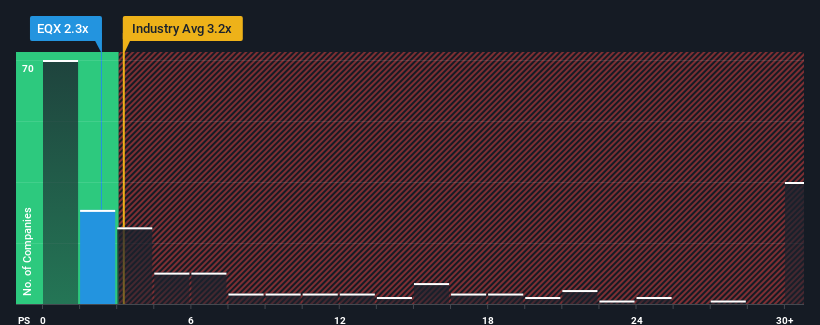

Equinox Gold Corp.'s (TSE:EQX) price-to-sales (or "P/S") ratio of 2.3x might make it look like a buy right now compared to the Metals and Mining industry in Canada, where around half of the companies have P/S ratios above 3.2x and even P/S above 17x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Equinox Gold

How Equinox Gold Has Been Performing

Equinox Gold certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Equinox Gold will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Equinox Gold?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Equinox Gold's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 14% last year. The solid recent performance means it was also able to grow revenue by 16% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 24% each year during the coming three years according to the seven analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 24% each year, which is not materially different.

With this in consideration, we find it intriguing that Equinox Gold's P/S is lagging behind its industry peers. It may be that most investors are not convinced the company can achieve future growth expectations.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've seen that Equinox Gold currently trades on a lower than expected P/S since its forecast growth is in line with the wider industry. Despite average revenue growth estimates, there could be some unobserved threats keeping the P/S low. It appears some are indeed anticipating revenue instability, because these conditions should normally provide more support to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Equinox Gold that you need to be mindful of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Equinox Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EQX

Equinox Gold

Engages in the acquisition, exploration, development, and operation of mineral properties in the Americas.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives