- Canada

- /

- Metals and Mining

- /

- TSX:ELR

Multiple Insiders Sold Eastern Platinum Shares Presenting Weak Signs For Investors

A number of Eastern Platinum Limited (TSE:ELR) insiders sold their shares in the last year, which may have raised concerns among investors. When analyzing insider transactions, it is usually more valuable to know whether insiders are buying versus knowing if they are selling, as the latter sends an ambiguous message. However, when multiple insiders sell stock over a specific duration, shareholders should take notice as that could possibly be a red flag.

While insider transactions are not the most important thing when it comes to long-term investing, logic dictates you should pay some attention to whether insiders are buying or selling shares.

Eastern Platinum Insider Transactions Over The Last Year

There wasn't any very large single transaction over the last year, but we can still observe some trading.

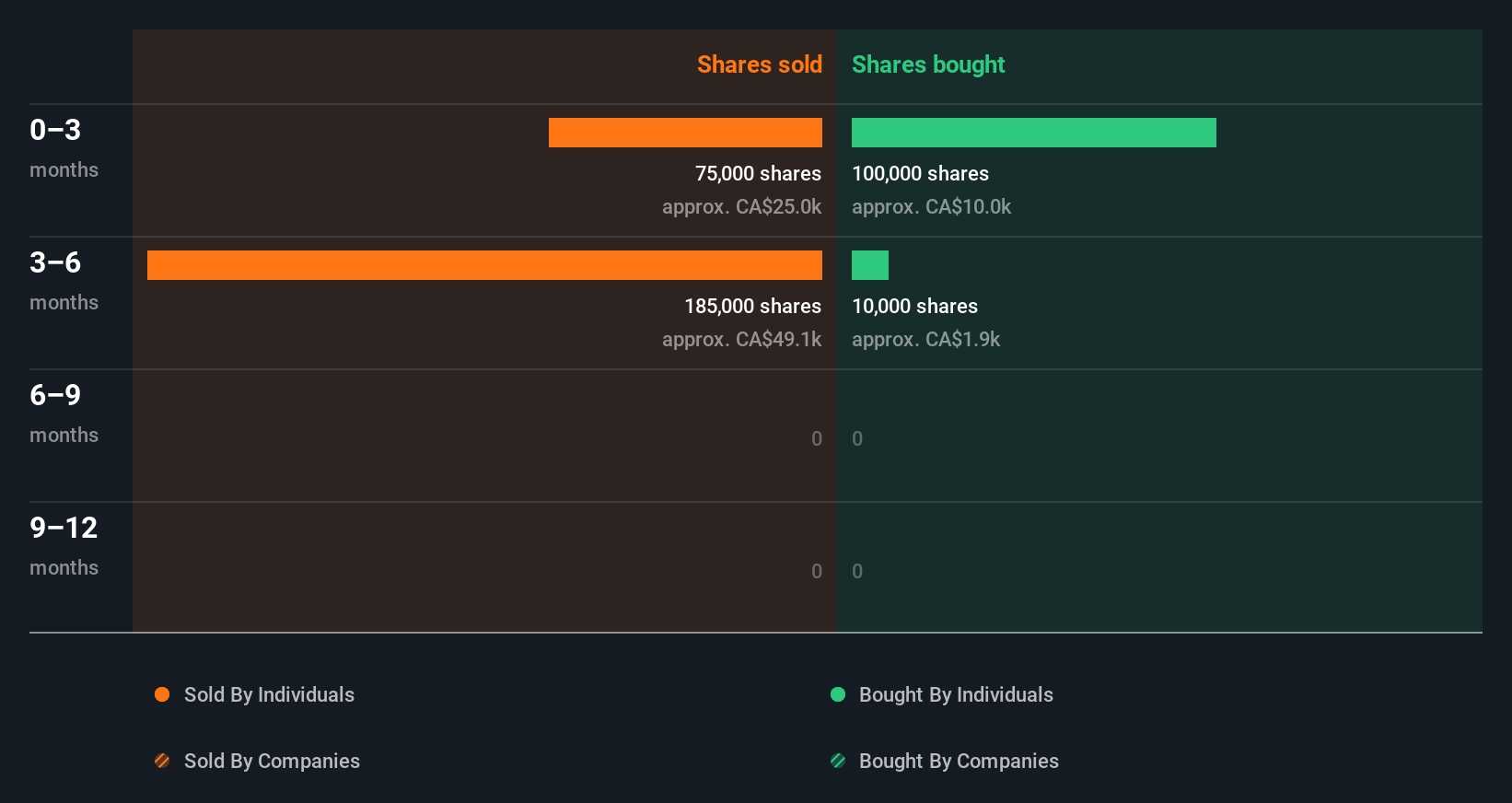

Happily, we note that in the last year insiders paid CA$12k for 110.00k shares. But they sold 310.00k shares for CA$92k. All up, insiders sold more shares in Eastern Platinum than they bought, over the last year. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

Check out our latest analysis for Eastern Platinum

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: Most of them are flying under the radar).

Insiders At Eastern Platinum Have Sold Stock Recently

We have seen a bit of insider selling at Eastern Platinum, over the last three months. In total, insiders sold CA$42k worth of shares in that time. But at least we saw CA$10.0k worth of buying. While it's not great to see insider selling, the net amount sold isn't enough for us to want to read anything into it.

Insider Ownership Of Eastern Platinum

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Our information indicates that Eastern Platinum insiders own about CA$104k worth of shares. But they may have an indirect interest through a corporate structure that we haven't picked up on. This level of insider ownership is notably low, and not very encouraging.

So What Do The Eastern Platinum Insider Transactions Indicate?

We note that there's been a little more insider selling than buying, recently. But the difference is small, and thus, not concerning. Recent insider selling makes us a little nervous, in light of the broader picture of Eastern Platinum insider transactions. And we're not picking up on high enough insider ownership to give us any comfort. So while it's helpful to know what insiders are doing in terms of buying or selling, it's also helpful to know the risks that a particular company is facing. To help with this, we've discovered 3 warning signs (1 doesn't sit too well with us!) that you ought to be aware of before buying any shares in Eastern Platinum.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Platinum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ELR

Eastern Platinum

Eastern Platinum Limited, together with its subsidiaries, mines, explores, and develops platinum group metal and chrome properties in South Africa.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026