- Canada

- /

- Trade Distributors

- /

- TSX:RUS

Top Undervalued Small Caps With Insider Action In Canada July 2024

Reviewed by Simply Wall St

As the Canadian market navigates through a period of potential economic softening and anticipates possible shifts in consumption and growth, small-cap stocks might present unique opportunities for investors looking to diversify their portfolios. Amidst this backdrop, insider actions within undervalued small caps could signal compelling entry points for those seeking exposure to potentially resilient sectors poised for recovery.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dundee Precious Metals | 8.5x | 2.9x | 32.41% | ★★★★★★ |

| Bragg Gaming Group | NA | 1.4x | 23.38% | ★★★★★★ |

| First National Financial | 8.8x | 3.0x | 48.29% | ★★★★★☆ |

| Calfrac Well Services | 2.3x | 0.2x | 27.63% | ★★★★★☆ |

| Nexus Industrial REIT | 2.8x | 3.4x | 13.66% | ★★★★☆☆ |

| Russel Metals | 9.7x | 0.5x | 40.55% | ★★★★☆☆ |

| Guardian Capital Group | 10.4x | 4.0x | 31.36% | ★★★★☆☆ |

| Sagicor Financial | 1.0x | 0.3x | -65.94% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 11.8x | 3.1x | 33.78% | ★★★★☆☆ |

| AutoCanada | 11.2x | 0.1x | -96.60% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

First National Financial (TSX:FN)

Simply Wall St Value Rating: ★★★★★☆

Overview: First National Financial is a Canadian company specializing in residential and commercial mortgage lending with a market capitalization of approximately CA$2 billion.

Operations: The company generates revenue from both commercial and residential segments, totaling CA$772.21 million as of the latest reporting period. It has achieved a gross profit margin of 83.11%, with a net income margin that has increased to 34.06%.

PE: 8.8x

First National Financial, a lesser-known entity in the Canadian market, recently demonstrated insider confidence with a significant purchase by Stephen J. Smith, who acquired 296,824 shares for CA$9.81 million, reflecting a robust belief in the company's prospects. This move coincides with consistent dividend affirmations and an impressive quarterly earnings report showing a jump to CA$49.89 million from CA$35.74 million year-over-year. Despite forecasts of slight earnings dips and revenue growth challenges ahead, these financial commitments and strategic insider investments suggest potential unrecognized worth in this firm's operational stability and future growth trajectory.

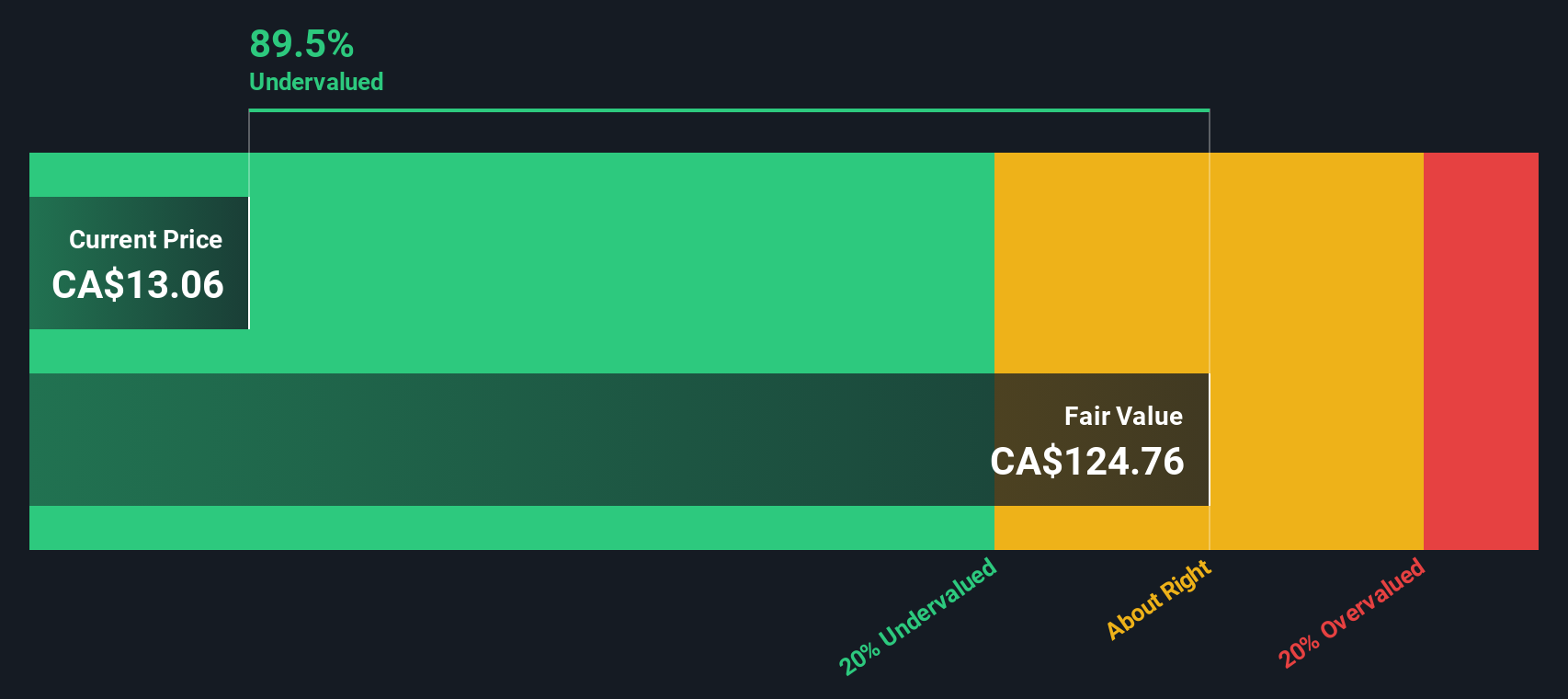

Interfor (TSX:IFP)

Simply Wall St Value Rating: ★★★★★★

Overview: Interfor is a lumber company that primarily operates in the solid wood segment, with a market capitalization of approximately CA$1.23 billion.

Operations: Solid Wood generated CA$3.30 billion in revenue, reflecting a gross profit margin of 3.63% as of the latest reporting period in 2024. This segment experienced a net loss, indicating a net income margin of -9.05%.

PE: -3.0x

Despite a challenging quarter where Interfor reported a net loss of CAD 72.9 million and a slight decline in sales to CAD 813.2 million, the company's increased lumber production signals resilience, rising from 1,031 million fbm to 1,069 million fbm year-over-year. This growth suggests operational efficiency amidst tough market conditions. Insider confidence is evident as they recently purchased shares, underscoring belief in the company’s future prospects despite current financial headwinds.

- Click to explore a detailed breakdown of our findings in Interfor's valuation report.

Gain insights into Interfor's past trends and performance with our Past report.

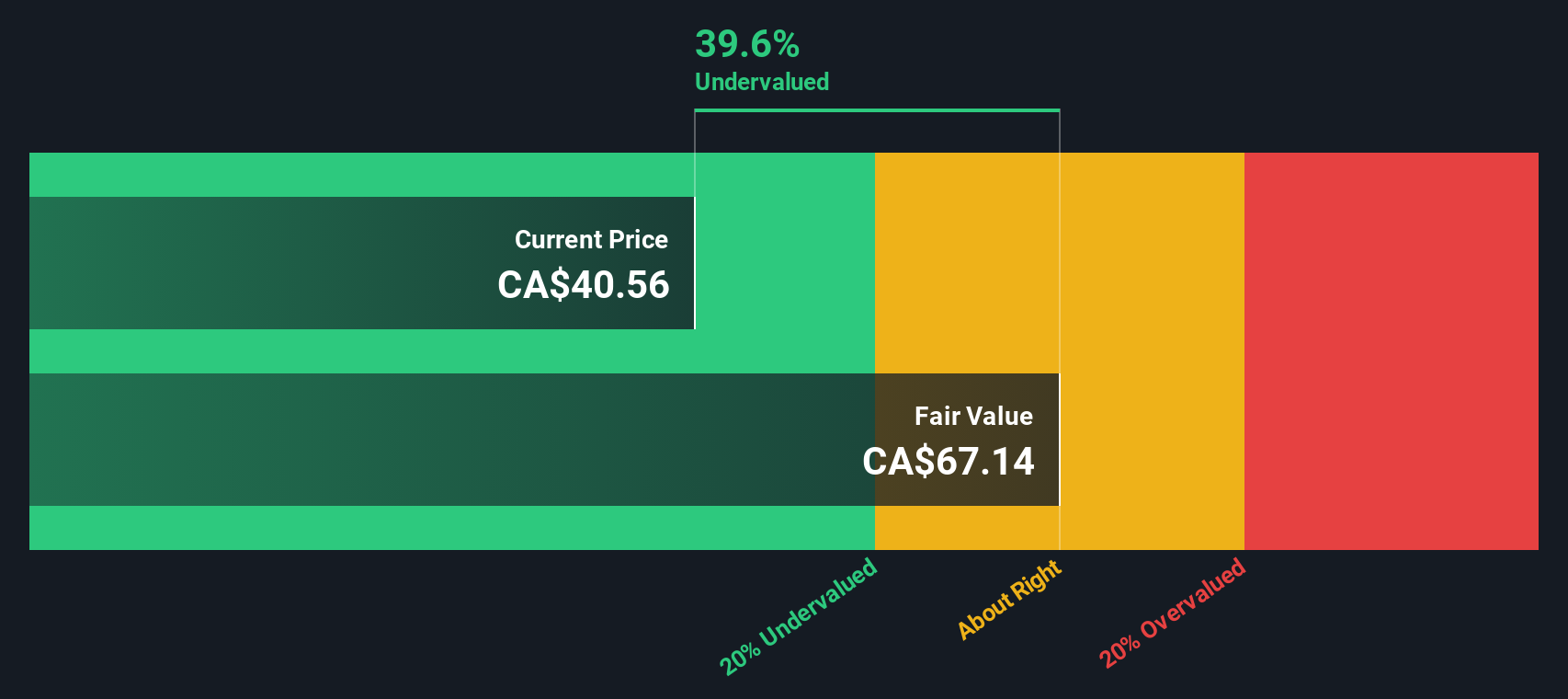

Russel Metals (TSX:RUS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Russel Metals operates as a metal distribution and processing company, serving markets primarily in North America with a market capitalization of approximately CA$1.48 billion.

Operations: The company's gross profit margin has shown a trend of fluctuation, peaking at 28.43% in the fourth quarter of 2021 and adjusting to 21.32% by the third quarter of 2024. Notably, net income also demonstrated variability, with a significant rise to CA$432.2 million in the fourth quarter of 2021 before settling at CA$242.5 million by mid-2024.

PE: 9.7x

Russel Metals, a notable player in the metals distribution sector, recently increased its quarterly dividend by 5%, signaling financial health and stability. This move follows a strategic expansion through the acquisition of seven service centers from Samuel, Son & Co., expected to close in Q3 2024. Despite a dip in Q1 sales and net income year-over-year, insider confidence is evident as they recently purchased shares. With CAD 52.3 million spent on repurchasing 1.2 million shares since August last year, the company demonstrates commitment to shareholder value amidst challenging market conditions.

- Click here to discover the nuances of Russel Metals with our detailed analytical valuation report.

Evaluate Russel Metals' historical performance by accessing our past performance report.

Summing It All Up

- Discover the full array of 32 Undervalued TSX Small Caps With Insider Buying right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RUS

Russel Metals

Operates as a metal distribution and processing company in Canada and the United States.

Flawless balance sheet established dividend payer.