- Canada

- /

- Metals and Mining

- /

- TSX:HBM

Hudbay Minerals (TSX:HBM) Is Down 6.3% After Snow Lake Wildfire Evacuation and Site Suspension Has The Bull Case Changed?

Reviewed by Simply Wall St

- Earlier this month, Hudbay Minerals temporarily suspended operations at its Snow Lake site following a mandatory wildfire evacuation order in northern Manitoba, while securing its assets and maintaining a limited workforce for monitoring and emergency support.

- Despite the disruption, the company has indicated that infrastructure remains well-protected, Flin Flon operations are unaffected, and annual Manitoba guidance for 2025 is still expected to be met.

- We'll examine how the temporary Snow Lake suspension and Hudbay's preparedness efforts may shape its outlook for future growth and earnings.

Hudbay Minerals Investment Narrative Recap

Hudbay Minerals’ appeal relies on investors’ confidence in its ability to drive future copper and gold production from ongoing projects, while managing operational risks from its geographically diverse portfolio. The recent Snow Lake suspension due to wildfires appears well-controlled, with the company maintaining Manitoba’s 2025 guidance and no material short-term shift to the most important catalyst, future output growth from major initiatives, nor significant escalation of the biggest current risk, which remains project execution and cost management elsewhere.

The June resumption of Snow Lake operations, following a previous wildfire-driven shutdown, is directly relevant here. Hudbay’s ability to protect infrastructure and restart production efficiently suggests robust preparedness, supporting its production objectives, a critical factor given that successful project ramp-up underpins both earnings outlook and any perceived valuation gap.

However, investors should not overlook the fact that, in contrast to operational recovery at Snow Lake, risks still remain around…

Read the full narrative on Hudbay Minerals (it's free!)

Hudbay Minerals' narrative projects $2.3 billion in revenue and $321.8 million in earnings by 2028. This requires 3.9% yearly revenue growth and a $245.1 million increase in earnings from $76.7 million today.

Exploring Other Perspectives

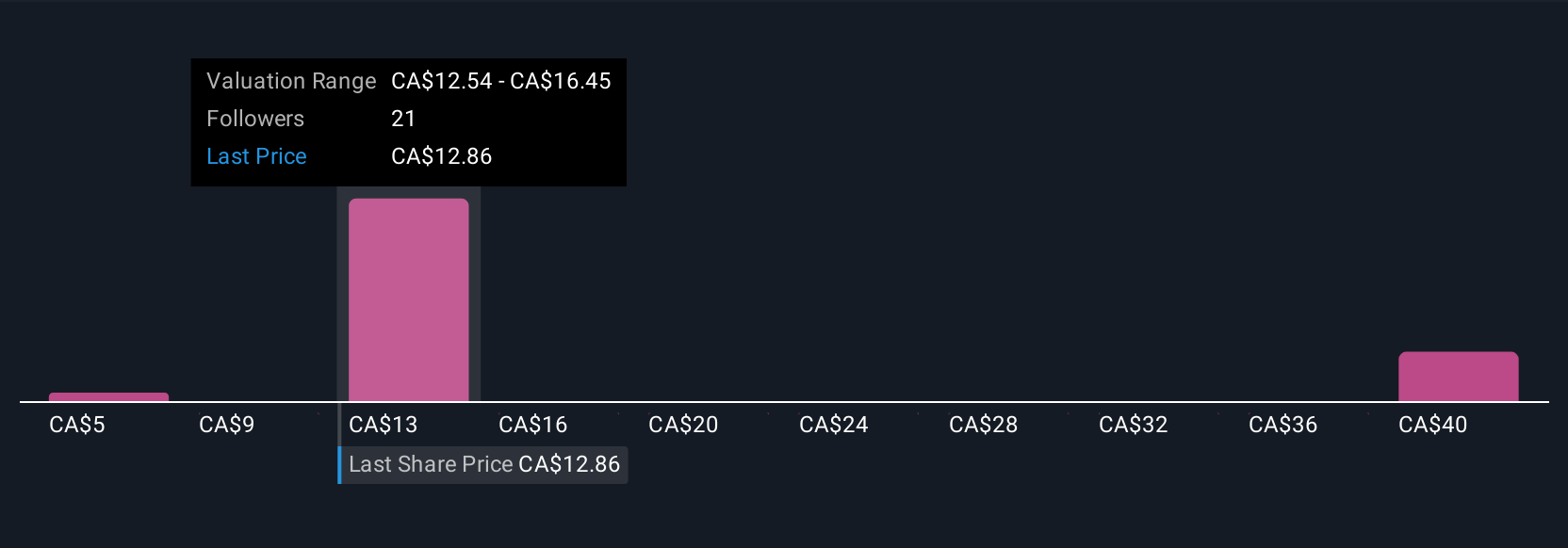

Five private investors in the Simply Wall St Community set fair value estimates that span from CA$4.71 to CA$42.62 per share. With this diversity in opinion, it’s important to keep in mind that project timing and cost controls continue to shape how the company’s long-term earnings progress and whether growth targets are met.

Build Your Own Hudbay Minerals Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Hudbay Minerals research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Hudbay Minerals research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Hudbay Minerals' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hudbay Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HBM

Hudbay Minerals

A diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives