- Canada

- /

- Metals and Mining

- /

- TSX:FNV

Unpleasant Surprises Could Be In Store For Franco-Nevada Corporation's (TSE:FNV) Shares

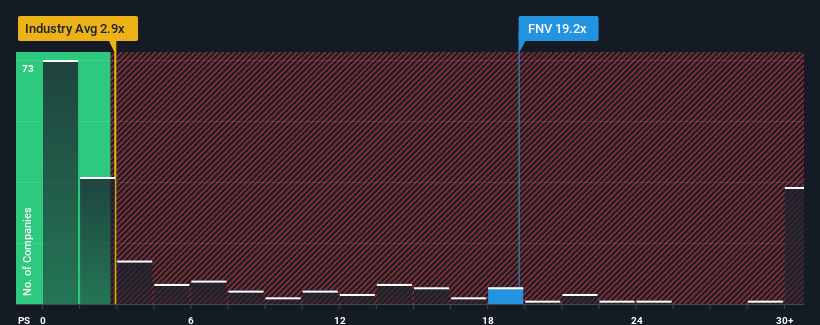

When close to half the companies in the Metals and Mining industry in Canada have price-to-sales ratios (or "P/S") below 2.9x, you may consider Franco-Nevada Corporation (TSE:FNV) as a stock to avoid entirely with its 19.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Franco-Nevada

How Franco-Nevada Has Been Performing

While the industry has experienced revenue growth lately, Franco-Nevada's revenue has gone into reverse gear, which is not great. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Franco-Nevada will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Franco-Nevada's to be considered reasonable.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 4.3%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 10% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 3.7% as estimated by the seven analysts watching the company. Meanwhile, the broader industry is forecast to expand by 18%, which paints a poor picture.

With this in mind, we find it intriguing that Franco-Nevada's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

For a company with revenues that are set to decline in the context of a growing industry, Franco-Nevada's P/S is much higher than we would've anticipated. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. Unless these conditions improve markedly, it'll be a challenging time for shareholders.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Franco-Nevada with six simple checks on some of these key factors.

If you're unsure about the strength of Franco-Nevada's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:FNV

Franco-Nevada

Operates as a royalty and stream company focused on precious metals in South America, Central America, Mexico, the United States, Canada, Australia, Europe, and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026