- Canada

- /

- Healthtech

- /

- TSX:VHI

3 TSX Stocks Estimated To Be Undervalued By Up To 30.9%

Reviewed by Simply Wall St

As the Canadian market navigates a landscape of economic resilience tempered by moderating growth, investors are closely watching the Bank of Canada's easing cycle and geopolitical risks that have so far had manageable effects on markets. In this environment, identifying undervalued stocks can offer potential opportunities for those looking to capitalize on discrepancies between market prices and intrinsic values.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Timbercreek Financial (TSX:TF) | CA$7.56 | CA$10.95 | 30.9% |

| TerraVest Industries (TSX:TVK) | CA$169.68 | CA$298.71 | 43.2% |

| OceanaGold (TSX:OGC) | CA$20.45 | CA$38.22 | 46.5% |

| Magna Mining (TSXV:NICU) | CA$1.715 | CA$3.10 | 44.7% |

| Lithium Royalty (TSX:LIRC) | CA$5.21 | CA$8.73 | 40.3% |

| Kolibri Global Energy (TSX:KEI) | CA$9.28 | CA$17.92 | 48.2% |

| Journey Energy (TSX:JOY) | CA$2.04 | CA$2.94 | 30.6% |

| High Tide (TSXV:HITI) | CA$3.00 | CA$4.36 | 31.1% |

| Aris Mining (TSX:ARIS) | CA$9.40 | CA$13.31 | 29.4% |

| Alphamin Resources (TSXV:AFM) | CA$0.825 | CA$1.35 | 39% |

Below we spotlight a couple of our favorites from our exclusive screener.

NanoXplore (TSX:GRA)

Overview: NanoXplore Inc. is a graphene company that produces and distributes graphene powder for industrial markets in Australia, with a market cap of CA$390.69 million.

Operations: The company's revenue is primarily derived from its Advanced Materials, Plastics and Composite Products segment, which generated CA$134.79 million, and its Battery Cells and Materials segment, contributing CA$0.57 million.

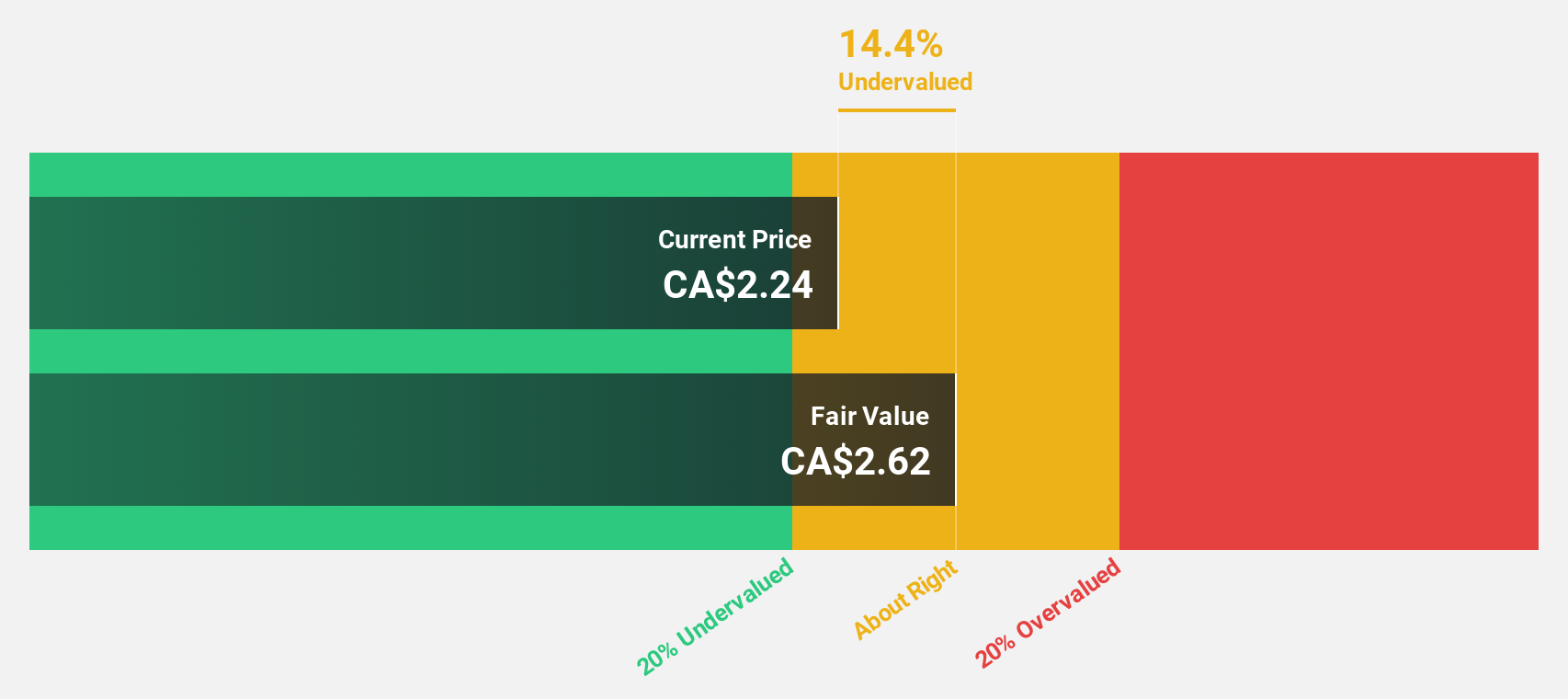

Estimated Discount To Fair Value: 12.7%

NanoXplore's recent earnings report showed a narrowed net loss of C$1.75 million for Q3 2025, down from C$3.09 million the previous year, with revenue slightly declining to C$30.45 million. Despite this, the stock trades at approximately 12.7% below its estimated fair value of C$2.62, suggesting potential undervaluation based on cash flows. Analysts forecast robust annual profit growth and a significant revenue increase of 21.4% annually over the next three years, outpacing market averages in Canada.

- According our earnings growth report, there's an indication that NanoXplore might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of NanoXplore.

Timbercreek Financial (TSX:TF)

Overview: Timbercreek Financial Corp. offers shorter-duration structured financing solutions to commercial real estate investors in Canada and has a market cap of CA$625.61 million.

Operations: The company generates revenue primarily from its financial services segment, specifically through mortgage operations amounting to CA$72.43 million.

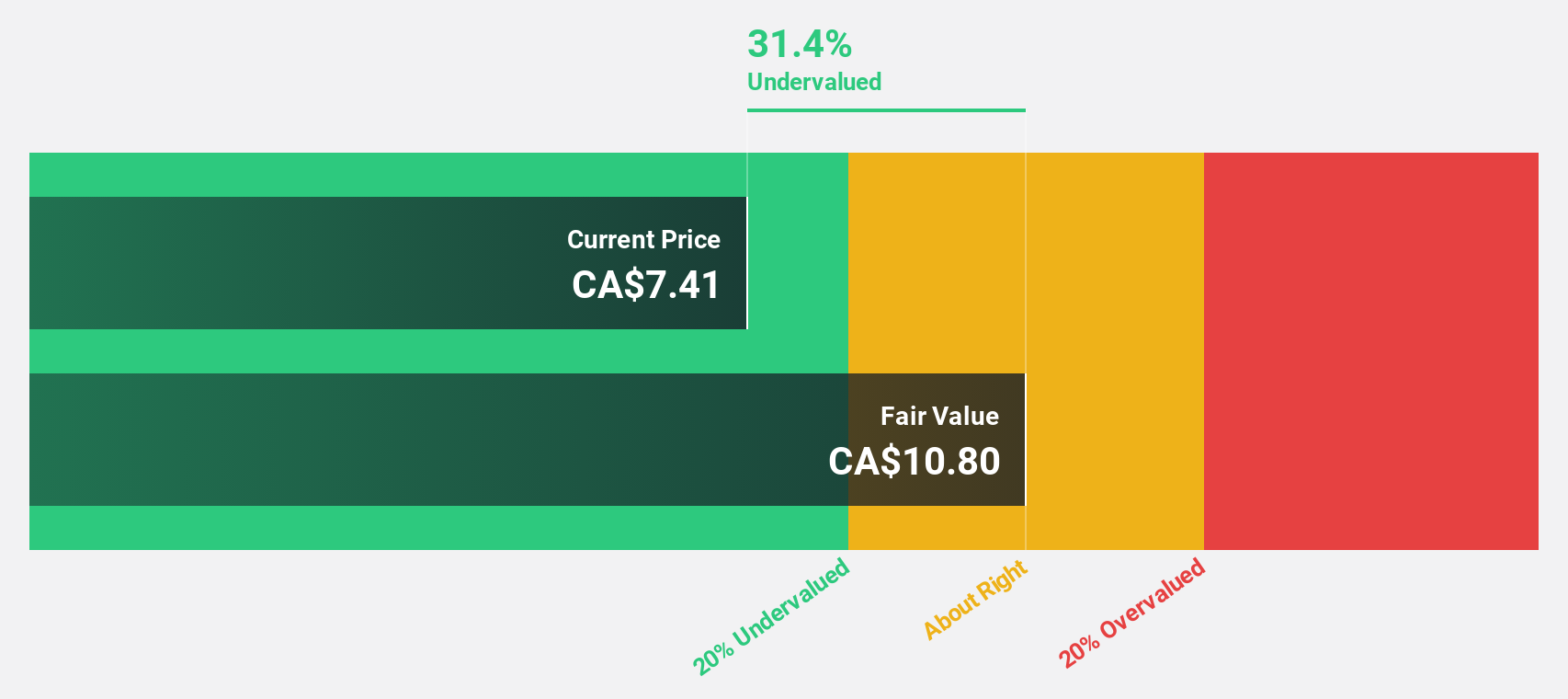

Estimated Discount To Fair Value: 30.9%

Timbercreek Financial's stock is trading at CA$7.56, significantly below its estimated fair value of CA$10.95, highlighting potential undervaluation based on cash flows. Despite the company's debt not being well covered by operating cash flow and a dividend yield of 9.13% that isn't well supported by earnings or free cash flows, revenue growth is forecast at an impressive 23.3% annually, outpacing the Canadian market's average growth rate.

- The analysis detailed in our Timbercreek Financial growth report hints at robust future financial performance.

- Get an in-depth perspective on Timbercreek Financial's balance sheet by reading our health report here.

Vitalhub (TSX:VHI)

Overview: Vitalhub Corp. offers technology and software solutions for health and human service providers across various regions, with a market cap of CA$616.82 million.

Operations: The company's revenue from its healthcare software segment is CA$75.01 million.

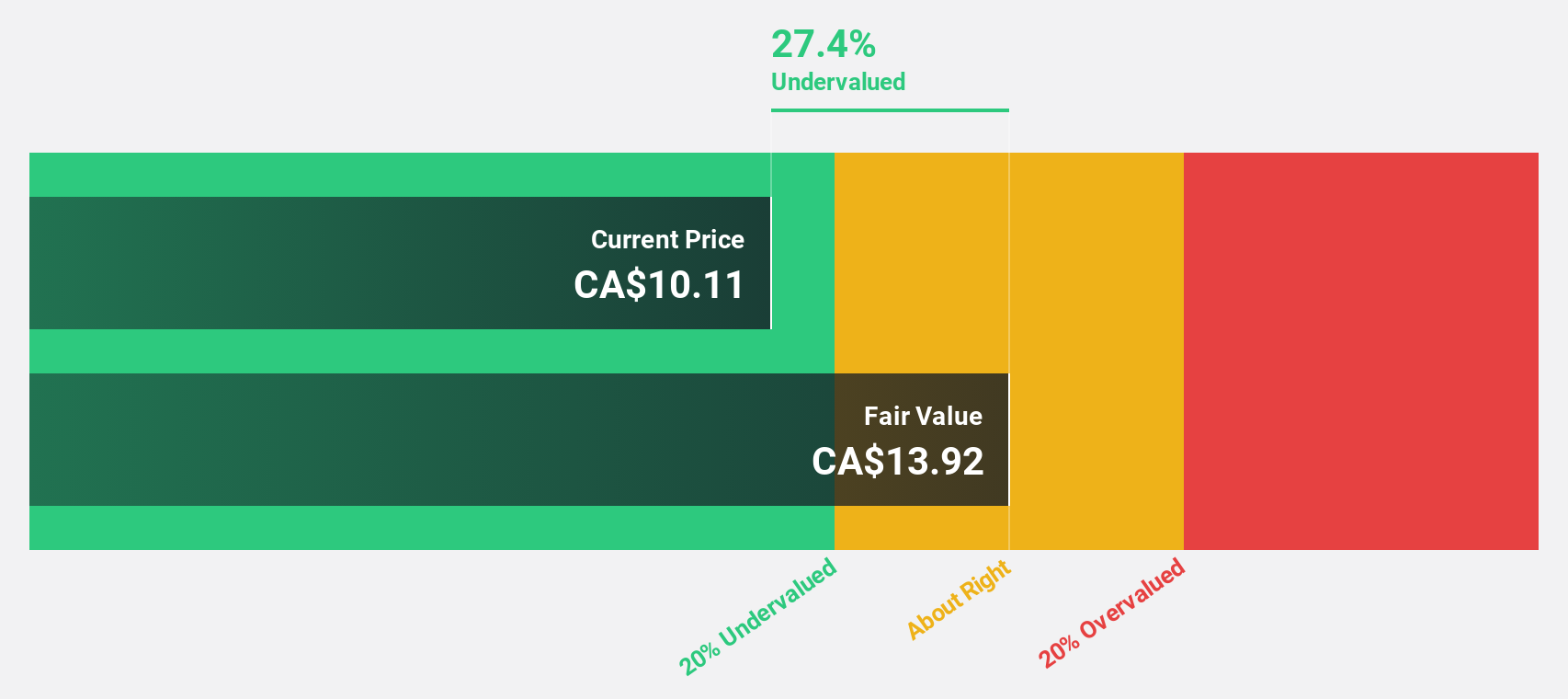

Estimated Discount To Fair Value: 22.7%

Vitalhub's stock, trading at CA$11.04, is significantly undervalued compared to its fair value estimate of CA$14.29, offering potential based on cash flows. Despite a dip in profit margins from 10.3% to 3.8%, the company forecasts robust annual earnings growth of 56.1%, outpacing the Canadian market's average of 12.1%. Analysts anticipate a price increase by 27.3%, and with revenue expected to grow at 16% annually, it presents an intriguing opportunity amidst recent CAD 250 million shelf registration filings.

- Our expertly prepared growth report on Vitalhub implies its future financial outlook may be stronger than recent results.

- Take a closer look at Vitalhub's balance sheet health here in our report.

Taking Advantage

- Click here to access our complete index of 21 Undervalued TSX Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VHI

Vitalhub

Provides technology and software solutions for health and human service providers in Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives