- Canada

- /

- Metals and Mining

- /

- TSX:GOLD

Irving Resources And 2 Other Top TSX Penny Stocks

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has risen by 1.0%, and over the past year, it has climbed 27%, with earnings forecasted to grow by 16% annually. In this context of growth, identifying stocks with solid financial foundations is crucial for investors seeking value and potential upside. Penny stocks, though a somewhat outdated term, remain relevant as they often represent smaller or newer companies that can offer substantial growth opportunities when backed by strong fundamentals.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| PetroTal (TSX:TAL) | CA$0.67 | CA$620.88M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.42 | CA$11.75M | ★★★★★☆ |

| Winshear Gold (TSXV:WINS) | CA$0.18 | CA$4.4M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.34 | CA$297.04M | ★★★★★★ |

| Pulse Seismic (TSX:PSD) | CA$2.37 | CA$119.71M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.80 | CA$303.41M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.37 | CA$221.84M | ★★★★★☆ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.17M | ★★★★★★ |

| Newport Exploration (TSXV:NWX) | CA$0.115 | CA$12.14M | ★★★★★★ |

| NamSys (TSXV:CTZ) | CA$1.11 | CA$30.89M | ★★★★★★ |

Click here to see the full list of 947 stocks from our TSX Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Irving Resources (CNSX:IRV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Irving Resources Inc. is a junior exploration stage company focused on acquiring and exploring mineral properties in Canada and Japan, with a market cap of CA$27.61 million.

Operations: Currently, there are no reported revenue segments for this junior exploration stage company focused on mineral properties in Canada and Japan.

Market Cap: CA$27.61M

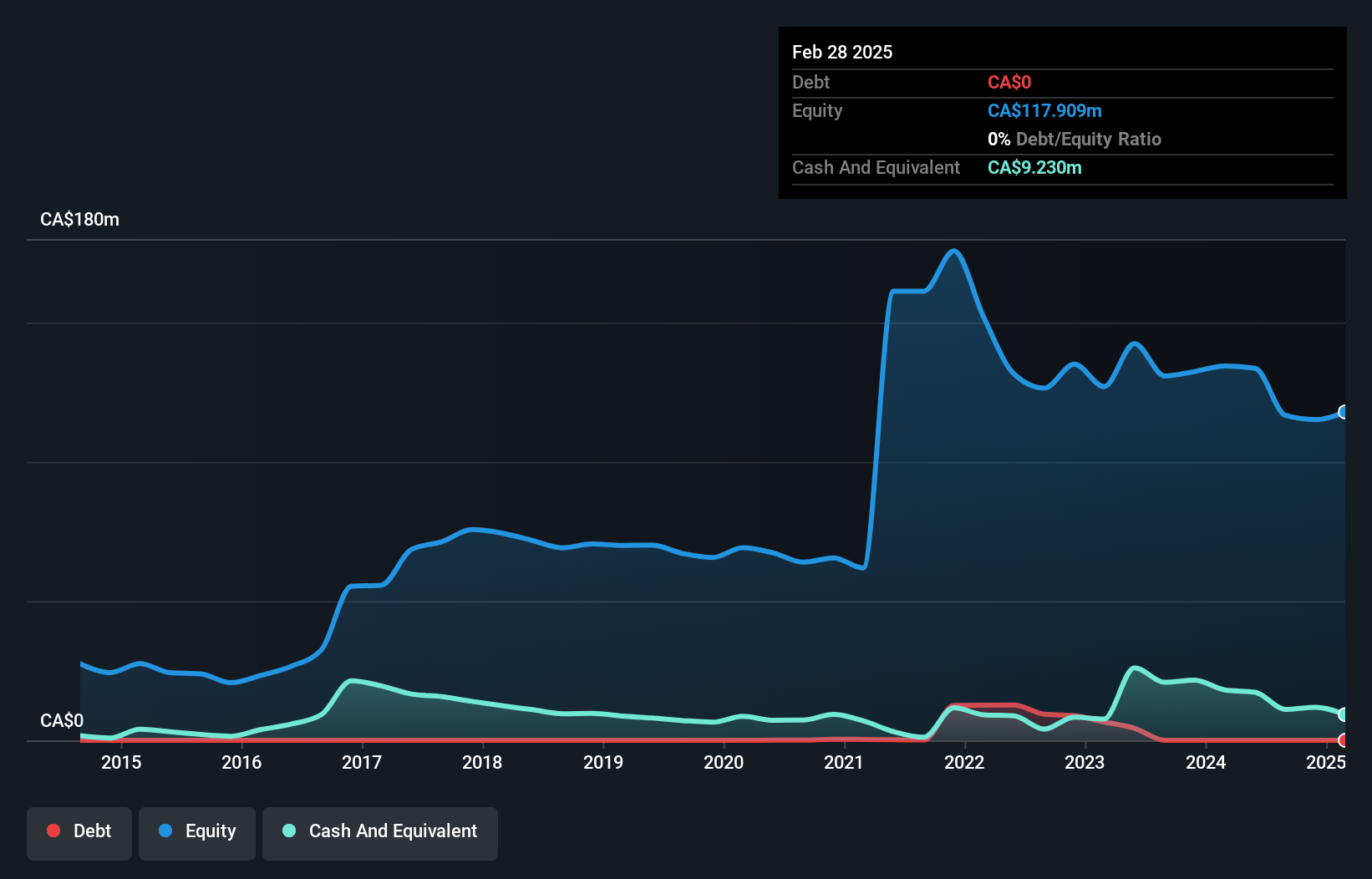

Irving Resources Inc., a pre-revenue junior exploration company, remains debt-free with short-term assets of CA$3.6 million exceeding both its short and long-term liabilities. Despite being unprofitable, it has reduced losses over the past five years by 14.9% annually. The company's share price has been highly volatile recently, and shareholders experienced a 3.7% dilution in the past year. Irving's strategic alliance with Newmont Overseas Exploration Limited and Sumitomo Corporation forms a joint venture for its Yamagano and Noto properties, positioning it as an initial manager with potential future management by Newmont.

- Get an in-depth perspective on Irving Resources' performance by reading our balance sheet health report here.

- Explore historical data to track Irving Resources' performance over time in our past results report.

Foraco International (TSX:FAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Foraco International SA, with a market cap of CA$221.84 million, offers drilling services across North America, Europe, the Middle East, Africa, South America, and the Asia Pacific.

Operations: The company's revenue is derived from two main segments: Mining, which contributes $297.61 million, and Water, which accounts for $39.01 million.

Market Cap: CA$221.84M

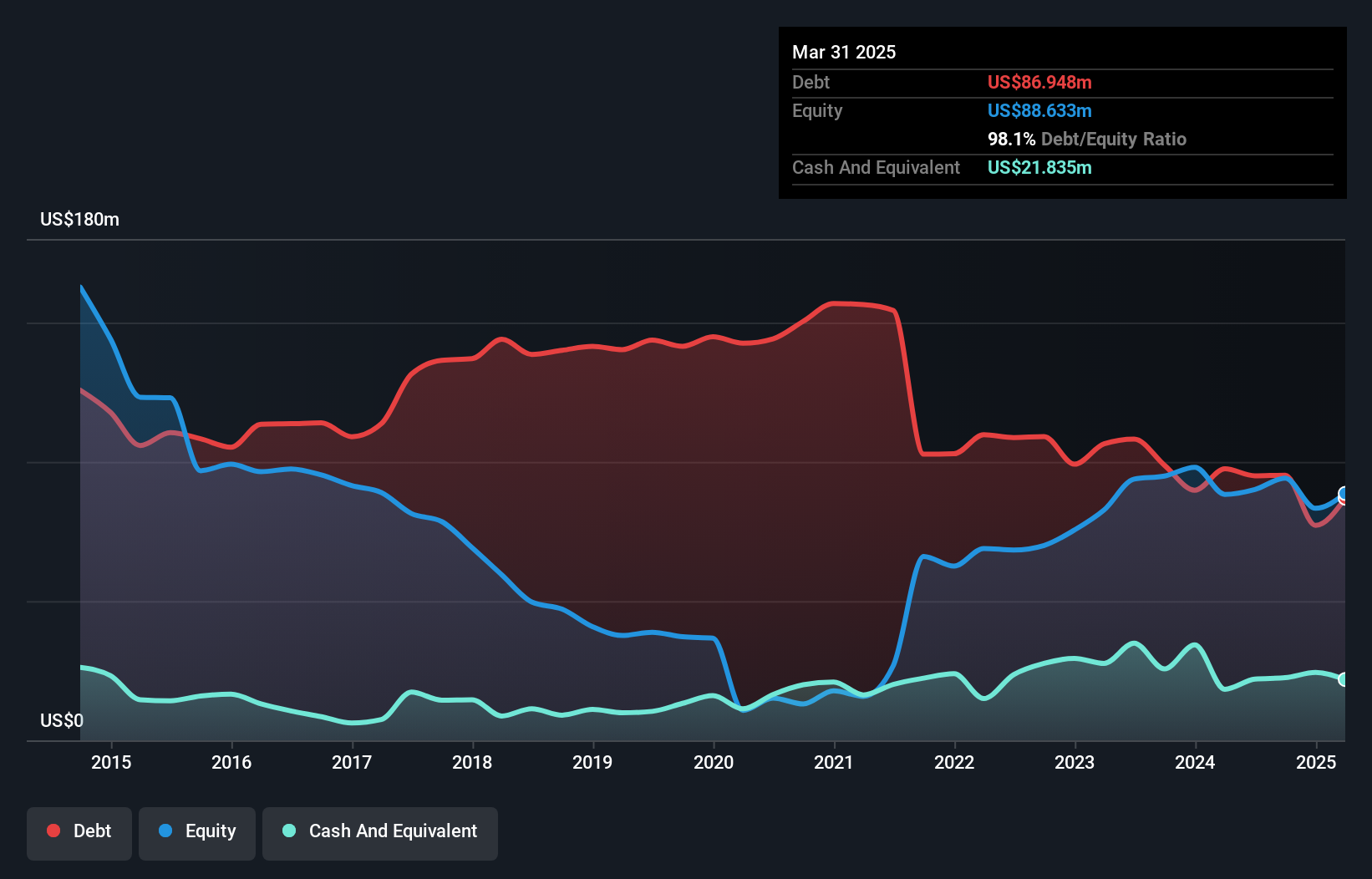

Foraco International SA, with a market cap of CA$221.84 million, demonstrates mixed financial health as a penny stock. Despite negative earnings growth last year, the company has shown profitability over five years with a 42.1% annual increase in earnings. Its debt-to-equity ratio has improved significantly from 370.2% to 105.4% over five years, although it remains high at 81%. The company’s interest payments are well-covered by EBIT and operating cash flow covers its debt adequately at 41.4%. Foraco's recent share buyback program reflects strategic capital management amid stable weekly volatility and high-quality earnings.

- Jump into the full analysis health report here for a deeper understanding of Foraco International.

- Understand Foraco International's earnings outlook by examining our growth report.

GoldMining (TSX:GOLD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GoldMining Inc. is a mineral exploration company that focuses on acquiring, exploring, and developing gold assets in the Americas, with a market cap of CA$257.79 million.

Operations: GoldMining Inc. currently does not report any revenue segments.

Market Cap: CA$257.79M

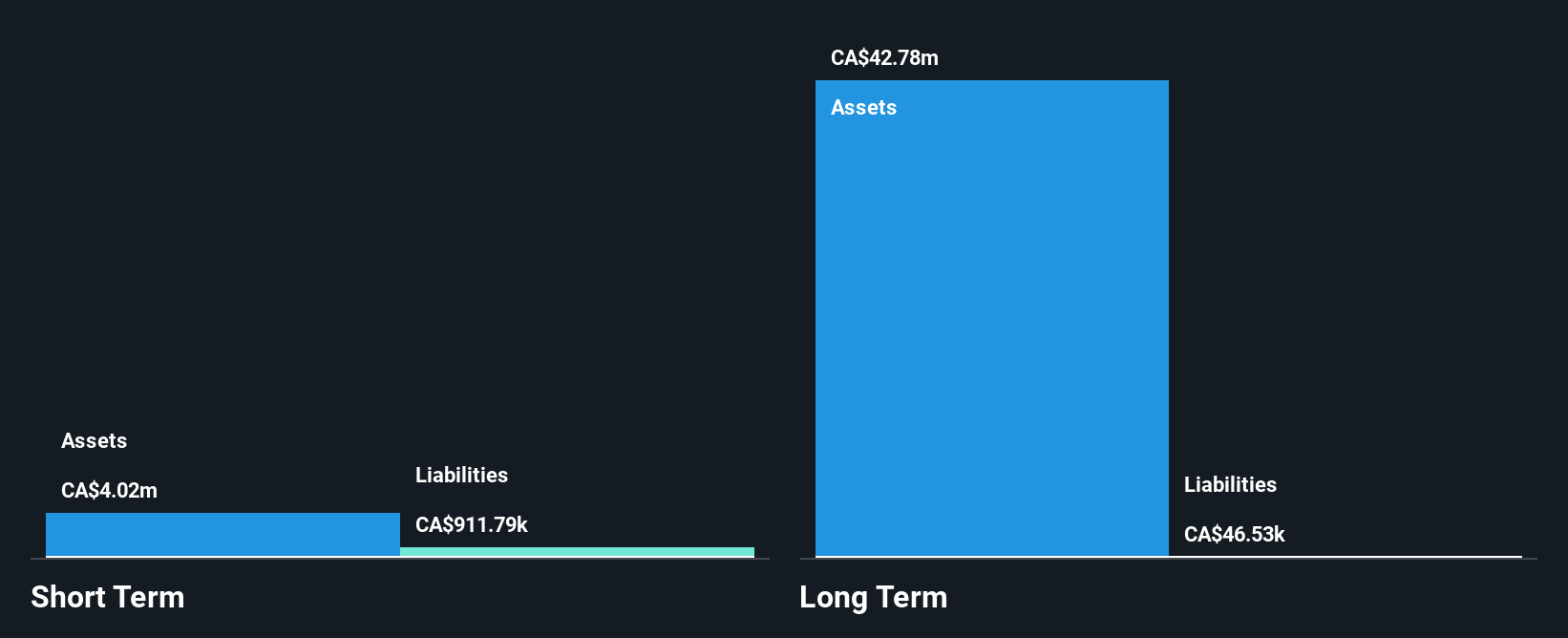

GoldMining Inc., with a market cap of CA$257.79 million, remains pre-revenue and unprofitable, facing challenges typical of penny stocks. The company has no debt and its short-term assets cover both short- and long-term liabilities, but it has less than a year of cash runway based on current free cash flow trends. Recent exploration at the São Jorge Project in Brazil shows promising gold and copper mineralization potential, yet significant insider selling occurred recently. Despite being added to the S&P Global BMI Index, shareholder dilution by 8% over the past year highlights ongoing financial pressures.

- Dive into the specifics of GoldMining here with our thorough balance sheet health report.

- Explore GoldMining's analyst forecasts in our growth report.

Summing It All Up

- Dive into all 947 of the TSX Penny Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GOLD

GoldMining

A mineral exploration company, engages in the acquisition, exploration, and development of gold and copper assets in the Americas.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives