- Canada

- /

- Metals and Mining

- /

- TSX:FVI

Fortuna Mining (TSX:FVI): Weighing Valuation After Diamba Sud Resource Upgrade and Exploration Momentum

Reviewed by Simply Wall St

Fortuna Mining (TSX:FVI) just followed up its Diamba Sud resource upgrade with fresh drilling results from the Southern Arc zone in Senegal, keeping investor attention on how this early stage growth story might reshape future production.

See our latest analysis for Fortuna Mining.

The fresh Diamba Sud update comes against a backdrop of strong momentum, with a 30 day share price return of 14.12 percent and a year to date share price return of 107.28 percent. The 1 year total shareholder return of 120.32 percent shows investors have increasingly been willing to pay up for Fortuna Mining’s growth story.

If this kind of early stage exploration success catches your eye, it could be worth seeing what else is out there via fast growing stocks with high insider ownership.

Yet with Fortuna now trading near its analyst target and boasting a stellar one year run, the key question is whether the stock still offers mispriced upside or if the market is already discounting Diamba Sud driven growth.

Most Popular Narrative Narrative: 2.7% Overvalued

With Fortuna Mining closing at CA$13.66 against a narrative fair value near CA$13.30, the story hinges on how future margins and earnings evolve from here.

Analysts expect earnings to reach $235.3 million (and earnings per share of $0.72) by about September 2028, up from $171.2 million today. The analysts are largely in agreement about this estimate.

Curious how earnings can climb while headline revenue drifts lower and the valuation multiple still eases back from today’s level? The narrative leans on expanding margins, disciplined capital returns, and a future earnings base that looks very different from the last few years. Want to see the exact assumptions that make that math work?

Result: Fair Value of CA$13.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this outlook could quickly change if Diamba Sud or Séguéla encounter permitting or ramp up setbacks, or if high all in sustaining costs persist.

Find out about the key risks to this Fortuna Mining narrative.

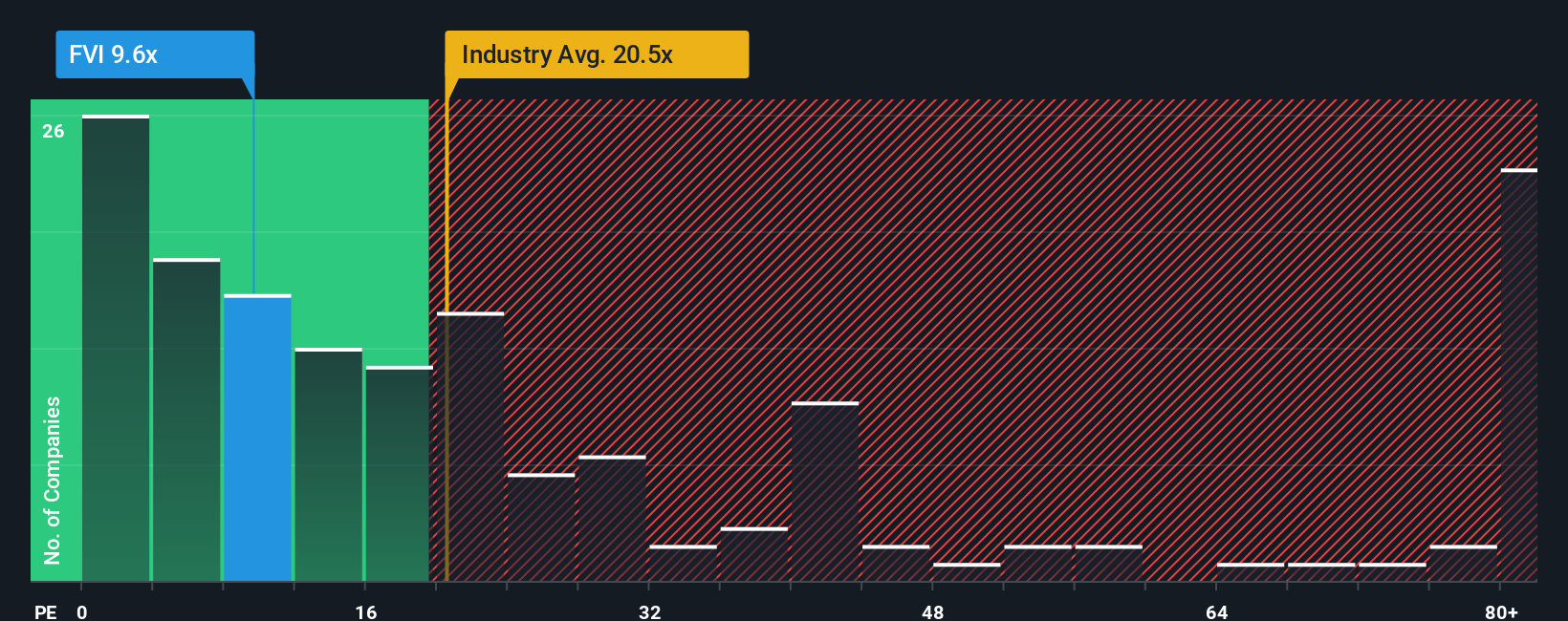

Another View: Earnings Multiple Signals Deep Value

While the narrative fair value flags Fortuna as slightly overvalued, its 11.6x price to earnings ratio looks cheap compared with both peers at 25.7x and the industry at 20.9x. This is also well below a 17.8x fair ratio and suggests the market may be underpricing execution going forward.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Fortuna Mining Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your Fortuna Mining research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with a single opportunity when you can quickly line up your next moves across high growth, income, and thematic plays tailored to your strategy.

- Capture asymmetric upside by scanning these 3627 penny stocks with strong financials that already show financial strength instead of blind speculation.

- Position ahead of the next productivity boom by focusing on these 29 healthcare AI stocks transforming how medicine is delivered worldwide.

- Lock in potential income streams by targeting these 13 dividend stocks with yields > 3% that combine meaningful yields with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FVI

Fortuna Mining

Engages in the precious and base metal mining and related activities in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, Peru, and Senegal.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion