- Canada

- /

- Metals and Mining

- /

- TSX:FM

First Quantum Minerals (TSX:FM) Returns to Profitability, Net Margin Rebound Challenges Bearish Sentiment

Reviewed by Simply Wall St

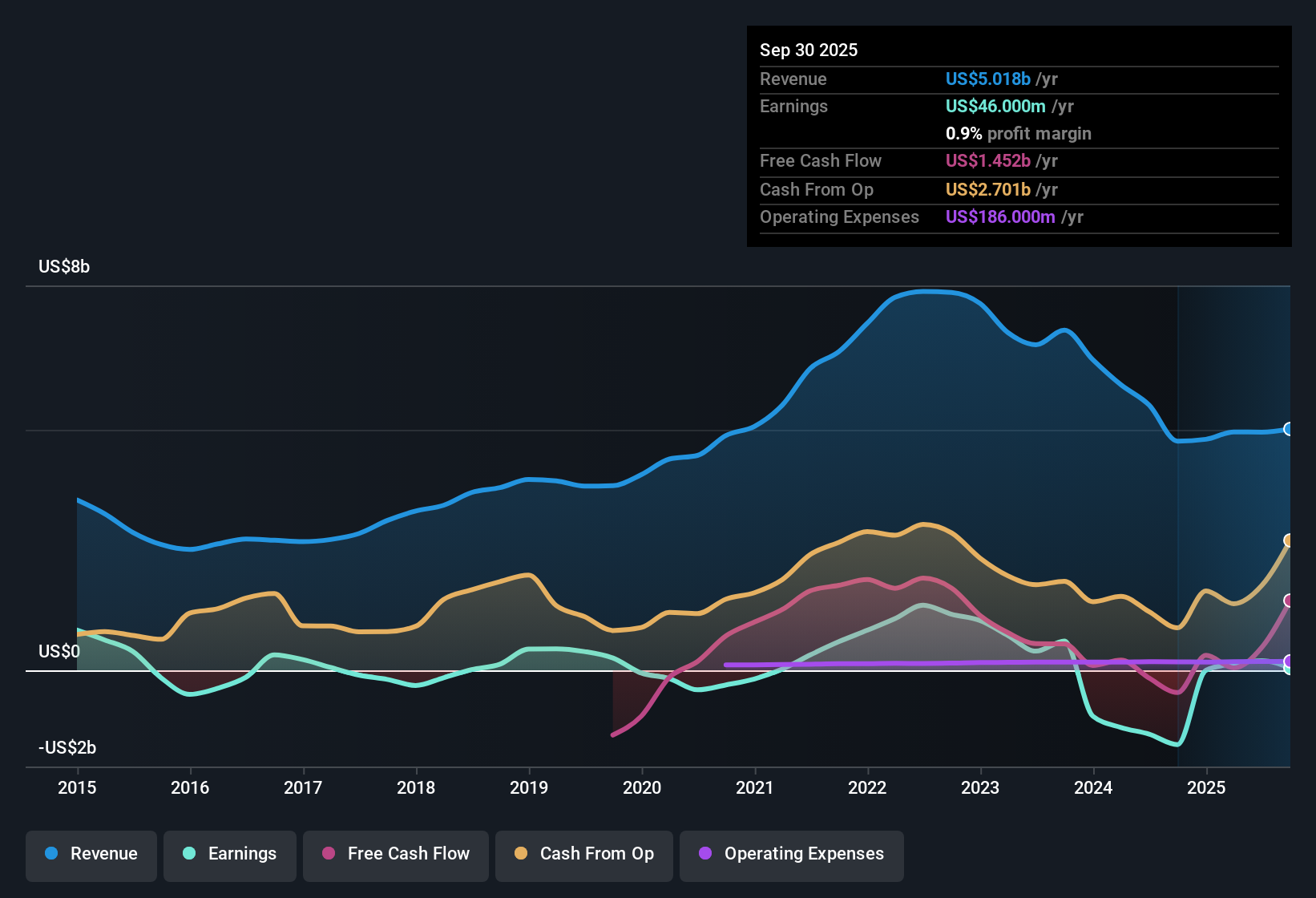

First Quantum Minerals (TSX:FM) turned profitable over the past year, even though its five-year average shows earnings declining by 27.8% per year. Looking ahead, analysts forecast revenue growth of 22.7% annually and expect earnings to jump by 59.3% per year for the next three years, both well ahead of the Canadian market averages. With shares trading at CA$30.51, below the estimated fair value of CA$80.82, investors are focusing on the company’s rapid earnings turnaround, improved net profit margin, and positive value signals. Financial risks remain part of the story.

See our full analysis for First Quantum Minerals.The next step is to see how these results measure up against the dominant narratives around First Quantum Minerals. It is time to check where the numbers reinforce market opinions and where they might challenge expectations.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Profit Margin Back in Positive Territory

- Recent filings indicate First Quantum Minerals turned profitable after years of average annual earnings declines of 27.8% over the past five years. This highlights a major shift in net profit margin quality.

- Bulls point to this margin turnaround as a key foundation for future upside.

- Renewed profitability marks a reversal from the multiyear downtrend and strengthens arguments that management’s strategy is improving core business performance.

- Forecasts project 59.3% earnings growth per year for the next three years, which strongly supports the bullish case that the margin improvement is not just a one-off but tied to a sustainable growth path.

Price-To-Sales Beats Industry Averages

- The company’s Price-To-Sales Ratio of 3.6x is attractively below both its peer median of 3.8x and the broader Canadian Metals and Mining sector’s average of 5.7x. This suggests a value edge not fully reflected in the market.

- Despite the apparent discount, risk factors around financial health remain prominent.

- Analysts highlight that the company is not in a good financial position, meaning that even with favorable sales multiples, valuation alone may not compensate for balance sheet concerns if growth wavers.

- This creates tension between strong value signals and the real operational risks highlighted in recent disclosures. Many scrutinize whether the current price truly prices in all risks.

DCF Fair Value Nearly Triples Current Price

- First Quantum Minerals is trading at CA$30.51, sharply below an estimated DCF fair value of CA$80.82. This flags a discount of more than 60% by this measure and sparks debate about market skepticism versus overlooked upside.

- Debate centers around whether this steep discount reflects deeper worries about the company’s financial position.

- Despite strong forecasts for revenue and profits, a major risk related to financial strength could explain why the market hasn’t moved closer to the DCF value.

- Prevailing analysis focuses on the disconnect between projected growth and market pricing, questioning if cautious investors are justified in demanding such a large risk premium at this point in the cycle.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First Quantum Minerals's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite First Quantum Minerals’ margin recovery and valuation discount, serious concerns remain about its financial position and balance sheet stability.

If you want to prioritize companies with stronger fundamentals, use solid balance sheet and fundamentals stocks screener (1987 results) to find options with healthier balance sheets and less risk of financial setbacks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FM

First Quantum Minerals

Engages in the exploration, development, and production of mineral properties.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion