- Canada

- /

- Metals and Mining

- /

- TSX:ELD

Eldorado Gold (TSX:ELD): Evaluating Valuation After Strong Year-to-Date Share Price Rally

Reviewed by Kshitija Bhandaru

See our latest analysis for Eldorado Gold.

The momentum behind Eldorado Gold is hard to ignore, with a 1-month share price return of over 11% and a 3-year total shareholder return of 366%. Share price gains this strong often reflect both investor optimism about future growth and a shift in how the market is evaluating the company's prospects.

If you're curious where similar market momentum might be taking off, this is a great moment to discover fast growing stocks with high insider ownership

After such a strong rally, many investors are now wondering if Eldorado Gold is still trading at a compelling value, or if the rapid climb has already accounted for all the potential upside.

Most Popular Narrative: 11% Overvalued

At the latest close of CA$40.53, Eldorado Gold trades above the most widely tracked fair value estimate of CA$36.53. This sets up a debate on whether recent optimism truly matches the company's long-term fundamentals, given how closely the stock price now aligns with the top end of analyst expectations.

Commissioning of a new copper-gold project and ongoing site optimizations are set to increase production, diversify revenue, and expand margins through improved efficiencies and lower costs. Industry trends and resilient gold prices, supported by macroeconomic factors and tight supply, coupled with active share buybacks, enhance long-term revenue and shareholder value.

What is the bold forecast underlying this uptick? A future built on expanded output and efficiency, but that is just the surface. The story pivots on whether aggressive growth projections and higher earnings multiples truly justify today’s share price. The details behind that narrative may surprise you.

Result: Fair Value of $36.53 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising operating costs and potential delays with the Skouries project remain critical risks that could quickly shift views on Eldorado Gold's outlook.

Find out about the key risks to this Eldorado Gold narrative.

Another View: Multiples Send a Different Signal

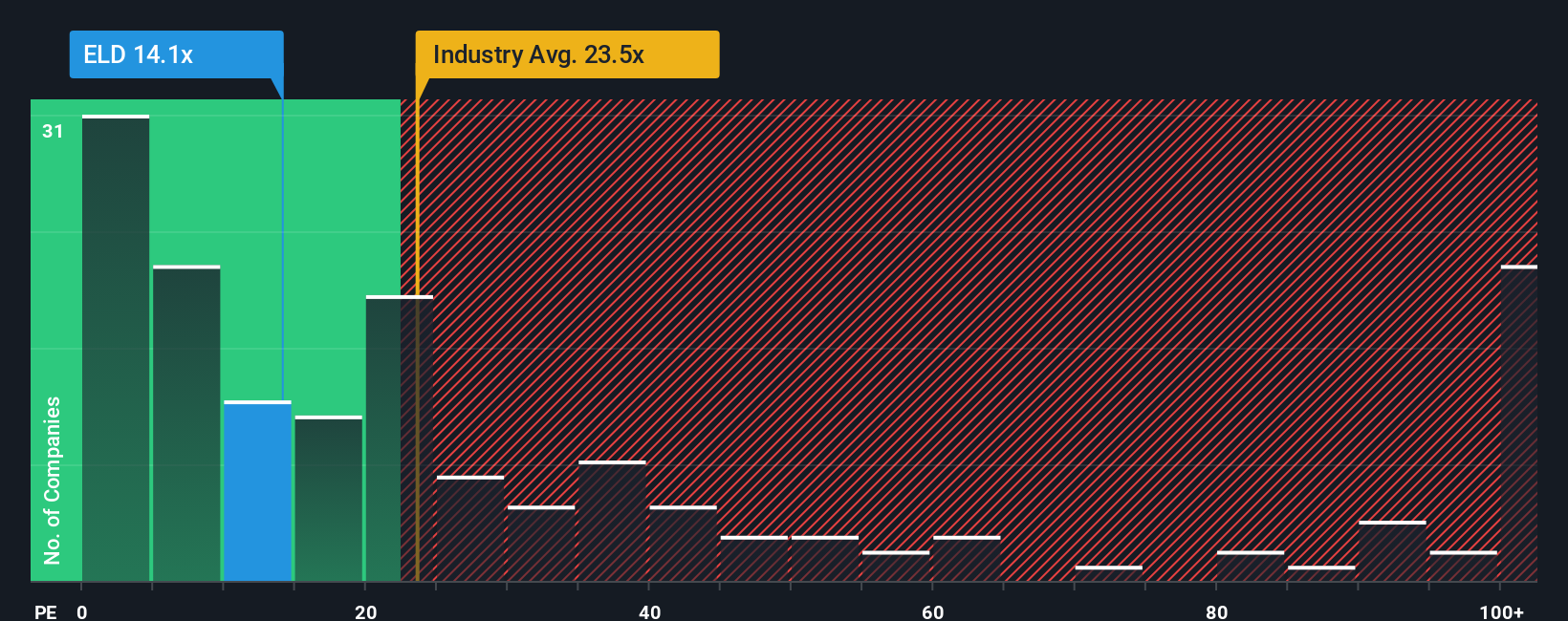

Despite talk of overvaluation based on fair value, Eldorado Gold actually looks attractive when you compare its price-to-earnings ratio of 14x to that of the Canadian Metals and Mining industry average at 23.6x, and the peer average at 28.2x. Even compared to a fair ratio of 33.2x, the company trades at a discount. This gap could hint at unrecognized upside or hidden risks. What is the real story behind the numbers?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eldorado Gold Narrative

If you see the numbers differently or want to dig into the details yourself, you can piece together your own narrative with just a few minutes of effort. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Eldorado Gold.

Looking for More Investment Ideas?

Don’t settle for just one opportunity when you can propel your strategy with stocks that offer real momentum. With Simply Wall Street’s screener, you will get ahead of the curve, spot possible winners others miss, and put yourself in control of your next move.

- Tap into the explosive potential of tech by checking out these 25 AI penny stocks. Here, innovation meets rapid returns across artificial intelligence leaders.

- Pounce on overlooked value and find hidden gems by browsing these 888 undervalued stocks based on cash flows, which highlights stocks trading below their intrinsic worth for those who want an edge.

- Secure regular income with peace of mind as you review these 19 dividend stocks with yields > 3%. This selection features shares offering yields above 3% for investors seeking reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eldorado Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELD

Eldorado Gold

Engages in the mining, exploration, development, and sale of mineral products primarily in Turkey, Canada, and Greece.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives