- Canada

- /

- Metals and Mining

- /

- TSX:HBM

Hudbay Minerals (TSX:HBM) Valuation in Focus After Strong Q2 Earnings and Upbeat Production Outlook

Reviewed by Simply Wall St

Most Popular Narrative: 8.9% Undervalued

According to community narrative, Hudbay Minerals is considered undervalued by nearly 9%, with substantial growth catalysts and risk factors shaping the fair value assessment.

Hudbay's upcoming Copper World project, now significantly derisked and funded through a strategic joint venture with Mitsubishi, positions the company for a more than 50% increase in annual copper output. This enables direct exposure to intensifying demand from electrification, renewable energy, and U.S. critical mineral supply chain initiatives. The likely result is higher future revenues and potential premium pricing.

Rumors are swirling about just how much Hudbay's value could climb as new partnerships unlock growth. Outrageous profit projections? Ambitious revenue targets? The full narrative lays out bold assumptions driving this price call. Curious what the debate is really about? Find out what factors could propel the stock far beyond today's numbers.

Result: Fair Value of $17.87 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, operational setbacks at flagship projects or unexpected cost overruns could quickly challenge the positive outlook that is driving Hudbay's current valuation narrative.

Find out about the key risks to this Hudbay Minerals narrative.Another View: Discounted Cash Flow Perspective

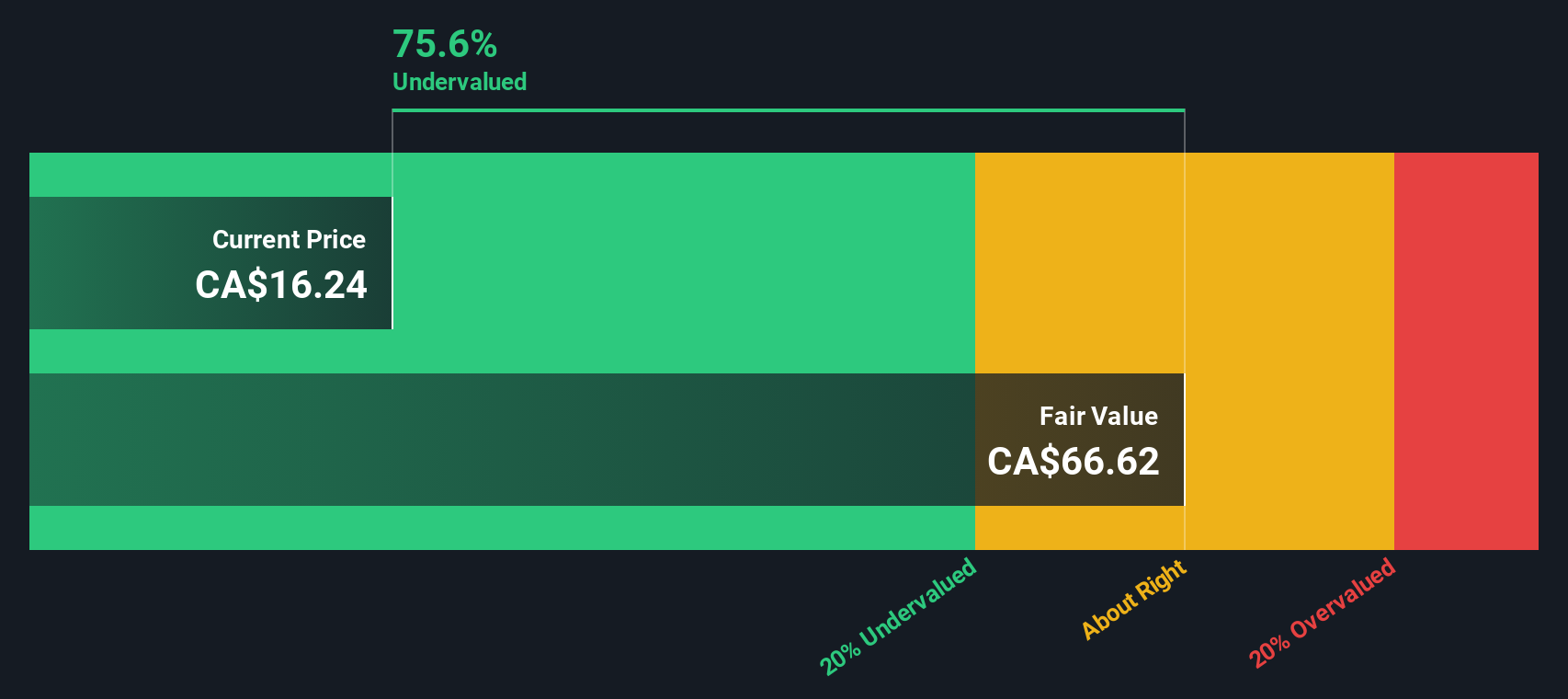

Taking a closer look using our DCF model, the valuation story shifts. This method measures value based on long-term cash flows, and it produces a result that still points to shares being undervalued. Could the real opportunity be bigger than most investors think?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hudbay Minerals Narrative

For those who want a different angle or trust their own due diligence, there is always the option to build a view from scratch in just minutes. do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Hudbay Minerals.

Looking for More Smart Investment Opportunities?

Why stick to just one winning idea when you can expand your playbook? Now is the time to spot tomorrow's leading stocks, tailor your strategy, and get ahead of the crowd. These handpicked routes are designed for smarter, more confident investing. Skip the hesitation and seize your edge now.

- Uncover the potential of generating strong income streams by tracking companies offering dividend stocks with yields > 3%.

- Capitalize on the artificial intelligence revolution by targeting the most promising AI penny stocks making waves in today's markets.

- Zero in on financial stability with a focus on undervalued stocks based on cash flows that could deliver lasting value when others overlook them.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hudbay Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HBM

Hudbay Minerals

A diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives