- Canada

- /

- Metals and Mining

- /

- TSXV:CPER

TSX Penny Stocks With Market Caps Over CA$9M

Reviewed by Simply Wall St

The Canadian market has been navigating a period of sideways consolidation, which may be acting as a corrective force against potential downturns, while investors focus on diversification and balance to manage volatility. Penny stocks, often representing smaller or newer companies, continue to offer intriguing growth opportunities despite their somewhat outdated label. By identifying those with strong financial health and solid fundamentals, investors can uncover potential gems that align with current market dynamics.

Top 10 Penny Stocks In Canada

| Name | Share Price | Market Cap | Financial Health Rating |

| Alvopetro Energy (TSXV:ALV) | CA$4.72 | CA$172.56M | ★★★★★★ |

| Findev (TSXV:FDI) | CA$0.50 | CA$14.32M | ★★★★★★ |

| Mandalay Resources (TSX:MND) | CA$4.79 | CA$449.82M | ★★★★★★ |

| PetroTal (TSX:TAL) | CA$0.69 | CA$632.31M | ★★★★★★ |

| BluMetric Environmental (TSXV:BLM) | CA$0.97 | CA$35.81M | ★★★★★★ |

| New Gold (TSX:NGD) | CA$3.93 | CA$3.11B | ★★★★★☆ |

| NamSys (TSXV:CTZ) | CA$1.15 | CA$30.89M | ★★★★★★ |

| Amerigo Resources (TSX:ARG) | CA$1.81 | CA$298.08M | ★★★★★☆ |

| Foraco International (TSX:FAR) | CA$2.03 | CA$200.35M | ★★★★★☆ |

| Orezone Gold (TSX:ORE) | CA$0.82 | CA$379.19M | ★★★★★☆ |

Click here to see the full list of 931 stocks from our TSX Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Eloro Resources (TSX:ELO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Eloro Resources Ltd. is involved in the exploration and development of mineral properties in Bolivia and Peru, with a market cap of CA$84.49 million.

Operations: Eloro Resources Ltd. does not report any revenue segments as it focuses on the exploration and development of mineral properties in Bolivia and Peru.

Market Cap: CA$84.49M

Eloro Resources is a pre-revenue company with a market cap of CA$84.49 million, focusing on mineral exploration in Bolivia and Peru. Recent drilling at the Iska Iska project revealed promising tin mineralization, suggesting potential for significant resource expansion with two distinct deposit styles: silver-zinc-lead and high-grade tin systems. Despite being debt-free, Eloro faces financial challenges with less than a year of cash runway and increasing losses over five years. The management team is experienced, but profitability remains elusive without near-term forecasts for positive earnings. These factors highlight both the opportunities and risks typical of penny stocks in the mining sector.

- Click to explore a detailed breakdown of our findings in Eloro Resources' financial health report.

- Examine Eloro Resources' earnings growth report to understand how analysts expect it to perform.

GoldMining (TSX:GOLD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: GoldMining Inc. is a mineral exploration company that focuses on acquiring, exploring, and developing gold assets in the Americas, with a market cap of CA$224.04 million.

Operations: GoldMining Inc. does not report specific revenue segments, as it is primarily engaged in the exploration and development of gold assets across the Americas.

Market Cap: CA$224.04M

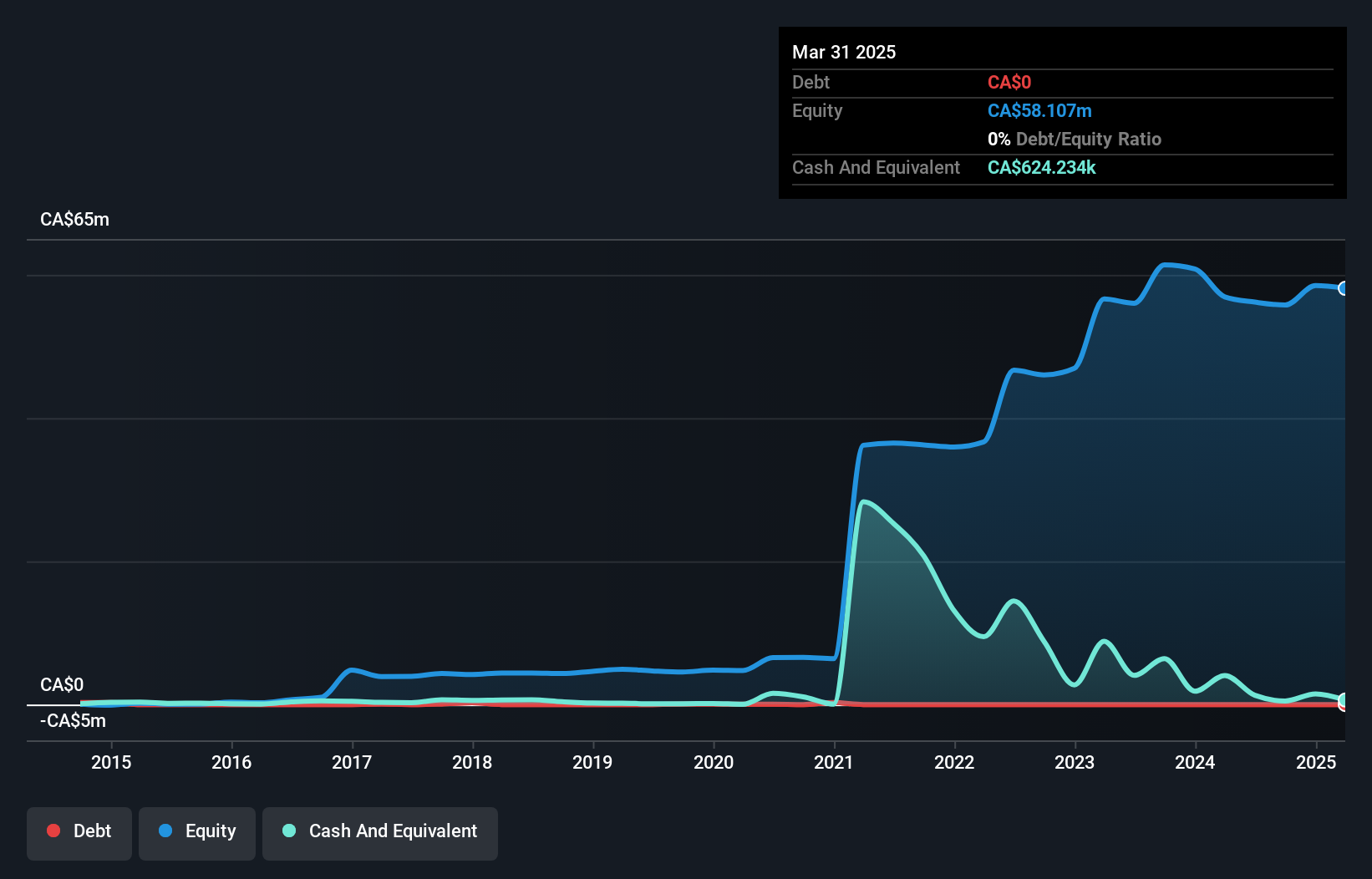

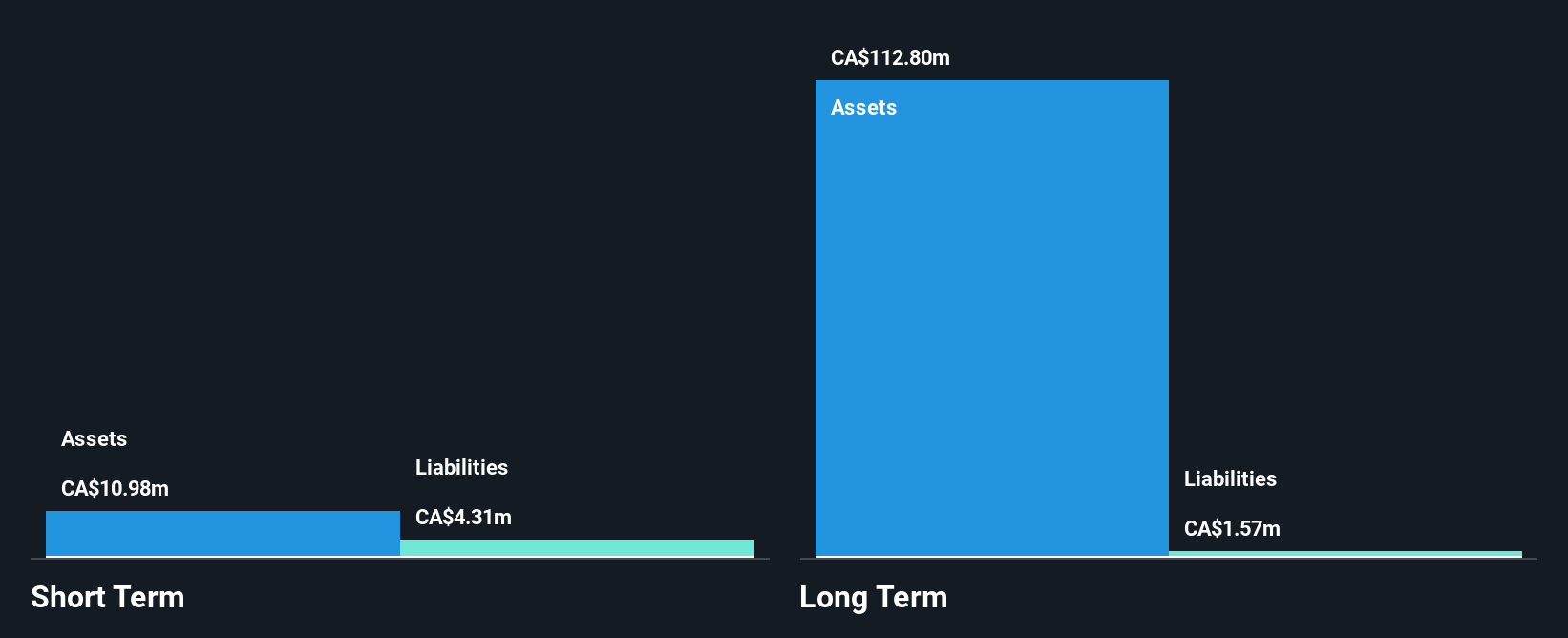

GoldMining Inc., with a market cap of CA$224.04 million, is a pre-revenue company focused on gold exploration in the Americas. The company recently reported a net loss of CA$25.29 million for the year ending November 2024, reflecting ongoing financial challenges typical for its sector. Despite being debt-free and having short-term assets exceeding liabilities, GoldMining's cash runway is limited to six months without further capital infusion. The recent renewal of its at-the-market equity program aims to raise up to US$50 million for exploration and potential acquisitions, underscoring both growth ambitions and inherent risks associated with penny stocks in mining.

- Dive into the specifics of GoldMining here with our thorough balance sheet health report.

- Gain insights into GoldMining's outlook and expected performance with our report on the company's earnings estimates.

CopperCorp Resources (TSXV:CPER)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: CopperCorp Resources Inc. focuses on acquiring, exploring, and evaluating mineral resources in Australia, with a market cap of CA$9.72 million.

Operations: CopperCorp Resources Inc. has not reported any revenue segments.

Market Cap: CA$9.72M

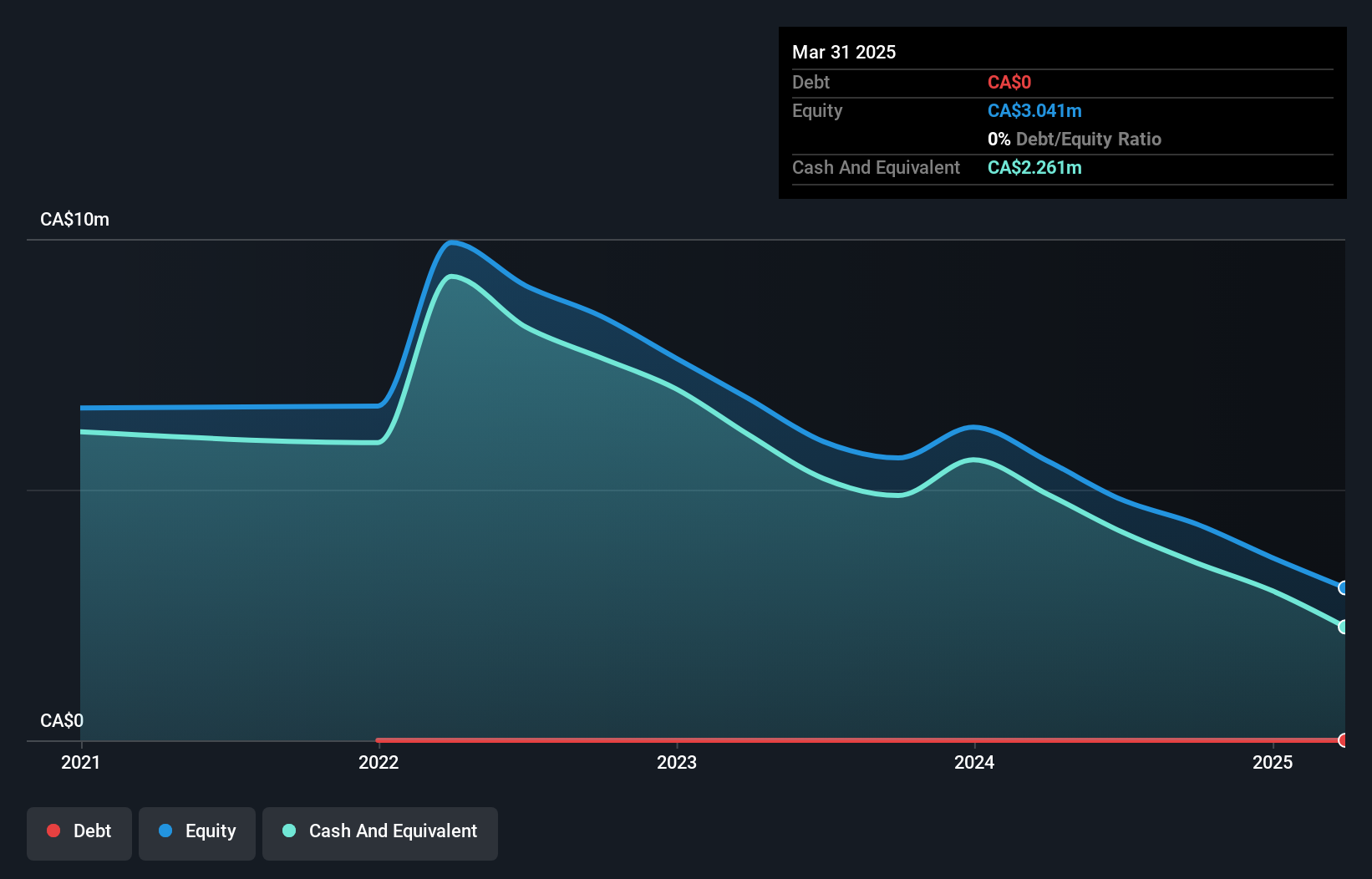

CopperCorp Resources Inc., with a market cap of CA$9.72 million, is a pre-revenue company focused on mineral exploration in Tasmania, Australia. The company remains debt-free and has sufficient cash runway for over a year, supporting its ongoing exploration activities at the Razorback Copper-Gold-REE property. Recent updates highlight promising developments at the Jukes and Hydes prospects, including high-grade copper mineralization findings and planned IP surveys to refine drill targets. However, the company's share price has been highly volatile recently, reflecting typical risks associated with penny stocks in early-stage mining ventures.

- Unlock comprehensive insights into our analysis of CopperCorp Resources stock in this financial health report.

- Explore historical data to track CopperCorp Resources' performance over time in our past results report.

Make It Happen

- Click here to access our complete index of 931 TSX Penny Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:CPER

CopperCorp Resources

Engages in the acquisition, exploration, and evaluation of mineral resources in Australia.

Flawless balance sheet with low risk.

Market Insights

Community Narratives