- Canada

- /

- Metals and Mining

- /

- TSX:FAR

3 TSX Penny Stocks With Market Caps Over CA$30M To Watch

Reviewed by Simply Wall St

As the Canadian market maintains strong momentum into 2025, investors are encouraged to remain vigilant for potential challenges that could impact their portfolios. While the broader market enjoys elevated valuations, not all areas share this trend, presenting opportunities in sectors trading at or below historical averages. In this context, penny stocks—though an older term—continue to offer intriguing prospects; these smaller or newer companies can provide substantial returns when underpinned by solid financial health and growth potential.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.24 | CA$160.38M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$281.86M | ★★★★★☆ |

| Pulse Seismic (TSX:PSD) | CA$2.36 | CA$120.59M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.63 | CA$565.76M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$3.45 | CA$335.5M | ★★★★★★ |

| Vox Royalty (TSX:VOXR) | CA$3.89 | CA$187.19M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.455 | CA$13.03M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.15 | CA$215.73M | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$28.74M | ★★★★★★ |

| East West Petroleum (TSXV:EW) | CA$0.04 | CA$3.62M | ★★★★★★ |

Click here to see the full list of 959 stocks from our TSX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Foraco International (TSX:FAR)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Foraco International SA, with a market cap of CA$215.73 million, offers drilling services across various regions including North America, Europe, the Middle East, Africa, South America, and the Asia Pacific.

Operations: The company's revenue is primarily derived from its mining segment, which generated $280.96 million, complemented by $38.25 million from the water segment.

Market Cap: CA$215.73M

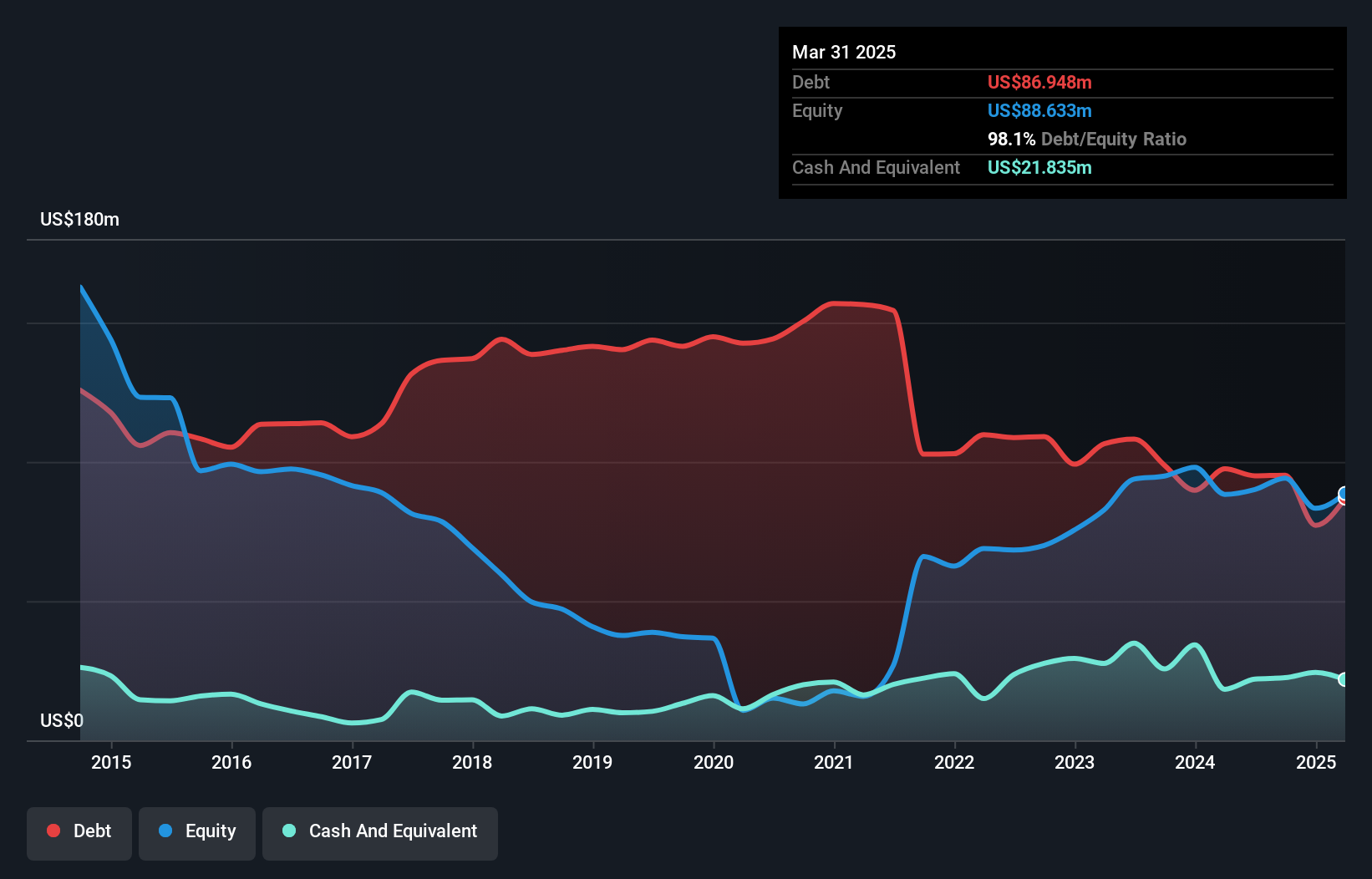

Foraco International SA, with a market cap of CA$215.73 million, is navigating challenges in earnings growth and high debt levels. Despite negative earnings growth of -18.1% over the past year compared to industry averages, the company maintains a solid financial position with short-term assets exceeding liabilities and well-covered interest payments by EBIT. Recent announcements show declining sales and net income for Q3 2024 compared to the previous year, yet analysts expect significant stock price appreciation. The company's share repurchase program indicates confidence in its valuation despite current volatility and management's relatively inexperienced team.

- Take a closer look at Foraco International's potential here in our financial health report.

- Understand Foraco International's earnings outlook by examining our growth report.

GreenPower Motor (TSXV:GPV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GreenPower Motor Company Inc. designs, manufactures, and distributes electric vehicles for commercial markets in the United States and Canada with a market cap of CA$33.64 million.

Operations: GreenPower Motor generates revenue of $21.60 million from its operations in the manufacture and distribution of all-electric transit, school, and charter buses.

Market Cap: CA$33.64M

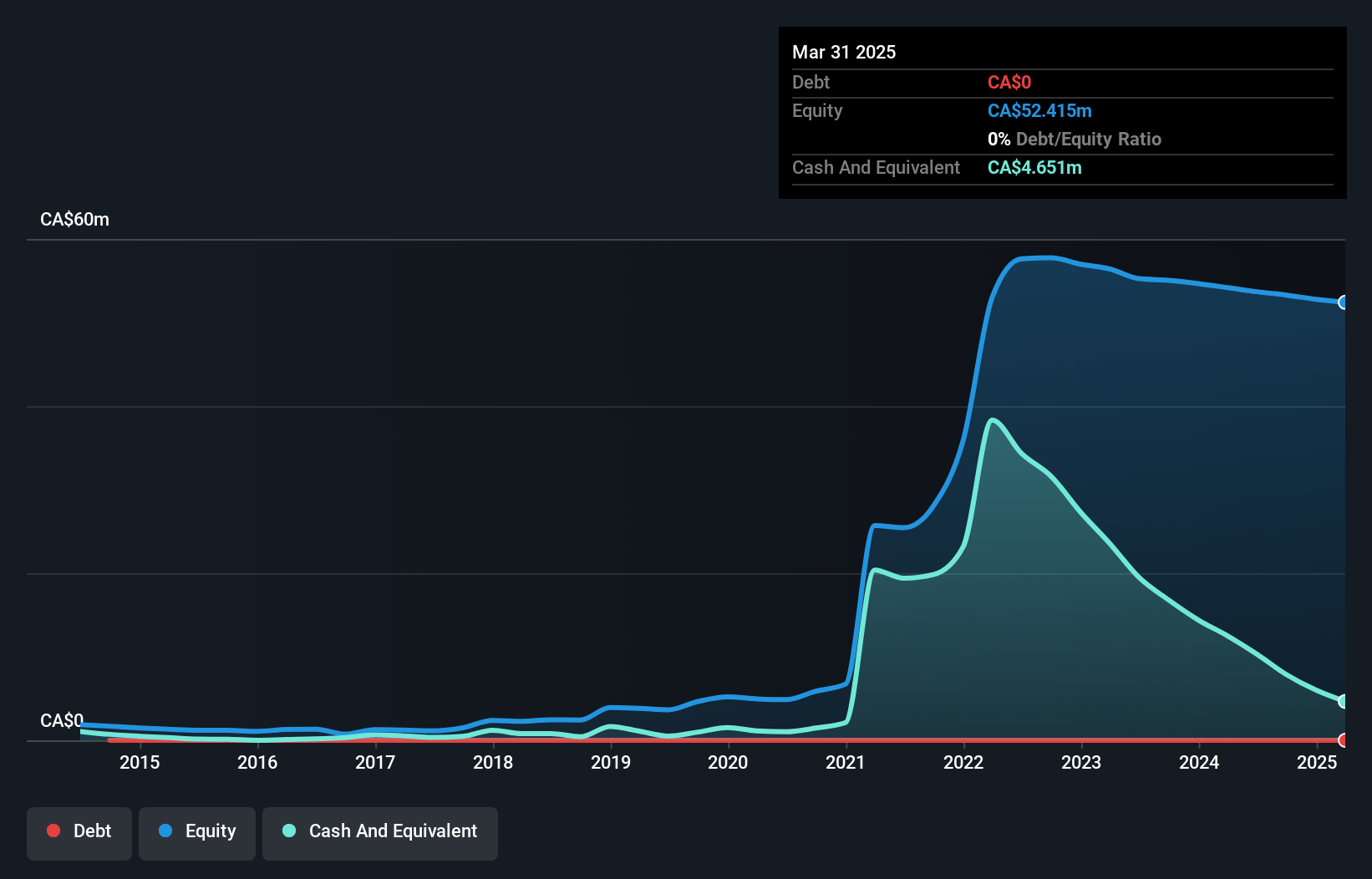

GreenPower Motor Company Inc., with a market cap of CA$33.64 million, faces challenges typical of penny stocks, including high volatility and financial instability. Recent earnings reports highlight a decline in sales to US$5.35 million for the quarter ended September 30, 2024, alongside increased net losses. Despite these hurdles, GreenPower continues to secure significant orders for its all-electric buses under programs like the EPA Clean School Bus Program and California's ZESBI initiative. Although unprofitable with high debt levels and shareholder dilution concerns, it has managed to raise additional capital through equity offerings to support ongoing operations.

- Click here and access our complete financial health analysis report to understand the dynamics of GreenPower Motor.

- Gain insights into GreenPower Motor's outlook and expected performance with our report on the company's earnings estimates.

Century Lithium (TSXV:LCE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Century Lithium Corp. is an exploration and development stage company focused on acquiring, exploring, evaluating, and developing mineral resource properties in the United States with a market cap of CA$38.12 million.

Operations: Century Lithium Corp. does not have any reported revenue segments as it is currently in the exploration and development stage.

Market Cap: CA$38.12M

Century Lithium Corp., with a market cap of CA$38.12 million, is pre-revenue and faces typical penny stock challenges such as high volatility and limited cash runway. The company focuses on its Angel Island lithium project in Nevada, where recent developments include producing battery-grade lithium carbonate at its Pilot Plant. Despite unprofitability and a forecasted earnings decline, Century Lithium's experienced management team is working on process optimization to reduce costs and improve project economics. Recent financials show increased net losses, but short-term assets exceed liabilities, providing some financial stability without debt concerns.

- Dive into the specifics of Century Lithium here with our thorough balance sheet health report.

- Learn about Century Lithium's future growth trajectory here.

Next Steps

- Dive into all 959 of the TSX Penny Stocks we have identified here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FAR

Foraco International

Provides drilling services in North America, South America, the Asia Pacific, the Middle East, Africa, and Europe.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives