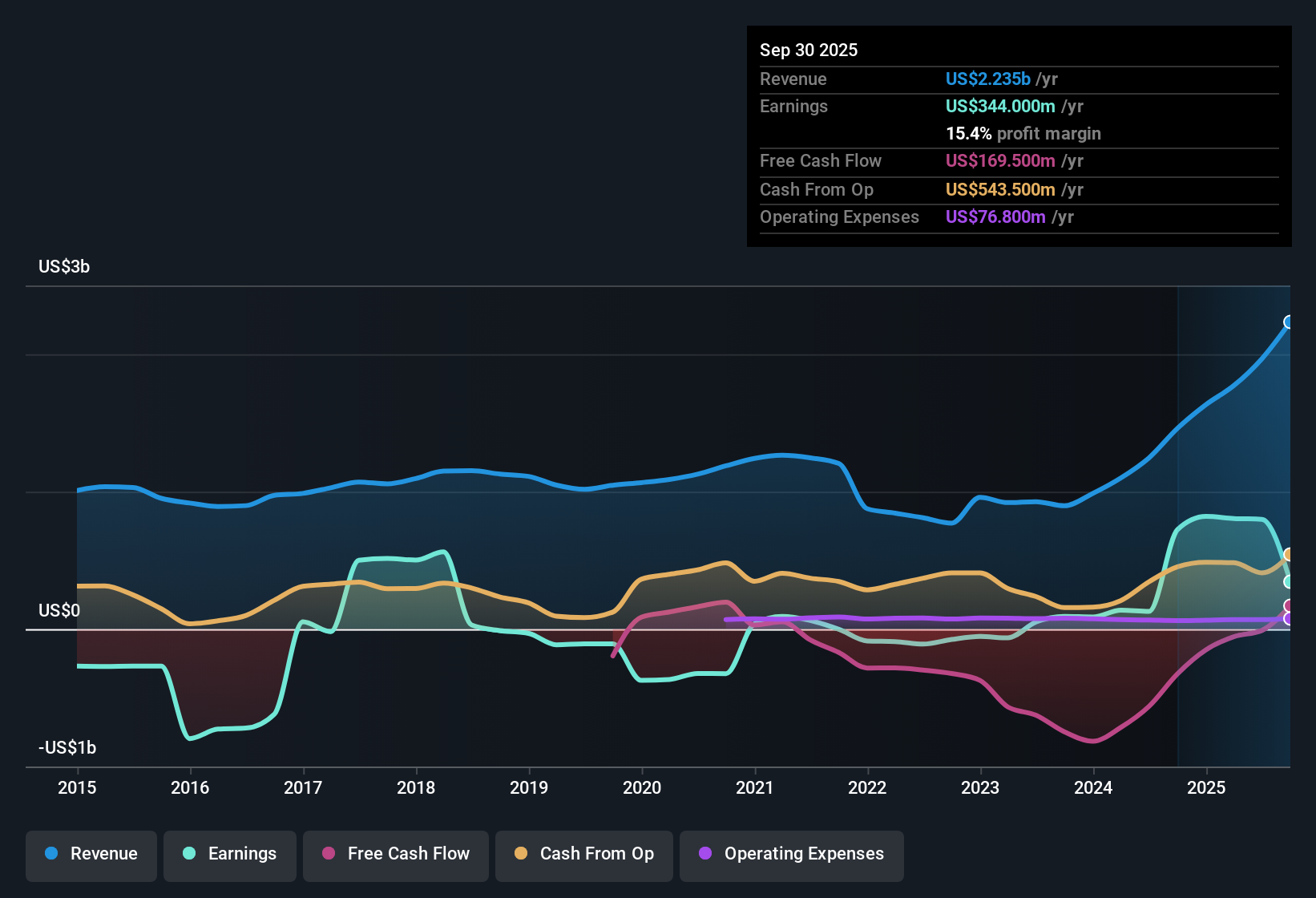

IAMGOLD (TSX:IMG) reported net profit margins of 40.6%, up from 10.4% a year earlier, with earnings growing at an average of 77.7% per year over the past five years as the company turned profitable. However, this jump was influenced by a significant one-off gain of $530 million in the recent period. Investors should note that regular earnings growth is forecast at 5.55% per year, trailing the Canadian market’s 12.1% projection. With shares trading at CA$16.82, well below the estimated fair value of CA$65.09 and valuation multiples under industry and peer averages, the story is about growth tempered by the caveats around earnings quality.

See our full analysis for IAMGOLD.The next section will put these figures head to head with the most widely followed narratives about IAMGOLD, comparing where the data backs up expectations and where the numbers challenge market stories.

See what the community is saying about IAMGOLD

Profit Margins Set to Shrink from 40.6% to 22.2% Within Three Years

- Analysts project IAMGOLD’s net profit margins will decrease from the current 40.6%, driven by a large one-off gain, to 22.2% in three years. This reflects expectations for more normalized profitability as temporary gains subside.

- According to the analysts' consensus view, the company’s margin pressure is expected to come from several fronts:

- Rising operating and capital costs, including higher all-in sustaining costs, royalties, and enhanced maintenance needs, may erode future profitability and narrow margins if gold prices plateau or retrace.

- Analysts highlight that as ramp-up costs at Côté Gold fade, future results will reflect a more stable but lower level of profitability. This reinforces the narrative that current elevated margins are unlikely to persist as reported.

- The consensus narrative notes the upcoming margin contraction may lead some investors to recalibrate optimism about sustainable earnings strength in the years ahead.

- For a breakdown of how this shift could impact IAMGOLD’s long-term prospects and how analysts interpret the numbers, take a closer look at the full consensus narrative for the company. 📊 Read the full IAMGOLD Consensus Narrative.

Debt Load Remains a $1 Billion Overhang on Future Flexibility

- IAMGOLD continues to carry $1 billion in net debt even as its free cash flow improves and high-cost debt is repaid, a figure that could constrain the company’s ability to reinvest or return capital to shareholders in the near term.

- Analysts' consensus view is that this substantial debt position, despite recent deleveraging, exposes IAMGOLD to ongoing interest costs and limits maneuvering room at a time when reinvestment and technical improvements (such as crusher upgrades and ore handling) are essential:

- Bears argue that reliance on asset concentration, especially at Côté Gold and Essakane, compounds the risk. Should a disruption occur, revenue volatility could be magnified by limited financial flexibility.

- What is striking is that even as margins compress in projections, debt remains sticky, pointing to a cautious balance between growth ambitions and prudent risk management, as reflected in the consensus narrative.

PE Ratio of 8.6x Undercuts Industry and Peer Benchmarks

- IAMGOLD is trading at a Price-To-Earnings (PE) ratio of 8.6x, markedly below its industry average (19.8x) and the average among close peers (36x), indicating a significant valuation discount in the current share price of CA$16.82.

- Analysts' consensus view highlights how this valuation gap stands out:

- Bulls point to the combination of undervaluation relative to both industry and analyst DCF fair value (CA$65.09) as evidence the market discounts IAMGOLD’s future growth and profitability, even as it achieves major operational milestones and expands reserves.

- However, the consensus also notes that this discount reflects persistent concerns about the repeatability of recent earnings and the durability of growth amid risks tied to debt and asset concentration.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for IAMGOLD on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think the figures suggest a different outcome? Share your unique take and shape your own market narrative in just a few minutes. Do it your way

A great starting point for your IAMGOLD research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Despite IAMGOLD’s valuation discount, its hefty debt load and narrowing profit margins signal financial headwinds and limited flexibility ahead.

If you want to focus on companies built for resilience, shift your search to solid balance sheet and fundamentals stocks screener (1979 results) with stronger financial foundations and less debt risk weighing on future growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IMG

IAMGOLD

Through its subsidiaries, operates as a gold producer and developer in Canada and Burkina Faso.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives