- Canada

- /

- Metals and Mining

- /

- TSXV:SVE

TSX Penny Stocks Spotlight Erdene Resource Development And 2 Others

Reviewed by Simply Wall St

With Canada's election concluded, a layer of uncertainty has been lifted, allowing policymakers to focus on pressing issues like trade and the economy. As the government considers fiscal stimulus and potential interest rate cuts to bolster economic growth, investors are exploring diverse opportunities within the market. Penny stocks, often representing smaller or newer companies, remain an intriguing investment area for those seeking affordability and growth potential. In this article, we explore three penny stocks that demonstrate strong financials and offer promising prospects in today's evolving market landscape.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Rewards & Risks |

| Westbridge Renewable Energy (TSXV:WEB) | CA$0.79 | CA$80.92M | ✅ 3 ⚠️ 3 View Analysis > |

| NTG Clarity Networks (TSXV:NCI) | CA$2.11 | CA$84.2M | ✅ 4 ⚠️ 2 View Analysis > |

| Intermap Technologies (TSX:IMP) | CA$2.08 | CA$124.74M | ✅ 3 ⚠️ 2 View Analysis > |

| Thor Explorations (TSXV:THX) | CA$0.65 | CA$412.48M | ✅ 3 ⚠️ 2 View Analysis > |

| Orezone Gold (TSX:ORE) | CA$1.19 | CA$591.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Amerigo Resources (TSX:ARG) | CA$1.71 | CA$283.88M | ✅ 2 ⚠️ 2 View Analysis > |

| PetroTal (TSX:TAL) | CA$0.56 | CA$512.64M | ✅ 4 ⚠️ 3 View Analysis > |

| Pulse Seismic (TSX:PSD) | CA$2.52 | CA$126.99M | ✅ 1 ⚠️ 2 View Analysis > |

| Findev (TSXV:FDI) | CA$0.465 | CA$13.32M | ✅ 2 ⚠️ 3 View Analysis > |

| Enterprise Group (TSX:E) | CA$1.61 | CA$124.83M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 925 stocks from our TSX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Erdene Resource Development (TSX:ERD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Erdene Resource Development Corporation is engaged in the exploration and development of precious and base metal deposits in Mongolia, with a market cap of CA$313.58 million.

Operations: Erdene Resource Development Corporation has not reported any revenue segments.

Market Cap: CA$313.58M

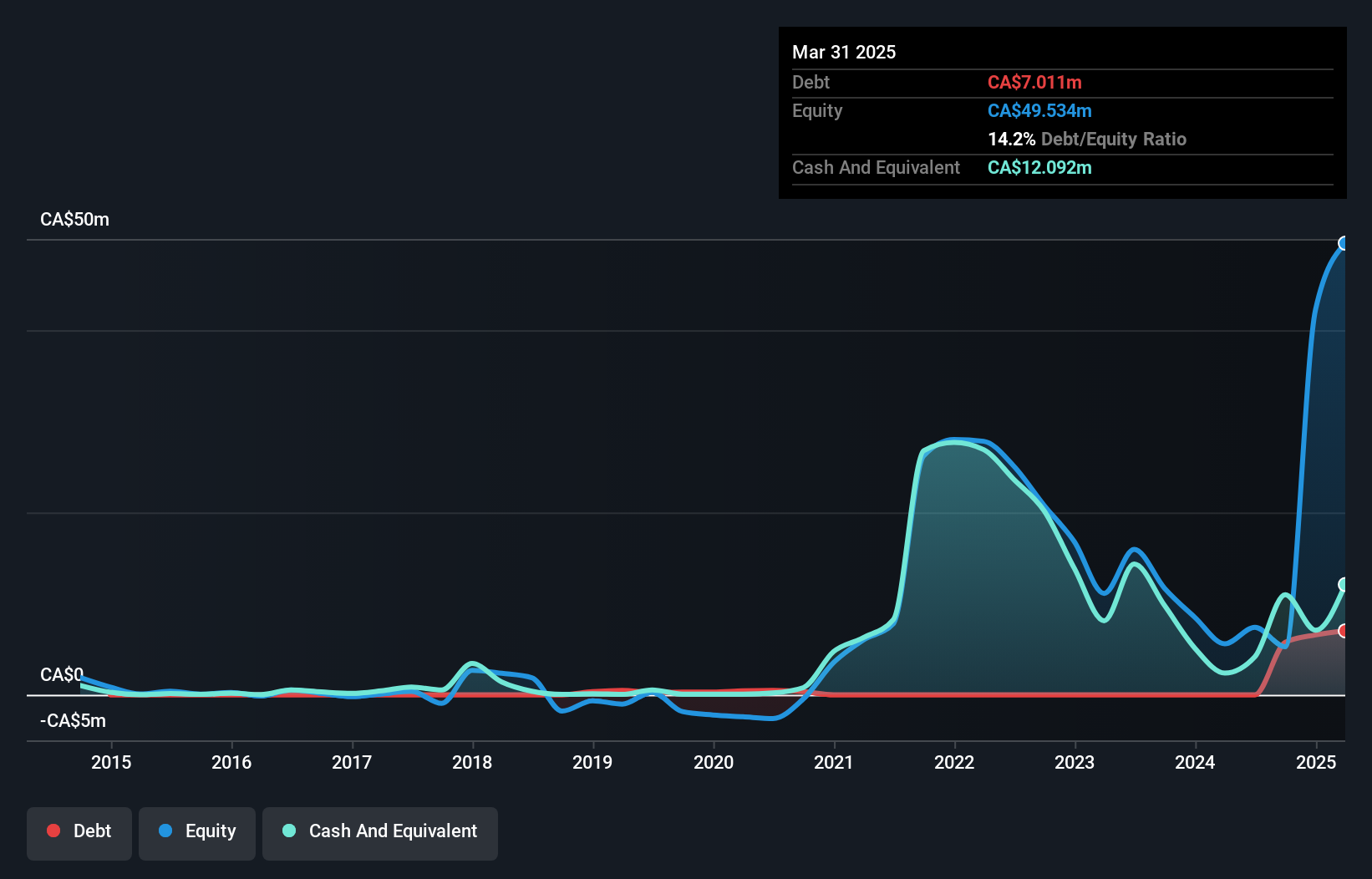

Erdene Resource Development Corporation is a pre-revenue company engaged in metal exploration in Mongolia, with a market cap of CA$313.58 million. Despite being unprofitable, it has reduced losses by 12.8% annually over five years and maintains a stable cash runway for over a year without any debt or long-term liabilities. Recent earnings showed a net loss of CA$8.25 million for 2024, contrasting with the previous year's net income, highlighting financial volatility typical of penny stocks. The experienced management team and board may provide stability as the company continues its development efforts.

- Click here and access our complete financial health analysis report to understand the dynamics of Erdene Resource Development.

- Learn about Erdene Resource Development's historical performance here.

Emerita Resources (TSXV:EMO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Emerita Resources Corp., through its subsidiary, acquires, explores, and develops mineral properties in Spain with a market cap of CA$333.69 million.

Operations: Emerita Resources Corp. currently does not report any specific revenue segments.

Market Cap: CA$333.69M

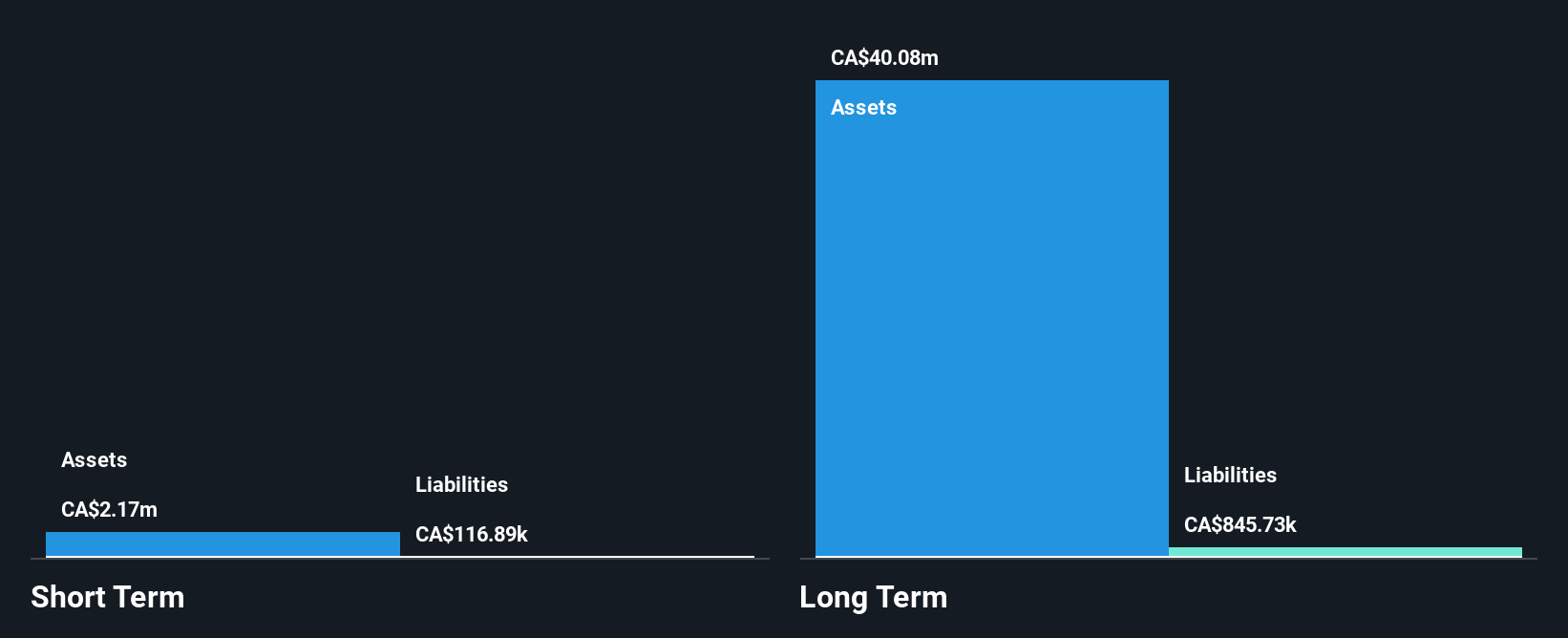

Emerita Resources Corp., with a market cap of CA$333.69 million, is a pre-revenue company focused on mineral exploration in Spain. Despite its unprofitability and increasing losses over the past five years, it maintains more cash than debt and has not diluted shareholders recently. The company’s seasoned management team supports its strategic efforts. Recent drilling at the El Cura deposit within the Iberian Belt West project shows promising copper-gold mineralization, enhancing potential resource growth. However, Emerita faces financial constraints with less than a year of cash runway if current free cash flow trends persist.

- Get an in-depth perspective on Emerita Resources' performance by reading our balance sheet health report here.

- Understand Emerita Resources' earnings outlook by examining our growth report.

Silver One Resources (TSXV:SVE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Silver One Resources Inc. focuses on acquiring, exploring, and developing mineral properties in the United States, with a market capitalization of CA$61.85 million.

Operations: Currently, there are no reported revenue segments for Silver One Resources Inc.

Market Cap: CA$61.85M

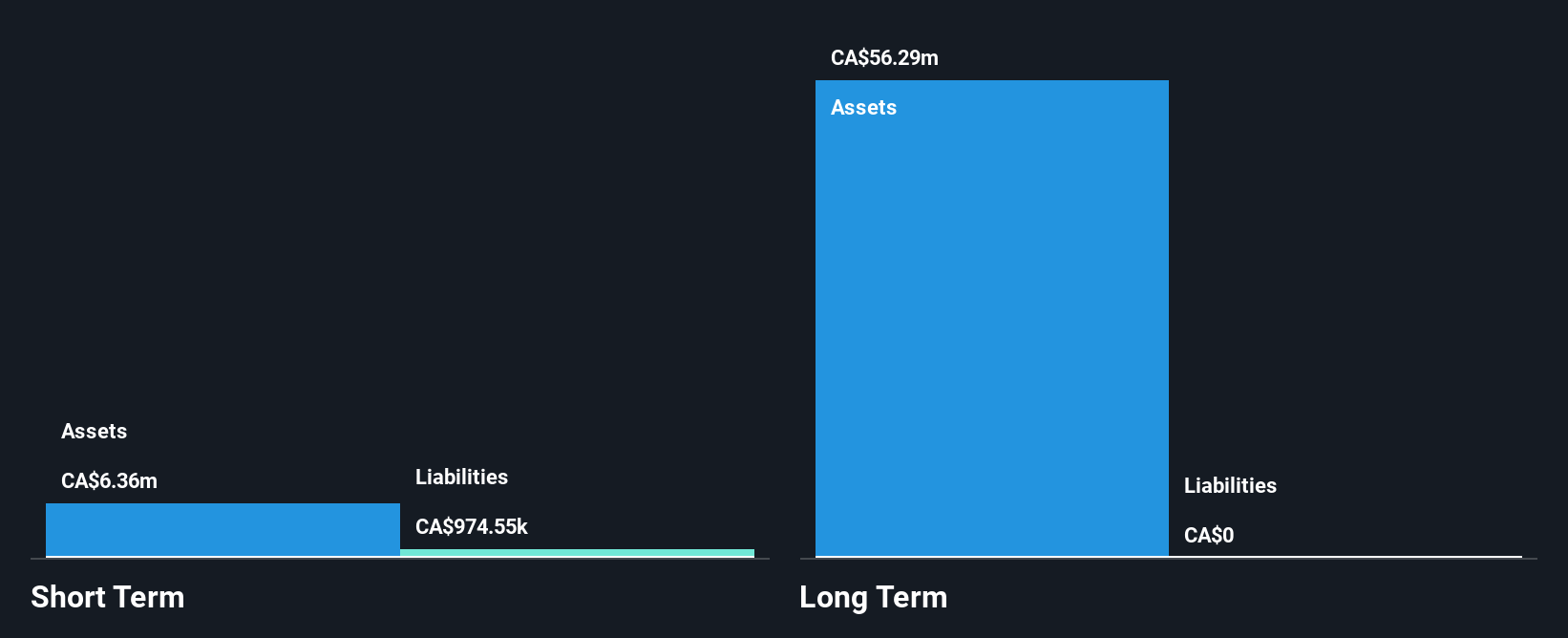

Silver One Resources Inc., with a market cap of CA$61.85 million, is pre-revenue and focuses on mineral exploration in the U.S. Its seasoned management and board provide stability, while its debt-free status is a positive aspect for investors. Recent updates highlight promising developments at the Candelaria Silver Mine in Nevada, where innovative cyanide-free leaching technology has shown potential to significantly increase silver recoveries. However, the company faces financial constraints with less than a year of cash runway based on current free cash flow trends, highlighting the need for careful financial management moving forward.

- Dive into the specifics of Silver One Resources here with our thorough balance sheet health report.

- Gain insights into Silver One Resources' past trends and performance with our report on the company's historical track record.

Taking Advantage

- Explore the 925 names from our TSX Penny Stocks screener here.

- Ready To Venture Into Other Investment Styles? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 28 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:SVE

Silver One Resources

Engages in the acquisition, exploration, and development of mineral properties in the United States.

Adequate balance sheet slight.

Market Insights

Community Narratives