- Canada

- /

- Metals and Mining

- /

- TSX:GMIN

How Investors May Respond To G Mining Ventures (TSX:GMIN) Reaffirmed 2025 Gold Production Guidance

Reviewed by Simply Wall St

- Earlier in July 2025, G Mining Ventures reported preliminary second-quarter and year-to-date operating results, including gold production of 42,587 ounces for Q2 and 78,165 ounces year to date, alongside detailed mining and processing volumes.

- The company also reaffirmed its previous 2025 guidance for the TZ mine, projecting full-year production between 175,000 and 200,000 ounces, which often signals operational visibility to investors.

- We'll explore how the reiterated production guidance shapes G Mining Ventures' investment narrative and signals management's confidence in achieving targets.

What Is G Mining Ventures' Investment Narrative?

To get behind G Mining Ventures as a shareholder, you’d probably want to see robust project delivery and continued execution at the Tocantinzinho mine, alongside credible progress at Oko West. The company’s reaffirmed 2025 gold production guidance, fresh off its solid second-quarter output, supports near-term confidence and may provide some reassurance about operational continuity just as the mine ramps into full commercial status. This recent update has helped support the stock price, which moved higher following the announcement, suggesting that short-term catalysts, such as hitting guidance and achieving further positive cash flow, remain on track. However, the biggest risk right now continues to be execution: while the latest result helps reduce immediate operational uncertainty, any delays, cost overruns, or issues scaling up new projects could quickly shift sentiment. For now, the news is more confirming than transformative.

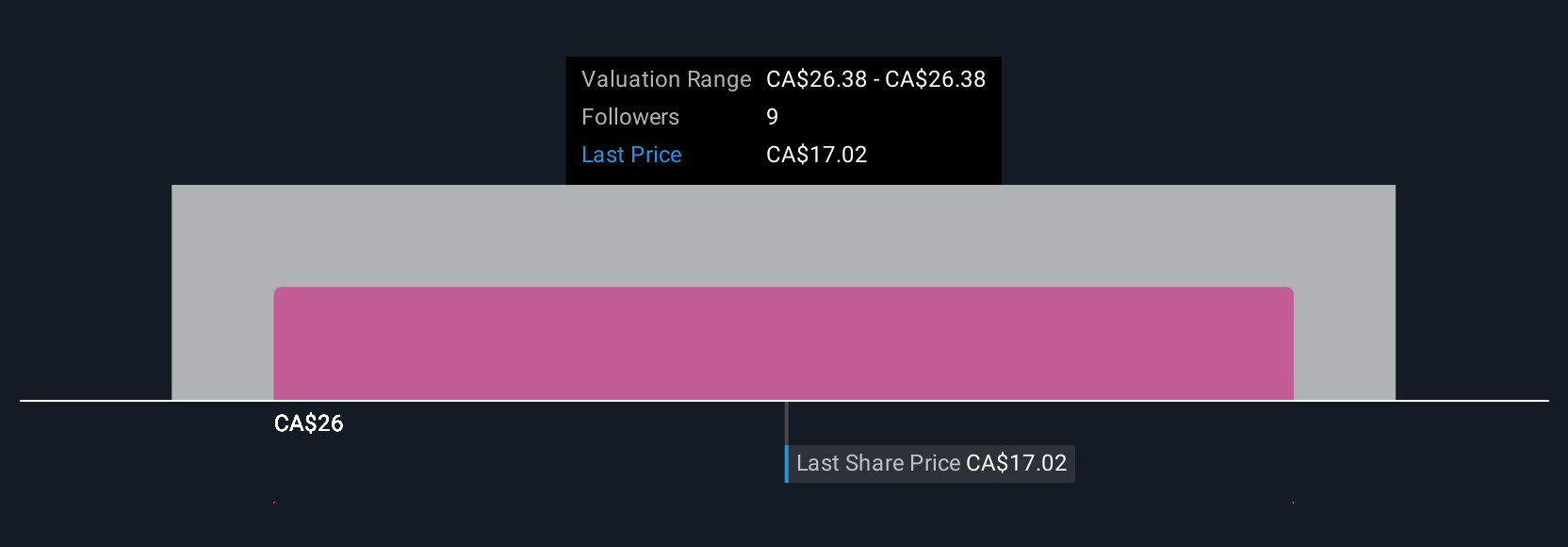

But against the promising output figures, execution risk as projects scale is still a factor investors should note. Our expertly prepared valuation report G Mining Ventures implies its share price may be lower than expected.Exploring Other Perspectives

Build Your Own G Mining Ventures Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your G Mining Ventures research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free G Mining Ventures research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate G Mining Ventures' overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GMIN

G Mining Ventures

A mining company, engages in the acquisition, exploration, and development of precious metal projects.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives