- Canada

- /

- Metals and Mining

- /

- TSX:EQX

A Look at Equinox Gold (TSX:EQX) Valuation After 88% Share Price Surge in Three Months

Reviewed by Kshitija Bhandaru

Equinox Gold (TSX:EQX) shares have climbed over 88% in the past 3 months, catching the eye of investors looking for value and growth in the gold mining sector. This momentum raises questions about what is driving renewed interest in the company.

See our latest analysis for Equinox Gold.

Over the past year, Equinox Gold has delivered a standout total shareholder return close to 98%, reflecting a decisive turnaround as sentiment shifts more favorably toward gold miners. While the most recent quarter's surge was particularly sharp, this run follows periods of lagging performance. This indicates that momentum is building once again as investors grow more optimistic about the company's growth prospects and sector tailwinds.

If renewed optimism around gold stocks has you looking for your next opportunity, this could be the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

The recent rally begs the question: does Equinox Gold still offer hidden value for investors, or is the market already fully pricing in future growth and optimism at current levels?

Most Popular Narrative: 4.9% Undervalued

Equinox Gold’s current fair value, according to the most widely followed narrative, stands just higher than its last close. This suggests the stock still trades below what many believe it’s truly worth. With this slim margin, the debate shifts from whether there is value left to how long it may last.

Successful ramp-up of Greenstone and Valentine mines, combined with the recent merger, positions Equinox Gold for significantly higher output and scale. This supports meaningful revenue and cash flow growth in the coming quarters as new production fully contributes.

Curious what bold financial projections drive this perceived discount? The narrative leans on market-defying growth, surging future margins, and a profit trajectory that could surprise many. Find out what specific forecasts analysts are betting on and what assumptions fuel this fair value before the share price catches up.

Result: Fair Value of $15.95 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, setbacks such as persistent lower grades at flagship mines or renewed community disputes could quickly challenge the current optimism surrounding Equinox Gold’s outlook.

Find out about the key risks to this Equinox Gold narrative.

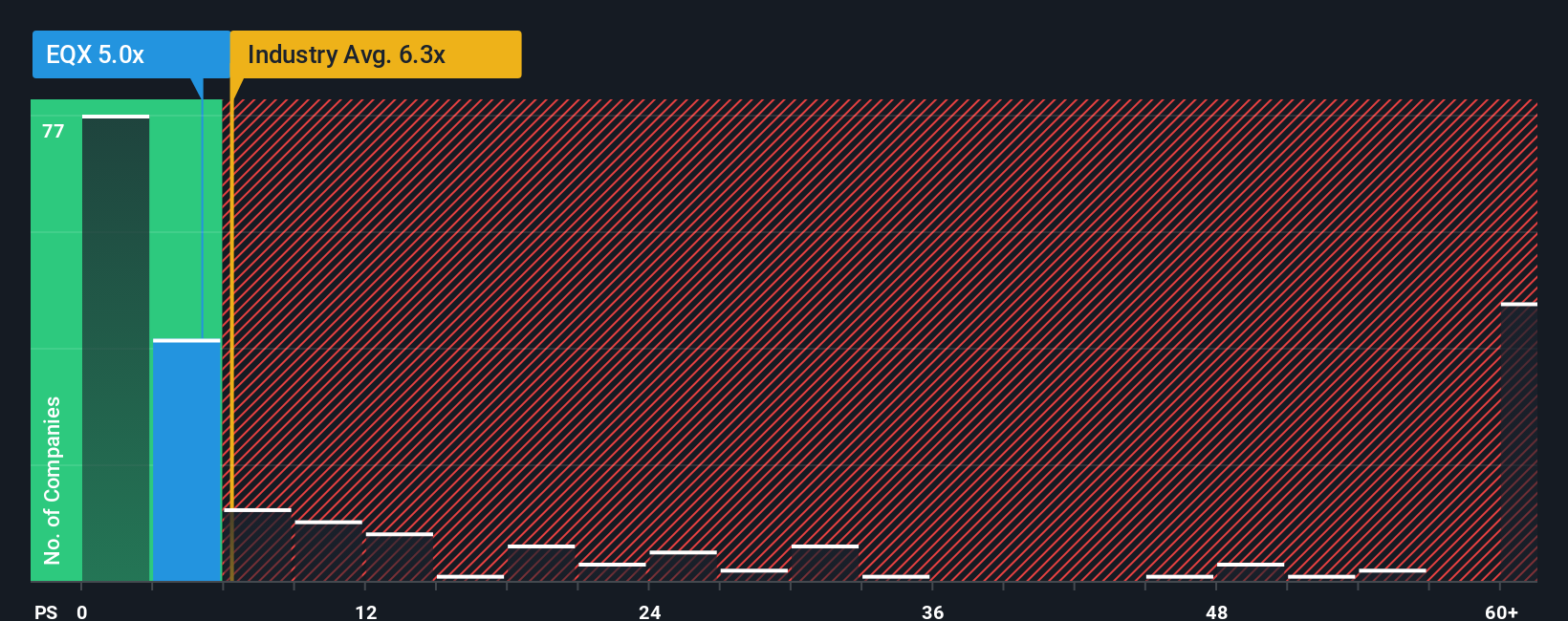

Another View: What Do Sales Ratios Suggest?

Looking through the lens of company sales, Equinox Gold trades at a 4.3x sales ratio. That is noticeably lower than the Canadian metals and mining industry average of 5.6x and well below the peer average of 11.3x. In fact, this aligns almost exactly with its fair ratio of 4.3x, suggesting the market is now valuing the business in line with sector expectations. Does this mean upside is capped, or is the market missing a deeper opportunity?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Equinox Gold Narrative

If you have a different perspective or want to dig into the numbers on your own terms, you can easily craft your own take in just a few minutes, so why not Do it your way

A great starting point for your Equinox Gold research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay ahead of the curve by tracking fresh opportunities beyond Equinox Gold. Don’t miss your chance to act early on innovative, potentially market-moving investments.

- Enhance your portfolio strategy by reviewing these 19 dividend stocks with yields > 3%, which offers reliable payouts above 3% and demonstrates resilience in changing markets.

- Explore the wave of technological transformation and begin with these 25 AI penny stocks, which are redefining entire industries through artificial intelligence breakthroughs.

- Identify undervalued gems before the crowd with these 887 undervalued stocks based on cash flows, supported by strong cash flow fundamentals and long-term growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equinox Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EQX

Equinox Gold

Engages in the acquisition, exploration, development, and operation of mineral properties in the Americas.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives