- Canada

- /

- Metals and Mining

- /

- TSX:GOLD

Does Regulatory Momentum in U.S. Gold Mining Strengthen the Investment Narrative for GoldMining (TSX:GOLD)?

Reviewed by Sasha Jovanovic

- In recent days, the U.S. Bureau of Land Management approved the first gold mining operation on federal property in eastern Kern County in 20 years, while U.S. GoldMining Inc. hosted Congressman Nick Begich at its Alaska-based Whistler Gold-Copper Project to highlight progress and responsible development.

- These developments bring renewed national focus to regulatory advancements and the economic potential of responsible gold mining in the United States.

- We'll explore how the regulatory approval in Kern County could shift GoldMining's investment narrative amid changing sector momentum.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is GoldMining's Investment Narrative?

For shareholders in GoldMining Inc., the story has always hinged on the company’s portfolio of gold and resource projects and the prospect of discovering value in underexplored regions. The recent approval of the Mesa Gold Project in Kern County is significant in that it could indicate a more receptive regulatory climate in the U.S., but its short-term impact on GoldMining appears limited, as the company is not directly involved in this new project. Instead, for GoldMining, the main drivers remain ongoing drilling results at its Crucero and São Jorge projects, infrastructure advances like the West Susitna Access Project for Whistler, and the company’s ability to control costs as losses persist. The risks investors must weigh haven’t changed much: the business continues to operate without revenue, remains unprofitable, and faces execution uncertainty, especially given ongoing sector volatility and macroeconomic headwinds. The current rally in GoldMining shares reflects broader sector momentum rather than a direct catalyst, but it’s worth watching if regulatory improvements elsewhere help shift sentiment. Yet, risks to profitability, especially in an unprofitable, pre-revenue company, are something investors should keep top of mind.

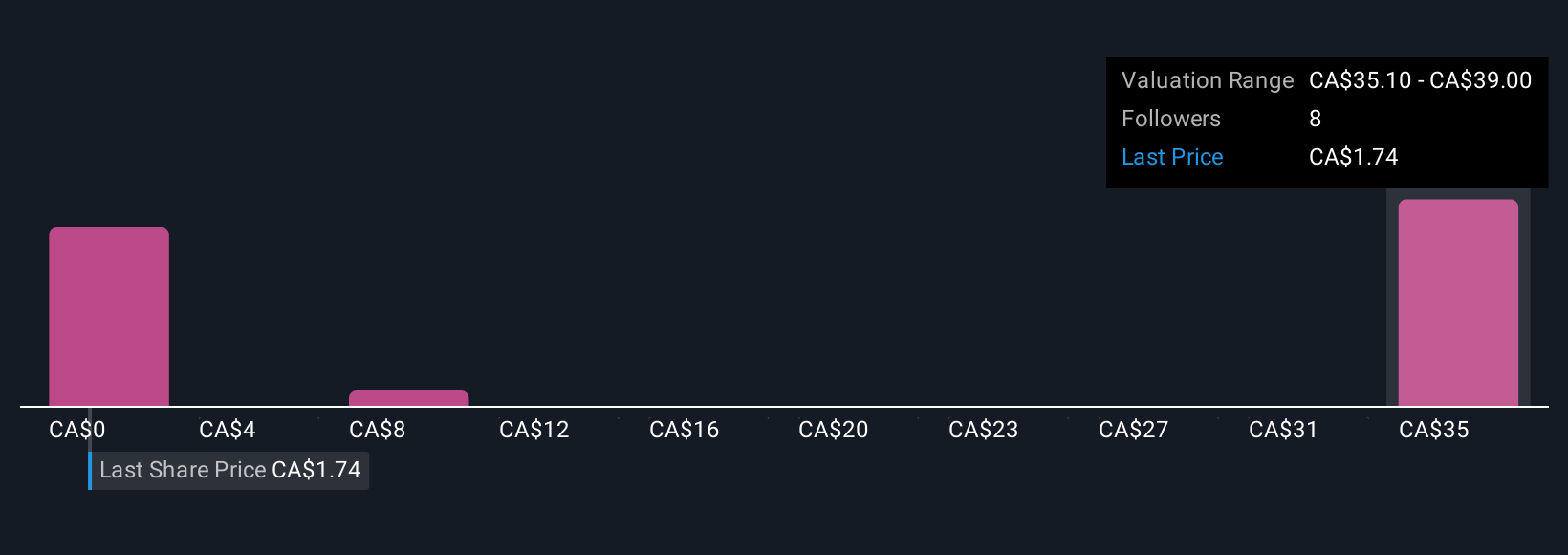

Our expertly prepared valuation report on GoldMining implies its share price may be too high.Exploring Other Perspectives

Explore 9 other fair value estimates on GoldMining - why the stock might be worth just CA$3.90!

Build Your Own GoldMining Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GoldMining research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free GoldMining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GoldMining's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GOLD

GoldMining

A mineral exploration company, engages in the acquisition, exploration, and development of gold and copper assets in the Americas.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives