- Canada

- /

- Metals and Mining

- /

- TSX:GAU

Galiano Gold (TSX:GAU): Assessing Valuation After Civil Unrest at Asanko Mine

Reviewed by Simply Wall St

If you hold or follow Galiano Gold (TSX:GAU), you have probably heard about the intense situation at its Asanko Gold Mine in Ghana. A confrontation between community members and military personnel resulted in civil unrest, damage to contractor equipment, and, sadly, a fatality. The company responded swiftly by suspending operations at the Esaase deposit. Other areas of the mine and the processing plant continue to operate. Galiano Gold is now working closely with local authorities and community leaders as investigations unfold, making this a significant development for investors tracking operational risks.

This incident comes at a time when the stock has seen substantial momentum. The share price is up 86% year-to-date and has gained 70% over the past year. Over the past month alone, shares surged 62%, reflecting changing perceptions around growth and risk. While the mine’s other deposits remain operational, management’s handling of the crisis and community relations will take center stage as investors try to gauge the financial and reputational impact.

After this year’s remarkable gains, investors may be considering whether Galiano Gold is now trading at a discount or if the market is already factoring in future growth and operational risks.

Most Popular Narrative: 17.7% Undervalued

According to the most widely followed narrative, Galiano Gold is trading significantly below its calculated fair value. This view is built on bold growth forecasts, operational improvements, and the expectation of robust future profitability.

"Successful step-out and deep drilling at Abore has intercepted significant widths and grades of mineralization below current reserves, confirming the deposit is open at depth and along strike. This creates significant reserve and resource expansion potential, supporting future production growth and longer-term revenue visibility."

Curious what is fueling this bullish target? One key element of the narrative is record-setting improvement in margins and revenue growth, as well as an ambitious future profit multiple that puts Galiano Gold in a league with the sector’s most optimistic forecasts. The full valuation hinges on a handful of projections that many investors might find surprising. Want to uncover which assumptions are driving their math? Dig deeper into the narrative to decode what is really behind that eye-catching price target.

Result: Fair Value of $4.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent regulatory pressures and Galiano Gold's reliance on a single mine could quickly alter the company’s growth trajectory if challenges intensify.

Find out about the key risks to this Galiano Gold narrative.Another View: Our DCF Perspective

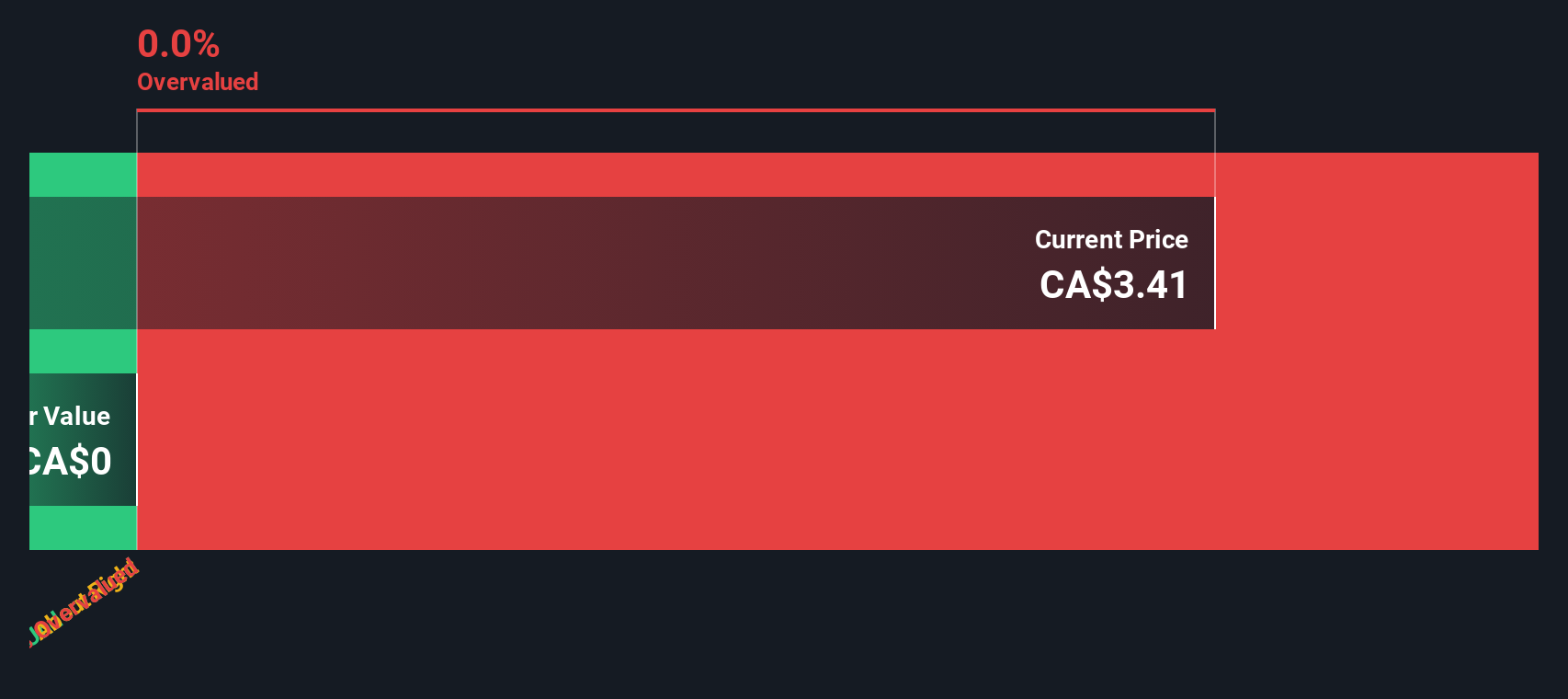

While analysts find Galiano Gold undervalued based on projected growth and profitability, our SWS DCF model tells a different story. This method weighs long-term cash flow potential and challenges whether the optimism is truly justified. Which view will prove right over time?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Galiano Gold for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Galiano Gold Narrative

If you have your own take on Galiano Gold’s story or want to dig into the numbers first-hand, you can craft your own scenario in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Galiano Gold.

Looking for More Unmissable Investment Opportunities?

Don’t stop at just one stock. Set yourself up for smarter investing by checking out handpicked ideas tailored to changing markets, technology, and trends.

- Reimagine your portfolio with value-driven picks by tapping into undervalued stocks based on cash flows, where stocks with attractive pricing and growth prospects are waiting for your attention.

- Unlock the future of healthcare innovation as you use healthcare AI stocks to pinpoint companies harnessing artificial intelligence for breakthroughs in medical technology and patient care.

- Power up your investment income with dividend stocks with yields > 3%. Focus on opportunities in companies offering robust dividend yields to help grow your wealth steadily.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GAU

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives