- Canada

- /

- Metals and Mining

- /

- TSX:GAU

Galiano Gold Inc.'s (TSE:GAU) Stock Has Seen Strong Momentum: Does That Call For Deeper Study Of Its Financial Prospects?

Galiano Gold (TSE:GAU) has had a great run on the share market with its stock up by a significant 10% over the last week. As most would know, fundamentals are what usually guide market price movements over the long-term, so we decided to look at the company's key financial indicators today to determine if they have any role to play in the recent price movement. In this article, we decided to focus on Galiano Gold's ROE.

Return on Equity or ROE is a test of how effectively a company is growing its value and managing investors’ money. In other words, it is a profitability ratio which measures the rate of return on the capital provided by the company's shareholders.

See our latest analysis for Galiano Gold

How Do You Calculate Return On Equity?

ROE can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Galiano Gold is:

4.0% = US$9.7m ÷ US$241m (Based on the trailing twelve months to June 2024).

The 'return' is the income the business earned over the last year. One way to conceptualize this is that for each CA$1 of shareholders' capital it has, the company made CA$0.04 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Galiano Gold's Earnings Growth And 4.0% ROE

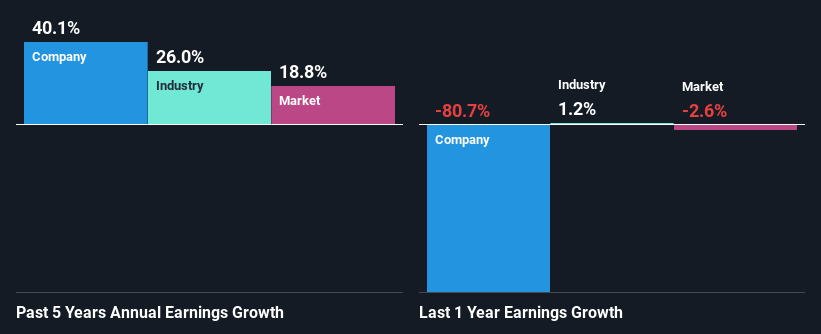

It is quite clear that Galiano Gold's ROE is rather low. Even compared to the average industry ROE of 9.3%, the company's ROE is quite dismal. Despite this, surprisingly, Galiano Gold saw an exceptional 40% net income growth over the past five years. Therefore, there could be other reasons behind this growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

Next, on comparing with the industry net income growth, we found that Galiano Gold's growth is quite high when compared to the industry average growth of 26% in the same period, which is great to see.

Earnings growth is an important metric to consider when valuing a stock. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Galiano Gold is trading on a high P/E or a low P/E, relative to its industry.

Is Galiano Gold Efficiently Re-investing Its Profits?

Given that Galiano Gold doesn't pay any regular dividends to its shareholders, we infer that the company has been reinvesting all of its profits to grow its business.

Conclusion

On the whole, we do feel that Galiano Gold has some positive attributes. Even in spite of the low rate of return, the company has posted impressive earnings growth as a result of reinvesting heavily into its business. With that said, the latest industry analyst forecasts reveal that the company's earnings growth is expected to slow down. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GAU

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives