- Canada

- /

- Metals and Mining

- /

- TSX:GMIN

Evaluating G Mining Ventures (TSX:GMIN) Valuation After Securing Major Tax Incentive for Tocantinzinho Mine

Reviewed by Kshitija Bhandaru

G Mining Ventures (TSX:GMIN) has secured a substantial tax incentive for its Tocantinzinho Gold Mine in Brazil. The government’s approval reduces the mine’s corporate tax rate from 34% to about 15% for a period of ten years.

See our latest analysis for G Mining Ventures.

This approval lands at a time when G Mining Ventures’ stock has shown steady, if modest, gains, with its 1-year total shareholder return of 2.2% building on longer-term momentum. Recent events, including ambitious development milestones, appear to be gradually strengthening investor confidence in the company’s outlook.

If you are watching how resource companies respond to regulatory shifts, consider broadening your search and discover fast growing stocks with high insider ownership

With shares still trading slightly below analyst targets, the question now is whether G Mining Ventures is trading at a discount that has yet to be recognized by the market, or if investors have already factored in the company’s future growth prospects.

Price-to-Earnings of 33.1x: Is it justified?

Shares of G Mining Ventures are currently trading at a price-to-earnings (P/E) ratio of 33.1x, which is higher than both the Canadian Metals and Mining industry average of 24x and the peer group average of 25.7x. This suggests the stock is trading at a notable premium to its sector counterparts.

The price-to-earnings ratio measures how much investors are willing to pay today for a dollar of current earnings. For a mining company like G Mining Ventures, this metric often reflects expectations about future profitability, growth initiatives, and the quality of recent earnings.

The premium valuation suggests that investors are placing significant weight on the company's transition to profitability and its anticipated high earnings growth. However, when considering the lower industry and peer P/E multiples, G Mining’s current market price reflects a level of confidence in future returns that may be difficult to sustain without strong operational performance. In addition, the company’s P/E also exceeds the estimated fair P/E ratio of 31.7x, which raises further questions about whether the current price is fully justified or somewhat expensive by historical standards.

Explore the SWS fair ratio for G Mining Ventures

Result: Price-to-Earnings of 33.1x (OVERVALUED)

However, slower than expected operational progress or broader market volatility could challenge the sustainability of G Mining Ventures’ current valuation premium.

Find out about the key risks to this G Mining Ventures narrative.

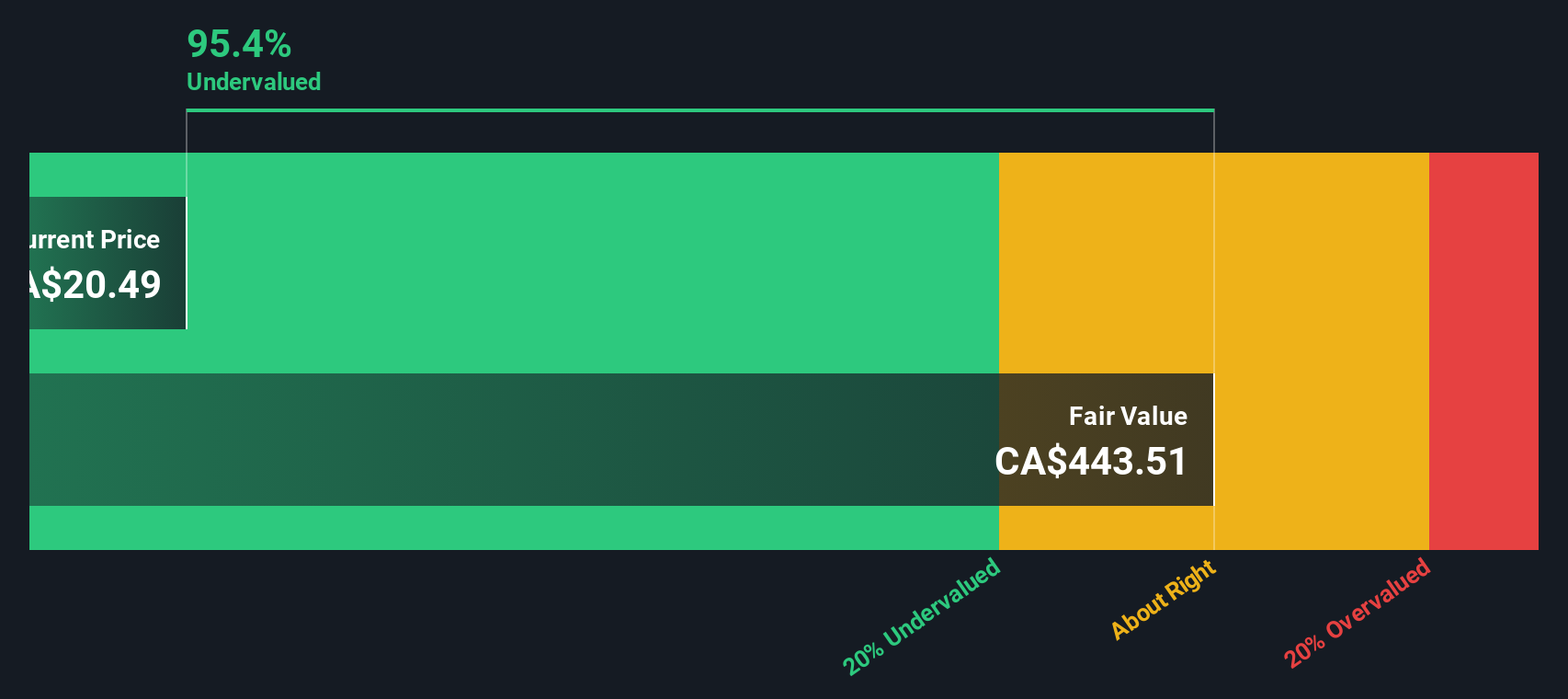

Another View: Contrasting the DCF Model

While the price-to-earnings ratio makes G Mining Ventures appear expensive compared to industry peers and its own fair ratio, the SWS DCF model provides a contrasting perspective. According to this method, the shares are valued at a significant discount to their estimated fair value, raising a debate about which approach better reflects investor reality. Which method should guide investors now?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out G Mining Ventures for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own G Mining Ventures Narrative

If you see the story differently or want to dig into the numbers yourself, you can easily build your own view in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding G Mining Ventures.

Looking for more investment ideas?

Don’t let opportunities pass you by. Use the Simply Wall St Screener to target stocks making moves across fast-growing, innovative sectors right now.

- Pinpoint tomorrow’s market disruptors by starting with these 24 AI penny stocks specializing in artificial intelligence and next-level automation solutions.

- Capture untapped value as you review these 896 undervalued stocks based on cash flows trading at a fraction of what their fundamentals suggest.

- Grow your income stream by choosing from these 19 dividend stocks with yields > 3% that consistently reward shareholders with generous, above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GMIN

G Mining Ventures

A mining company, engages in the acquisition, exploration, and development of precious metal projects.

Exceptional growth potential with adequate balance sheet.

Market Insights

Community Narratives