- Canada

- /

- Metals and Mining

- /

- TSX:IMG

IAMGOLD Corporation (TSE:IMG) Stock Catapults 30% Though Its Price And Business Still Lag The Industry

Despite an already strong run, IAMGOLD Corporation (TSE:IMG) shares have been powering on, with a gain of 30% in the last thirty days. The last month tops off a massive increase of 122% in the last year.

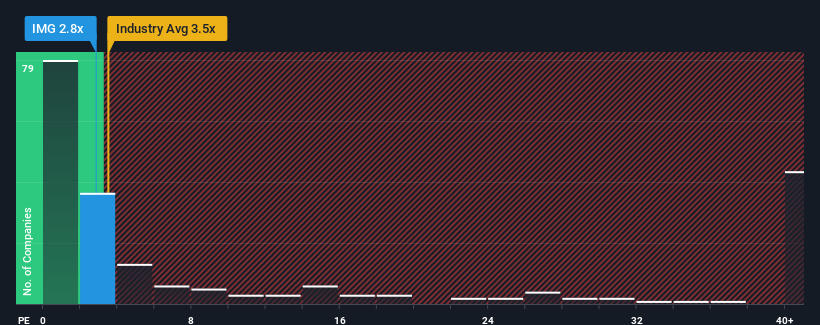

Although its price has surged higher, IAMGOLD's price-to-sales (or "P/S") ratio of 2.8x might still make it look like a buy right now compared to the Metals and Mining industry in Canada, where around half of the companies have P/S ratios above 3.6x and even P/S above 27x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

View our latest analysis for IAMGOLD

How Has IAMGOLD Performed Recently?

Recent times have been advantageous for IAMGOLD as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Keen to find out how analysts think IAMGOLD's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

There's an inherent assumption that a company should underperform the industry for P/S ratios like IAMGOLD's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 65% last year. The latest three year period has also seen an excellent 87% overall rise in revenue, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 15% per year over the next three years. With the industry predicted to deliver 57% growth each year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why IAMGOLD's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Despite IAMGOLD's share price climbing recently, its P/S still lags most other companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, our analysis of IAMGOLD's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

You need to take note of risks, for example - IAMGOLD has 3 warning signs (and 2 which don't sit too well with us) we think you should know about.

If these risks are making you reconsider your opinion on IAMGOLD, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:IMG

IAMGOLD

Through its subsidiaries, operates as a gold producer and developer in Canada and Burkina Faso.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success