- Canada

- /

- Metals and Mining

- /

- TSX:ERO

How Investors May Respond To Ero Copper (TSX:ERO) Beating Earnings and Launching Tucumã Production

Reviewed by Sasha Jovanovic

- Ero Copper recently reported second-quarter 2025 earnings with earnings per share of US$0.46, surpassing analyst expectations by more than 25%, alongside releasing its 2024 Sustainability Report.

- The company highlighted the successful and timely launch of commercial production at the Tucumã Operation, signaling a substantial increase in copper output as production ramps up into 2025.

- We'll explore how Tucumã's operational ramp-up and improved earnings performance may reshape Ero Copper's investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Ero Copper Investment Narrative Recap

To be a shareholder in Ero Copper now means believing in the company's ability to capitalize on its expanded production base while maintaining operational discipline, particularly with the ramp-up of the Tucumã Operation. The recent earnings beat highlights improved profitability, but the revenue miss and repeated guidance adjustments keep the spotlight fixed on the risk of ongoing production uncertainty, which remains the most critical short-term challenge for the business.

Tucumã’s successful launch into commercial production, as highlighted in the latest sustainability report, is the most relevant announcement, reinforcing the view that near-term growth hinges on consistent execution at new and existing assets. While this operational milestone helps strengthen Ero Copper’s growth potential, the story is far from settled as investors weigh near-term delivery against historical challenges.

Yet against these achievements, it’s the company’s history of revised production forecasts that investors should be particularly aware of...

Read the full narrative on Ero Copper (it's free!)

Ero Copper's narrative projects $996.0 million in revenue and $298.7 million in earnings by 2028. This requires a 22.9% yearly revenue growth and a $156 million increase in earnings from the current $142.7 million.

Uncover how Ero Copper's forecasts yield a CA$31.67 fair value, in line with its current price.

Exploring Other Perspectives

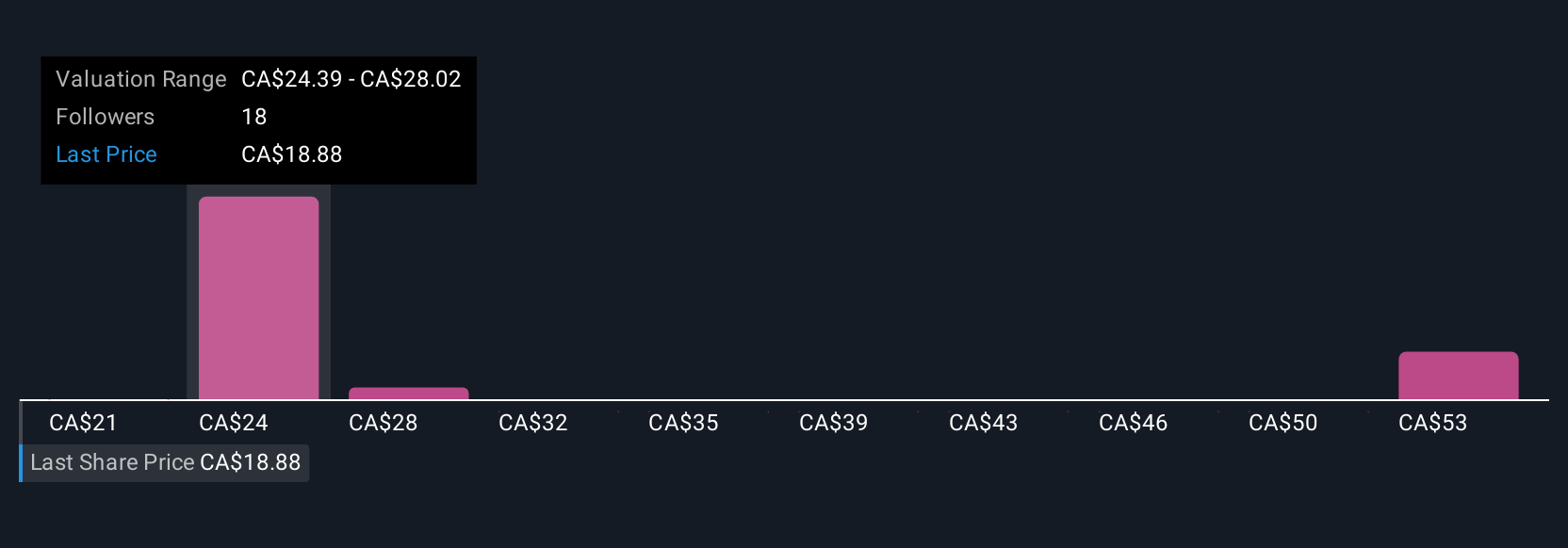

Seven members of the Simply Wall St Community estimate Ero Copper's fair value anywhere from US$20.76 to US$80.68 per share. While opinions differ, ongoing execution risks tied to production targets give plenty to consider when weighing these viewpoints.

Explore 7 other fair value estimates on Ero Copper - why the stock might be worth over 2x more than the current price!

Build Your Own Ero Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ero Copper research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ero Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ero Copper's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ero Copper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ERO

Ero Copper

Engages in the exploration, development, and production of mining projects in Brazil.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives