- Canada

- /

- Metals and Mining

- /

- TSX:ELD

Eldorado Gold (TSX:ELD) Valuation in Focus After Skouries Mine Progress and Strategy Update

Reviewed by Kshitija Bhandaru

Eldorado Gold (TSX:ELD) announced that its Skouries copper-gold mine expansion in Greece is progressing as planned. Production is set to start in the first quarter, with commercial output aimed for mid-year. Investors are watching closely as the company signals further growth, capital returns, and new opportunities beyond the mine’s completion.

See our latest analysis for Eldorado Gold.

After a year of sharp gains driven by growing excitement over the Skouries project and well-timed buybacks, Eldorado Gold’s 1-year total shareholder return stands at 74%, with momentum accelerating. Just look at its 15.7% share price return for the past month and a 91.7% gain year-to-date. Long-term holders have also seen outsized rewards, with a 452% total return over three years as confidence in the company’s growth agenda continues to build.

If the surge in gold miners has you curious about broader opportunities, it could be the perfect time to discover fast growing stocks with high insider ownership

The question now is whether Eldorado Gold’s stellar run and bright outlook leave the stock attractively valued, or if the market has already factored in upcoming growth, offering little room for new investors to benefit.

Most Popular Narrative: Fairly Valued

With the last close near CA$43.37 and the most widely followed narrative fair value at CA$40.79, current prices echo consensus expectations for the company’s outlook.

The approaching commissioning of the Skouries copper-gold project, slated for Q1 2026 and on schedule, is expected to be transformative by materially increasing production volumes, diversifying the revenue mix, and expanding EBITDA margins due to the asset's high grades and lower costs relative to existing operations.

Want to see what’s powering this verdict? The storyline behind this fair value is guided by game-changing growth projections and margin expansion that would turn heads in any mining executive boardroom. The real surprise is just how aggressive their future profit and revenue targets get. Check out the underlying forecasts that could swing the market’s narrative next.

Result: Fair Value of $40.79 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing cost pressures and potential delays at Skouries could threaten Eldorado Gold’s margin expansion and earnings growth. These factors warrant close investor attention.

Find out about the key risks to this Eldorado Gold narrative.

Another View: Testing the Numbers with the SWS DCF Model

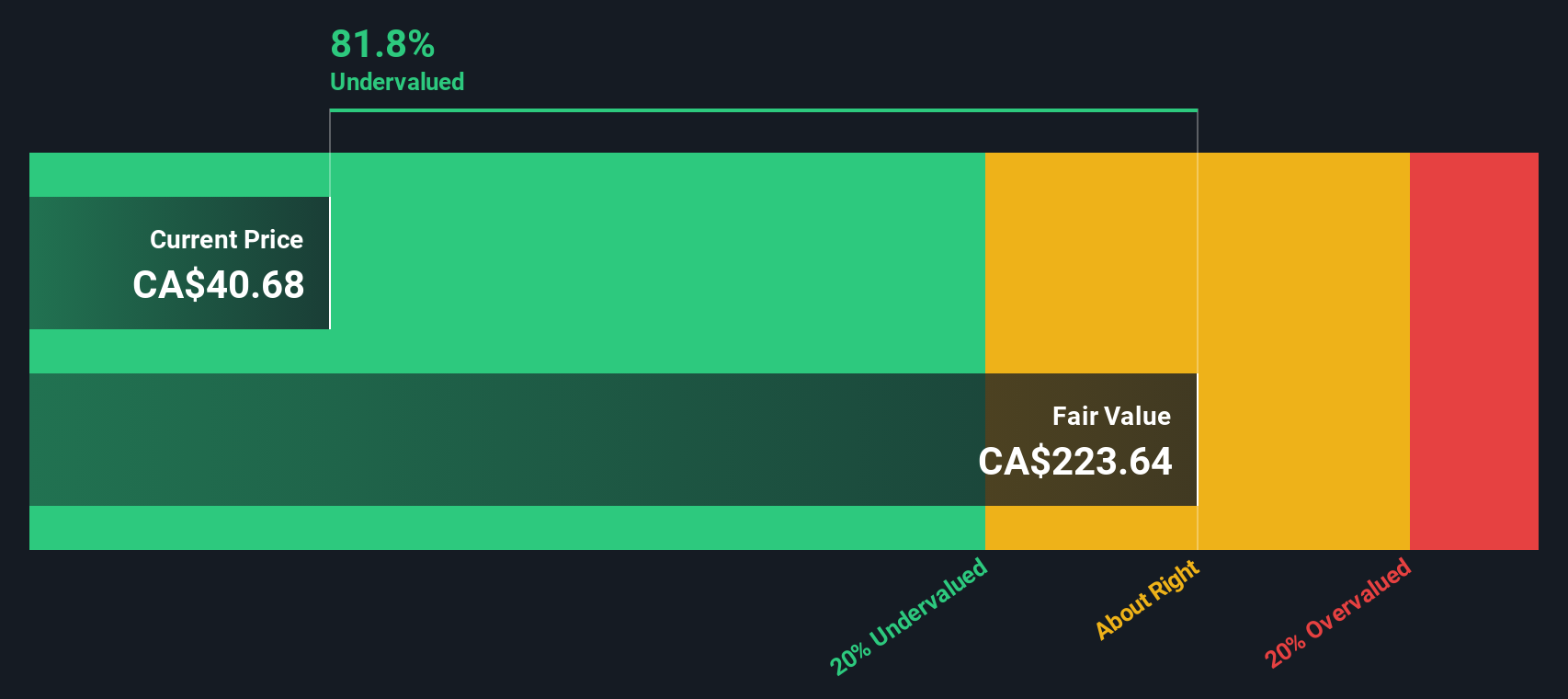

Looking at Eldorado Gold through the lens of our DCF model paints a very different picture. The stock is trading at a significant discount, about 84% below what our model sees as fair value. This suggests an unusually large potential upside. However, can such a wide gap persist as the Skouries project progresses?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Eldorado Gold Narrative

If you’d rather dig into the numbers and see the story from your own angle, shaping a narrative takes just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Eldorado Gold.

Looking for More Smart Investment Moves?

Capitalize on emerging trends now, before everyone else catches on. Broaden your portfolio with new inspiration—here are three dynamic opportunities waiting for you:

- Unlock the potential for rapid growth by jumping into these 3581 penny stocks with strong financials, which are quietly making waves with strong fundamentals and proven resilience.

- Benefit from reliable income streams by targeting these 20 dividend stocks with yields > 3%, focusing on stocks with yields above 3% for stable returns in any market cycle.

- Ride the wave of innovation by getting in early on these 24 AI penny stocks, powering tomorrow’s breakthroughs in artificial intelligence and transformative industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eldorado Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELD

Eldorado Gold

Engages in the mining, exploration, development, and sale of mineral products primarily in Turkey, Canada, and Greece.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives