- Canada

- /

- Metals and Mining

- /

- TSX:FOM

Foran Mining Rallies 22.8% as Green Metals Demand Sparks New Valuation Debate

Reviewed by Bailey Pemberton

Trying to make sense of Foran Mining's latest movements? You are not the only one. Over the past 30 days, the stock has surged by an eye-catching 22.8%, building on a more modest 4.6% uptick in just the last week. But if you zoom out, the ups and downs start to look even wilder. The share price is still down 4.5% for the year to date, and over the past year, it has slipped by 7.5%. Despite that, Foran Mining boasts an astonishing 1,815% gain over five years. This highlights how explosive smaller mining plays can be when the market gets behind them.

What is fueling those kinds of numbers? Market developments have amplified interest in green metals and clean-energy infrastructure, and Foran's story fits neatly into those big-picture trends. When sentiment swings, investors have shown they can move quickly in or out, sometimes on little more than a shift in industry outlook or commodity prices. That helps explain the volatility, as well as the remarkable long-term return for those who have held on for the ride.

But is Foran Mining actually undervalued right now, or is the excitement already baked in? Our value score gives the company a 2 out of 6, meaning Foran passes two key valuation checks. In the sections that follow, we will dig into each of the most common valuation methods to see how the numbers stack up. If you are looking for a more insightful angle, we will reveal an even better way to get the real story behind the valuation at the end.

Foran Mining scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

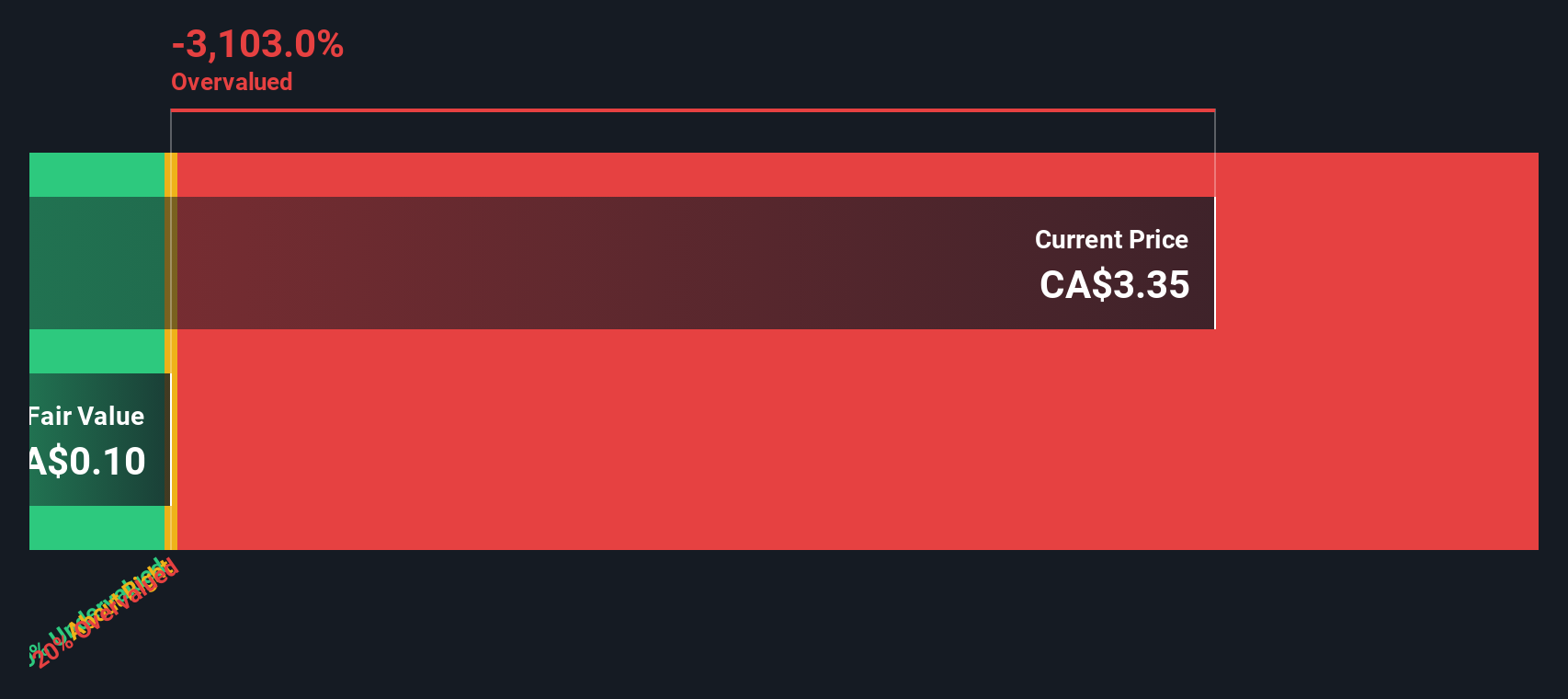

Approach 1: Foran Mining Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and then discounting them back to today's value. This approach is particularly useful for businesses like Foran Mining, where cash flows can be volatile from year to year.

Foran Mining's latest reported Free Cash Flow (FCF) was negative, at CA$-473.19 million over the last twelve months. Looking forward, analysts forecast that FCF will climb significantly. By 2028, it is projected to reach CA$43.13 million, before slowly tapering down in subsequent years according to modeled estimates. It's important to note that while analyst estimates extend only five years ahead, the further projections used here are informed extrapolations.

After discounting each of these future figures back to present value, the DCF model estimates Foran Mining's intrinsic value at CA$0.18 per share. However, comparing this to the current share price reveals a far less attractive reality. The stock is trading at a level that is 2,058.2% above its estimated intrinsic value. In other words, the DCF analysis sees the stock as massively overvalued at today's price.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Foran Mining may be overvalued by 2058.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Foran Mining Price vs Book

The Price-to-Book (PB) ratio is a useful valuation metric for companies like Foran Mining, especially when earnings are negative or unpredictable. Unlike earnings or sales-based multiples, PB focuses on a company's assets and is often favored in the mining sector where asset values and project development drive much of the story.

Foran Mining currently trades at a PB ratio of 1.87x. This stands below the industry average, which is 2.57x, and is far lower than the peer average of 52.60x. Typically, companies with strong growth prospects, lower risk, and high asset quality command higher PB multiples. Companies facing uncertainty or operational challenges tend to trade at lower levels.

To go beyond simple peer comparisons, Simply Wall St calculates a proprietary Fair Ratio for each stock, using a blend of factors such as projected earnings growth, industry dynamics, profit margins, market capitalization, and specific business risks. This Fair Ratio aligns the expected multiple for Foran Mining specifically, making it more tailored and meaningful than just using the industry or peer averages.

In Foran Mining’s case, the Fair Ratio data suggests a value that is extremely close to its actual PB multiple. The stock appears to be fairly priced when adjusting for all relevant factors. When considering the company’s future outlook and asset profile, valuations at current levels seem reasonable compared to what would typically be expected.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

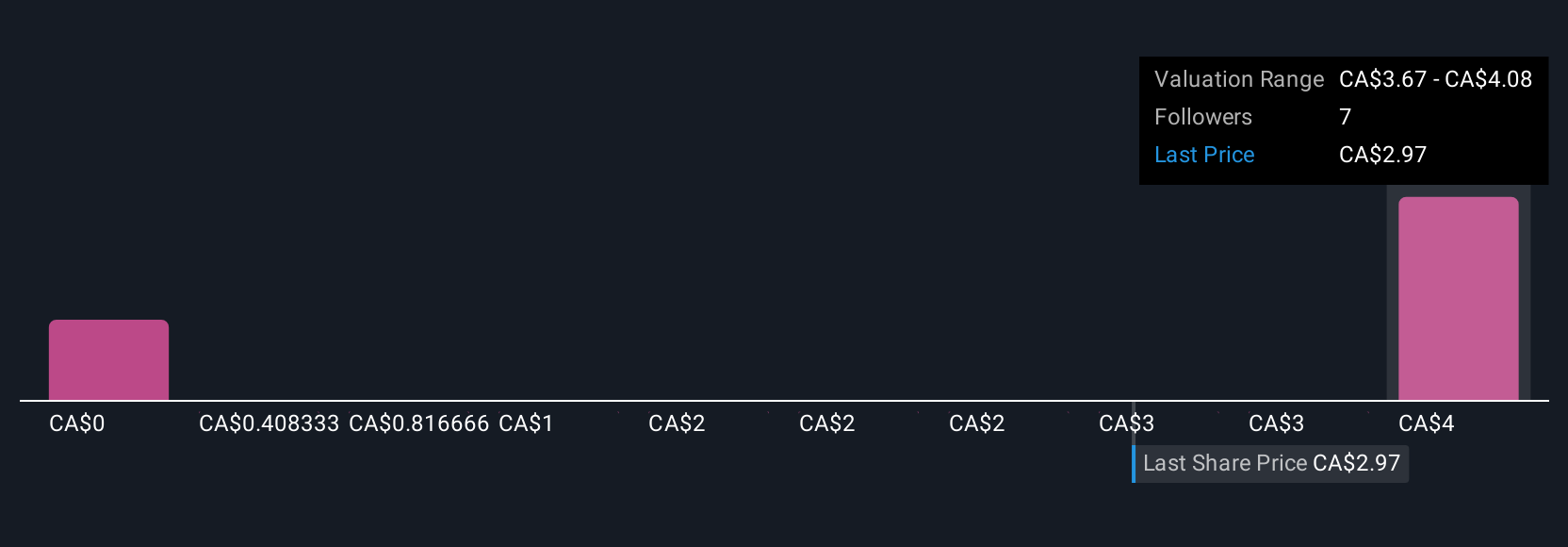

Upgrade Your Decision Making: Choose your Foran Mining Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your own story about a company, connecting what you believe about its future to your estimates for things like revenue, earnings, and ultimately, its fair value. Instead of just looking at the numbers, Narratives invite you to explain the logic behind your outlook, linking the company’s story to a tangible financial forecast and fair value.

Narratives are available on Simply Wall St’s Community page and used by millions of investors, making them a simple and accessible tool to help guide your buy or sell decisions. By comparing your calculated Fair Value to the current Price, Narratives reveal whether you think a stock is attractive or risky, and they update automatically as fresh news or earnings come in.

For example, with Foran Mining, some investors draw on bullish copper demand forecasts to see a much higher fair value, while others, cautious about project execution, land at a lower number. Narratives help you capture your own viewpoint and adapt it in real time, so you always know why you are making your investment decisions.

Do you think there's more to the story for Foran Mining? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FOM

Foran Mining

Engages in the acquisition, exploration, and development of mineral properties.

Moderate risk and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026