- Canada

- /

- Metals and Mining

- /

- TSX:ERO

Can Ero Copper's Reinvestment Strategy Offset Declining Efficiency Metrics for TSX:ERO Investors?

Reviewed by Simply Wall St

- In recent days, Ero Copper reported that its return on capital employed (ROCE) has decreased from 34% five years ago to 11%, reflecting reduced efficiency in turning investment into profits.

- The company’s decision to increase both capital employed and revenue highlights a focus on growth and reinvestment, which may affect short-term returns but signals potential for future operational strength.

- We'll explore how Ero Copper’s focus on growth through reinvestment impacts its broader investment case amid evolving efficiency metrics.

Rare earth metals are the new gold rush. Find out which 28 stocks are leading the charge.

Ero Copper Investment Narrative Recap

To invest in Ero Copper, you need to believe that the company’s aggressive reinvestment and production growth will overcome short-term drops in efficiency and help sustain long-term profitability. The recent fall in ROCE signals a near-term headwind, but has not materially changed the near-term catalysts as increased production and cost controls remain the key drivers; the main risk continues to be execution around guidance and operational consistency rather than one-off efficiency metrics.

The announcement of commercial production at Tucumã (effective July 1, 2025) stands out in relation to these recent efficiency updates, as it indicates one of Ero Copper's core growth projects is now online and producing at a majority of targeted capacity. This development ties directly to the company's growth ambitions and remains central to forecasts of revenue and margin improvement over the coming quarters.

Yet, despite stronger operational momentum, investors should watch for signals that Ero’s track record on production forecasting may again...

Read the full narrative on Ero Copper (it's free!)

Ero Copper's outlook anticipates $1.0 billion in revenue and $298.7 million in earnings by 2028. This is based on a 23.2% annual revenue growth rate and an increase in earnings of $156.0 million from the current $142.7 million.

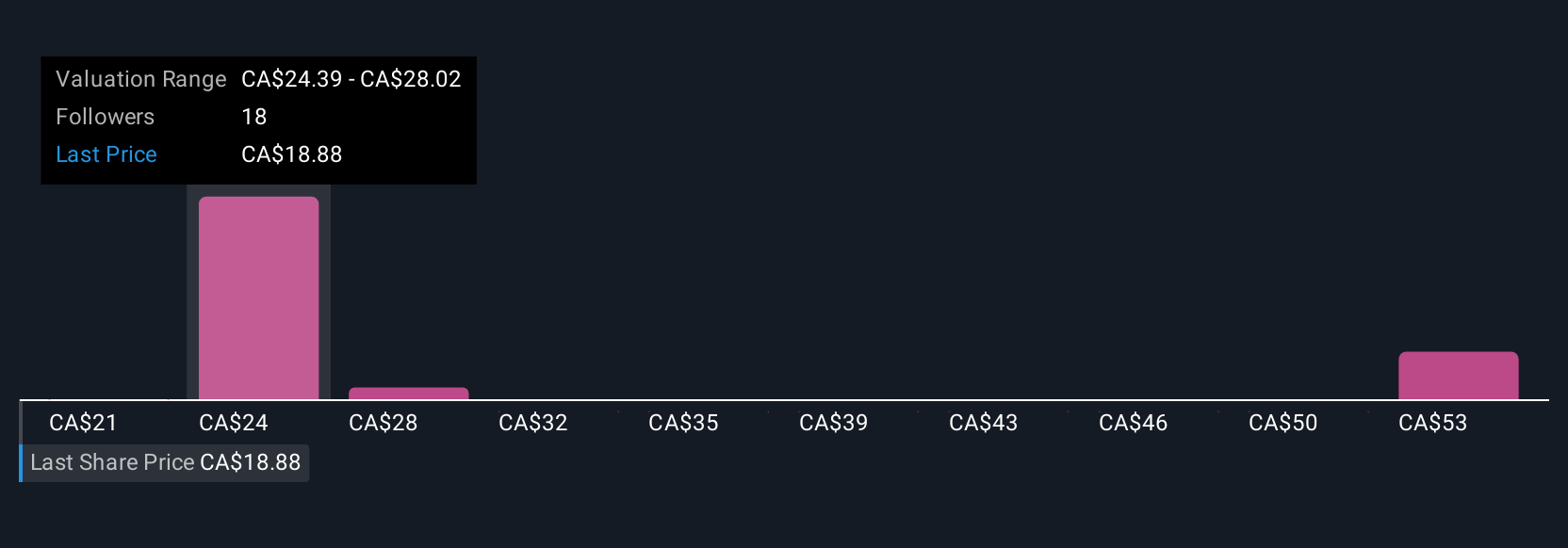

Uncover how Ero Copper's forecasts yield a CA$25.61 fair value, a 28% upside to its current price.

Exploring Other Perspectives

Six private investors in the Simply Wall St Community estimate Ero Copper’s fair value from CA$20.76 to CA$64.35 per share. While optimism surrounds growth at Tucumã, views on execution risk vary widely, so consider the range of outlooks before forming your own stance.

Explore 6 other fair value estimates on Ero Copper - why the stock might be worth over 3x more than the current price!

Build Your Own Ero Copper Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ero Copper research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ero Copper research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ero Copper's overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Ero Copper might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ERO

Ero Copper

Engages in the exploration, development, and production of mining projects in Brazil.

Very undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives