- Canada

- /

- Metals and Mining

- /

- TSX:HBM

Hudbay Minerals (TSX:HBM): How Constancia Disruption Frames the Current Valuation Debate

Reviewed by Kshitija Bhandaru

Hudbay Minerals (TSX:HBM) has taken the unusual step of halting operations at its Constancia mine in Peru because of growing social unrest and protests in the region. The company emphasizes this is a temporary and safety-driven measure, with management expecting to keep 2025 production on track.

See our latest analysis for Hudbay Minerals.

Despite this recent operational pause at Constancia, Hudbay Minerals’ momentum hasn’t faded. Investors have seen a 0.7% total shareholder return over the last year, and the share price remains near recent highs at $21.96. While project advances and copper’s positive outlook have supported the stock, any drawn-out disruption in Peru could influence sentiment from here.

If you want to see what other compelling companies are showing strong upward potential right now, this is a perfect moment to broaden your search and discover fast growing stocks with high insider ownership

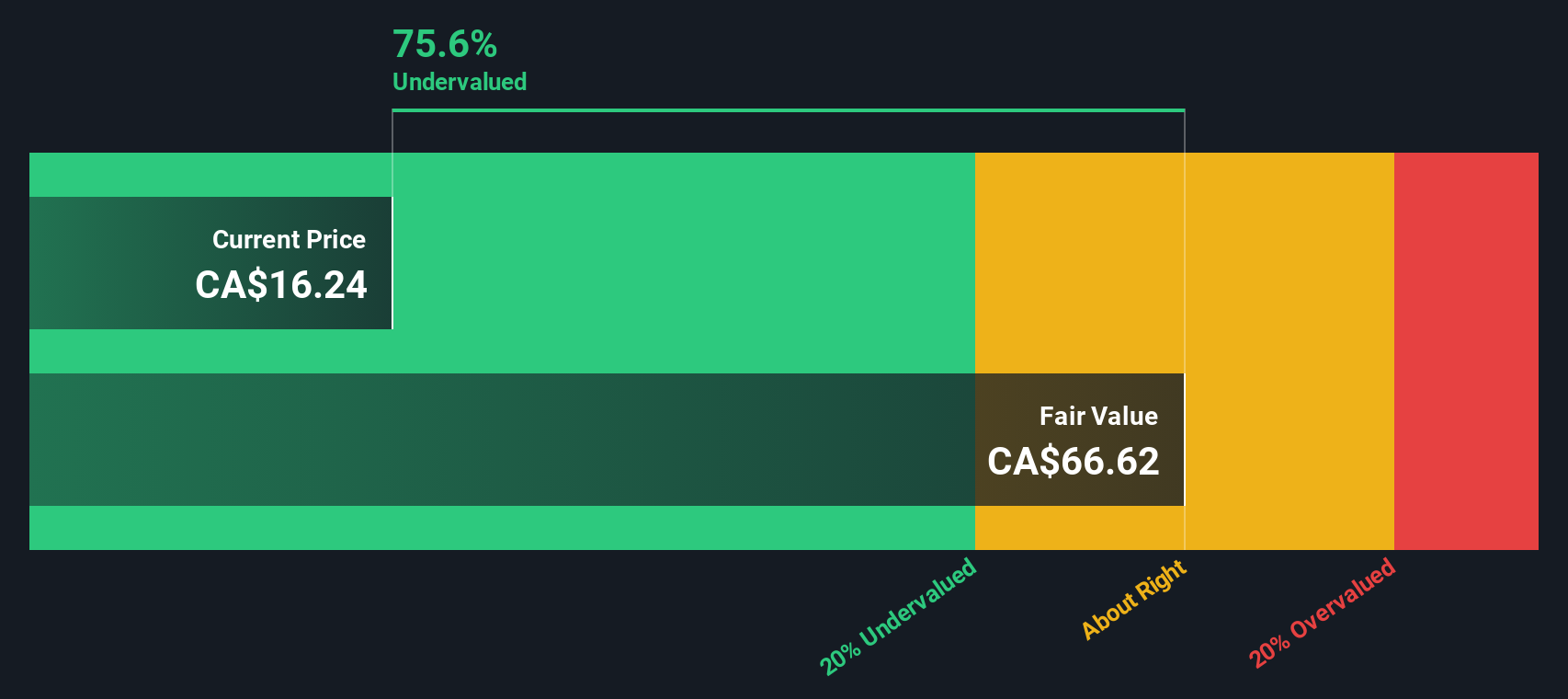

With the stock rallying nearly 80% year-to-date and trading close to recent highs, the big question now is whether Hudbay Minerals is still undervalued by the market or if all this future growth is already priced in.

Most Popular Narrative: 14.1% Overvalued

Hudbay Minerals’ current fair value estimate sits about 14% below its recent closing price, suggesting the market might be expecting more than the consensus view on future growth and risks. The latest price target revisions and robust commodity exposure set a high bar for the company to justify its valuation.

The partnership with Mitsubishi and enhanced Wheaton streaming arrangements provide Hudbay with financial flexibility, accelerated project timelines, and reduced up-front CapEx risk. These factors support strong free cash flow and lower the likelihood of equity dilution or excessive debt, which all benefit future earnings per share.

Curious what bold projections underpin these premium price targets? This narrative’s future depends on aggressive revenue growth, improving margins, and significant earnings expansion. Ready to uncover which controversial assumptions lie behind Hudbay’s high-stakes valuation?

Result: Fair Value of $19.25 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing disruptions in Peru or cost overruns at major projects like Copper World could still quickly shift sentiment and challenge Hudbay’s bullish outlook.

Find out about the key risks to this Hudbay Minerals narrative.

Another View: SWS DCF Model Shows Major Upside

While analyst multiples suggest Hudbay Minerals is overvalued, our SWS DCF model presents a different perspective. The DCF analysis indicates the stock could be trading at nearly 66% below its fair value. Can this significant gap really be sustained, or will the market catch up?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hudbay Minerals Narrative

If you see the story unfolding differently, or want to dig into the numbers yourself, you can craft your own view in just a few minutes: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Hudbay Minerals.

Looking for More Smart Investment Moves?

Great investors keep their options open. Don’t let the next opportunity pass you by. These unique ideas are just a click away on Simply Wall Street.

- Boost your potential for reliable earnings and steady income, and check out these 19 dividend stocks with yields > 3% packed with stocks boasting attractive yields above 3%.

- Tap into future-shaping breakthroughs by viewing these 24 AI penny stocks featuring companies at the forefront of artificial intelligence transformation.

- Act before the crowd and uncover hidden value by exploring these 896 undervalued stocks based on cash flows revealing stocks currently priced below their true cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hudbay Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HBM

Hudbay Minerals

A diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives