- Canada

- /

- Metals and Mining

- /

- TSX:ELR

It's Down 26% But Eastern Platinum Limited (TSE:ELR) Could Be Riskier Than It Looks

Eastern Platinum Limited (TSE:ELR) shares have retraced a considerable 26% in the last month, reversing a fair amount of their solid recent performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 127%.

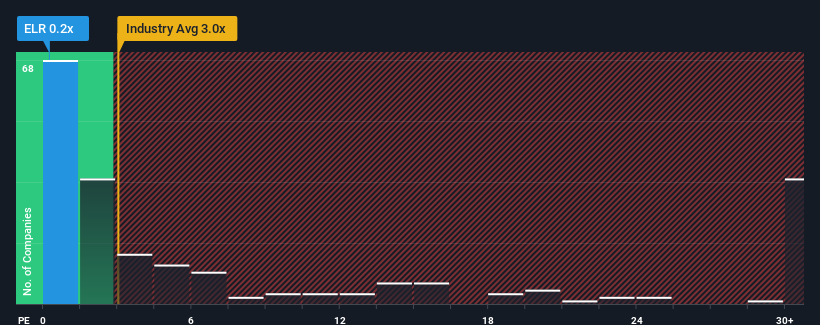

After such a large drop in price, Eastern Platinum may be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.2x, since almost half of all companies in the Metals and Mining industry in Canada have P/S ratios greater than 3x and even P/S higher than 17x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for Eastern Platinum

What Does Eastern Platinum's Recent Performance Look Like?

Recent times have been quite advantageous for Eastern Platinum as its revenue has been rising very briskly. Perhaps the market is expecting future revenue performance to dwindle, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Eastern Platinum's earnings, revenue and cash flow.How Is Eastern Platinum's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as depressed as Eastern Platinum's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 92% last year. The strong recent performance means it was also able to grow revenue by 78% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Weighing that recent medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 20% shows it's about the same on an annualised basis.

With this information, we find it odd that Eastern Platinum is trading at a P/S lower than the industry. Apparently some shareholders are more bearish than recent times would indicate and have been accepting lower selling prices.

What Does Eastern Platinum's P/S Mean For Investors?

Eastern Platinum's P/S looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

The fact that Eastern Platinum currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. At least the risk of a price drop looks to be subdued if recent medium-term revenue trends continue, but investors seem to think future revenue could see some volatility.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Eastern Platinum (1 is concerning) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Eastern Platinum might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELR

Eastern Platinum

Eastern Platinum Limited, together with its subsidiaries, mines, explores, and develops platinum group metal and chrome properties in South Africa.

Mediocre balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives