- Canada

- /

- Metals and Mining

- /

- TSX:HBM

A Look at Hudbay Minerals (TSX:HBM) Valuation Following Constancia Mine Restart and Renewed Production Stability

Reviewed by Kshitija Bhandaru

Hudbay Minerals (TSX:HBM) has fully resumed operations at the Constancia mine in Peru following a brief shutdown caused by local demonstrations and blockades. The mill is now operating at full production, and investors are paying close attention.

See our latest analysis for Hudbay Minerals.

Hudbay Minerals’ quick recovery from the Constancia mine disruption follows a series of upbeat events, including recent industry conference presentations. This is set against exceptionally strong share price momentum. With a 30-day share price return of 29% and a remarkable 90-day gain of nearly 81%, share price momentum has clearly accelerated. The one-year total shareholder return of 91% underscores long-term value creation for patient investors.

If you want to see what other fast-moving opportunities are out there, now is a great time to discover fast growing stocks with high insider ownership

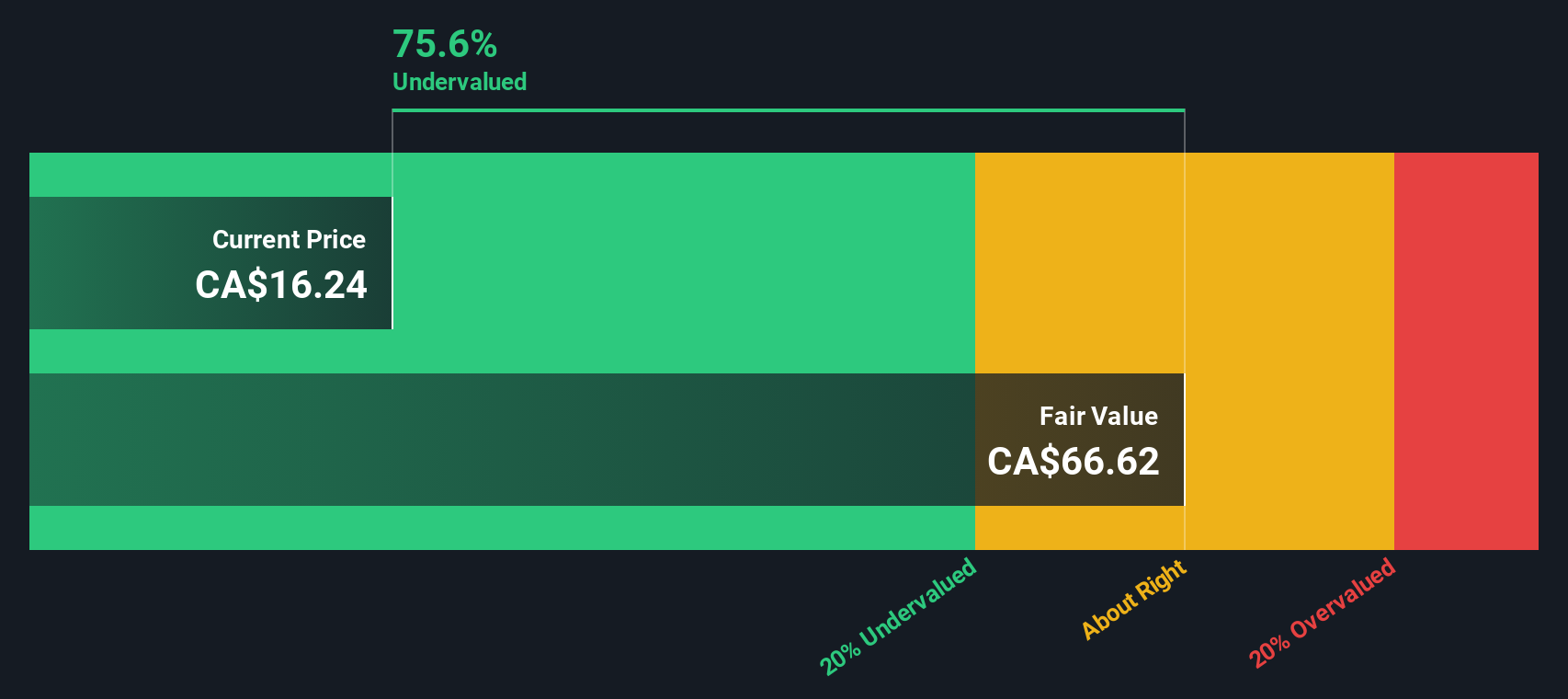

With the stock up more than 90% over the past year, investors are left to wonder: is Hudbay Minerals still trading at an attractive valuation, or has the market already priced in further growth potential?

Most Popular Narrative: 11.2% Overvalued

Hudbay Minerals’ most widely followed narrative points to a fair value below the current share price. Despite recent gains, analyst projections suggest the stock is now trading above its underlying fundamentals and anticipated future cash flows.

The partnership with Mitsubishi and enhanced Wheaton streaming arrangements furnish Hudbay with financial flexibility, accelerated project timelines, and reduced up-front CapEx risk. These factors support strong free cash flow and lower the likelihood of equity dilution or excessive debt, which all benefit future earnings per share.

Eager to see what powers this bullish outlook? The narrative hinges on bold growth bets, margin improvements, and a profit outlook that could reshape expectations. Wondering which surprising analyst assumptions drive this premium valuation? Only the full breakdown reveals the numbers behind the price.

Result: Fair Value of $21.79 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant project execution risks and regional instability could quickly challenge the current growth outlook. These factors have the potential to disrupt Hudbay Minerals’ bullish narrative.

Find out about the key risks to this Hudbay Minerals narrative.

Another Perspective: Cash Flow Signals a Value Opportunity

Taking a different angle, our DCF model estimates Hudbay Minerals' fair value at CA$57.74, which is significantly above its recent trading price. This suggests the market may be underestimating the company’s long-term cash flow potential. Is the crowd too cautious on future growth, or is DCF too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Hudbay Minerals Narrative

If you want to dig deeper or approach the data from your own angle, you can build your own narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Hudbay Minerals.

Looking for more investment ideas?

Great investors never settle for yesterday’s winners. Give yourself an edge by finding fresh opportunities tailored to your strategy with these carefully selected stock screens.

- Tap into the growth potential of artificial intelligence by reviewing these 24 AI penny stocks, which are set to transform industries with advanced data analysis and automation capabilities.

- Unlock deep value opportunities by finding hidden gems trading below their intrinsic worth through these 874 undervalued stocks based on cash flows and position yourself ahead of the crowd.

- Boost your income with reliable yields by checking out these 20 dividend stocks with yields > 3%, which offer stable dividends for consistent, long-term cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hudbay Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HBM

Hudbay Minerals

A diversified mining company, focuses on the exploration, development, operation, and optimization of properties in North and South America.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives