- Canada

- /

- Metals and Mining

- /

- TSX:FM

First Quantum Minerals (TSX:FM): Evaluating Valuation After $1B Bond Offering and La Granja Project Update

Reviewed by Kshitija Bhandaru

First Quantum Minerals (TSX:FM) is attracting attention after completing a $1 billion fixed-income offering and responding to concerns about its La Granja copper project in Peru. This highlights active management and efforts toward transparency.

See our latest analysis for First Quantum Minerals.

First Quantum Minerals shares have seen notable momentum lately, climbing 17.6% over the past month and surging 32.9% over the last three months as confidence grows around management's handling of financing and project transparency. The stock’s year-to-date share price return sits at an impressive 64.2%, and the one-year total shareholder return stands at 69.9%. This illustrates strong performance even amid recent volatility.

If the company's strategic moves have caught your attention, now is a perfect time to broaden your view and discover fast growing stocks with high insider ownership

With share prices surging on optimism and new developments, the key question for investors is whether First Quantum Minerals is still undervalued or if current prices have already factored in the company’s future growth potential.

Price-to-Earnings of 90.9x: Is it justified?

First Quantum Minerals is trading at a price-to-earnings (P/E) ratio of 90.9x, which is well above both its direct peers and the broader Canadian market. This signals the stock is considered expensive relative to recent profits at the current share price of CA$31.09.

The P/E ratio is a key gauge for investors measuring how much they are paying for each dollar of current earnings. For mining companies, a high P/E can sometimes reflect market optimism about future profit growth, but it also raises the bar for execution and sustained growth.

Currently, First Quantum’s P/E of 90.9x surpasses the peer average of 81x as well as the Canadian Metals and Mining industry average of 22.5x. It also exceeds the company’s estimated fair P/E ratio of 60.4x, indicating an even higher market expectation built into today’s price. Unless future earnings boom, there is a risk the multiple may eventually move closer to more modest levels.

Explore the SWS fair ratio for First Quantum Minerals

Result: Price-to-Earnings of 90.9x (OVERVALUED)

However, future market volatility or weaker earnings growth could quickly reverse confidence and challenge the optimistic outlook currently priced into First Quantum Minerals shares.

Find out about the key risks to this First Quantum Minerals narrative.

Another View: SWS DCF Model Suggests Deep Undervaluation

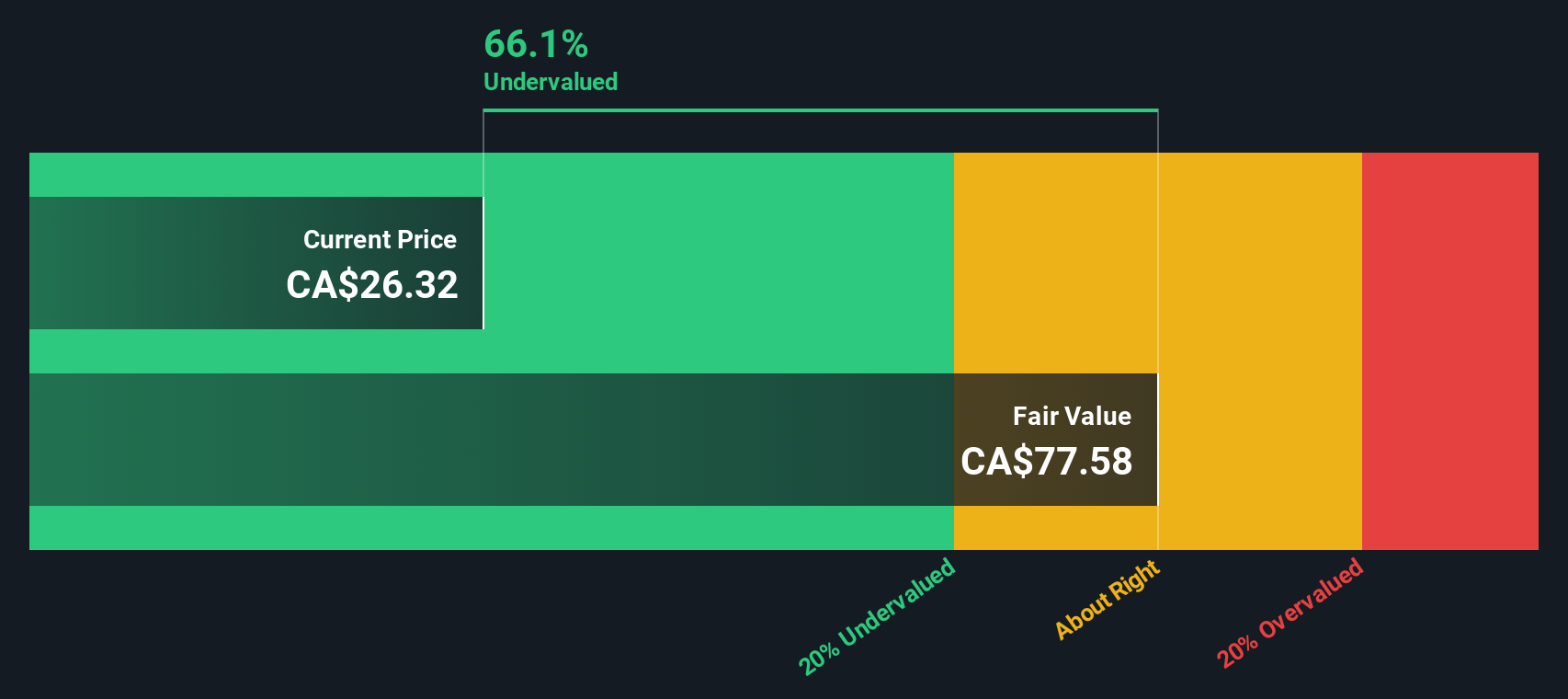

While the price-to-earnings ratio presents First Quantum Minerals as expensive, our SWS DCF model offers a different perspective. According to this method, the current share price of CA$31.09 is about 61% below its intrinsic value estimate of CA$79.52, suggesting the shares may be deeply undervalued.

Look into how the SWS DCF model arrives at its fair value.

So, is the market overly cautious or is the growth still underappreciated? This split view highlights why considering multiple valuation perspectives is crucial before making any investment decision.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Quantum Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Quantum Minerals Narrative

If you see the story differently or want a hands-on approach, you have the tools to explore the numbers and build your own view in just a few minutes with Do it your way.

A great starting point for your First Quantum Minerals research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your investing potential by checking out these curated opportunities on Simply Wall Street. Don't let your next big win slip by unnoticed.

- Uncover the next wave of healthcare innovation by checking out these 33 healthcare AI stocks, already pushing the boundaries of medical technology and patient outcomes.

- Benefit from market volatility and aim for above-average yields with these 18 dividend stocks with yields > 3%, which offer strong dividend potential for your income strategy.

- Catalyze your portfolio with early-stage growth by tapping into these 3596 penny stocks with strong financials, featuring strong financials and unique upside opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FM

First Quantum Minerals

Engages in the exploration, development, and production of mineral properties.

High growth potential and fair value.

Similar Companies

Market Insights

Community Narratives