- Canada

- /

- Metals and Mining

- /

- TSX:FVI

Fortuna Mining Corp.'s (TSE:FVI) high institutional ownership speaks for itself as stock continues to impress, up 22% over last week

Key Insights

- Given the large stake in the stock by institutions, Fortuna Mining's stock price might be vulnerable to their trading decisions

- The top 25 shareholders own 42% of the company

- Insiders have sold recently

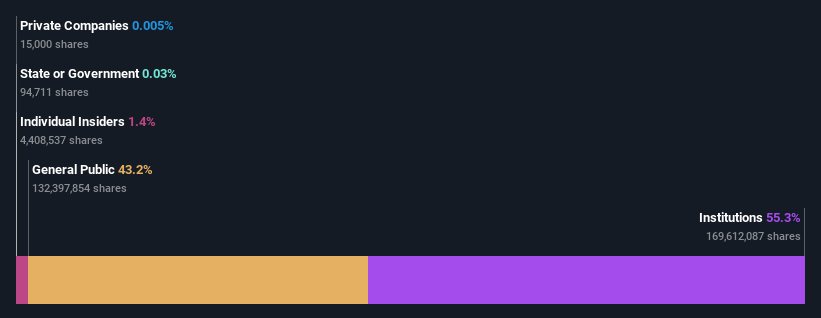

A look at the shareholders of Fortuna Mining Corp. (TSE:FVI) can tell us which group is most powerful. The group holding the most number of shares in the company, around 55% to be precise, is institutions. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

And last week, institutional investors ended up benefitting the most after the company hit CA$2.8b in market cap. The gains from last week would have further boosted the one-year return to shareholders which currently stand at 43%.

Let's delve deeper into each type of owner of Fortuna Mining, beginning with the chart below.

See our latest analysis for Fortuna Mining

What Does The Institutional Ownership Tell Us About Fortuna Mining?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

Fortuna Mining already has institutions on the share registry. Indeed, they own a respectable stake in the company. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Fortuna Mining's earnings history below. Of course, the future is what really matters.

Investors should note that institutions actually own more than half the company, so they can collectively wield significant power. We note that hedge funds don't have a meaningful investment in Fortuna Mining. Van Eck Associates Corporation is currently the company's largest shareholder with 9.1% of shares outstanding. The second and third largest shareholders are Dimensional Fund Advisors LP and Acadian Asset Management LLC, with an equal amount of shares to their name at 2.7%. In addition, we found that Jorge Ganoza Durant, the CEO has 0.8% of the shares allocated to their name.

On studying our ownership data, we found that 25 of the top shareholders collectively own less than 50% of the share register, implying that no single individual has a majority interest.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are plenty of analysts covering the stock, so it might be worth seeing what they are forecasting, too.

Insider Ownership Of Fortuna Mining

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Company management run the business, but the CEO will answer to the board, even if he or she is a member of it.

Most consider insider ownership a positive because it can indicate the board is well aligned with other shareholders. However, on some occasions too much power is concentrated within this group.

We can report that insiders do own shares in Fortuna Mining Corp.. The insiders have a meaningful stake worth CA$40m. Most would see this as a real positive. Most would say this shows alignment of interests between shareholders and the board. Still, it might be worth checking if those insiders have been selling.

General Public Ownership

The general public-- including retail investors -- own 43% stake in the company, and hence can't easily be ignored. While this size of ownership may not be enough to sway a policy decision in their favour, they can still make a collective impact on company policies.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too.

Many find it useful to take an in depth look at how a company has performed in the past. You can access this detailed graph of past earnings, revenue and cash flow.

Ultimately the future is most important. You can access this free report on analyst forecasts for the company.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FVI

Fortuna Mining

Engages in the precious and base metal mining and related activities in Argentina, Burkina Faso, Côte d’Ivoire, Mexico, Peru, and Senegal.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion