- Canada

- /

- Metals and Mining

- /

- TSX:HBM

Hudbay Minerals Inc.'s (TSE:HBM) Price Is Right But Growth Is Lacking After Shares Rocket 38%

Hudbay Minerals Inc. (TSE:HBM) shares have had a really impressive month, gaining 38% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 99% in the last year.

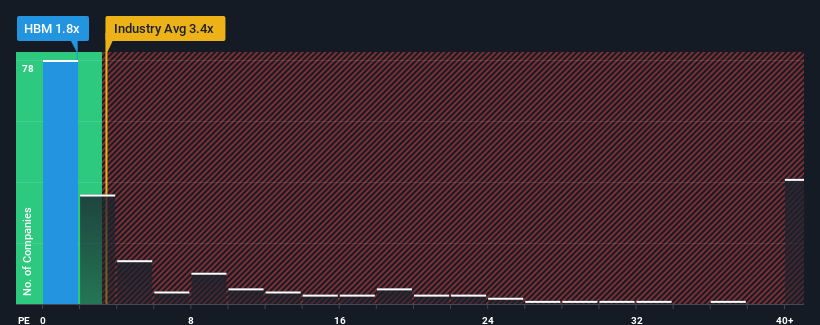

Even after such a large jump in price, Hudbay Minerals may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.8x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 3.4x and even P/S higher than 22x are not unusual. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Hudbay Minerals

How Hudbay Minerals Has Been Performing

With revenue growth that's superior to most other companies of late, Hudbay Minerals has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Hudbay Minerals will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Hudbay Minerals?

The only time you'd be truly comfortable seeing a P/S as low as Hudbay Minerals' is when the company's growth is on track to lag the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 59%. Pleasingly, revenue has also lifted 50% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 2.2% per year during the coming three years according to the eleven analysts following the company. That's shaping up to be materially lower than the 27% per year growth forecast for the broader industry.

In light of this, it's understandable that Hudbay Minerals' P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From Hudbay Minerals' P/S?

Hudbay Minerals' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Hudbay Minerals' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you settle on your opinion, we've discovered 1 warning sign for Hudbay Minerals that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Hudbay Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:HBM

Hudbay Minerals

A diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives